FICO Introduces the New FICO Resilience Index

The Fair Isaac Corporation (FICO) has introduced the new FICO Resilience Index which will complement the well-known and widely used credit-worthiness FICO score in an attempt to “…help[s] lenders, borrowers, and investors make more informed and precise decisions in assessing risk during rapidly changing economic cycles.”

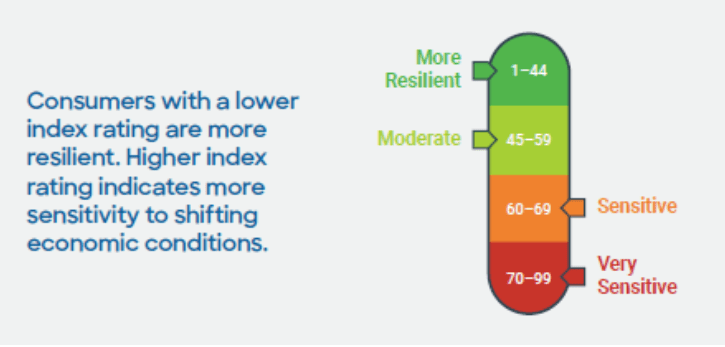

The FICO Resilience Index takes into account metrics such as credit usage, payment history, number of accounts, credit history and current balances to determine an individual’s ability to withstand a period of economic disruption.

While the traditional FICO score primarily provides information on a borrower’s historical credit usage, it appears the new Resilience Index will consider a variety of factors to predict potential future behavior.

The FICO Resilience Index came about from research that looked at over 70 million consumer credit files from the Great Recession.

According to the FICO press release on the Resilience Index, the research found “…that most consumers, including those with lower FICO Scores, paid their credit obligations and responsibly managed their financial affairs even under the challenging economic conditions of double-digit unemployment and low consumer confidence.”

The research also noted, “…incremental losses from the downturn were disproportionately concentrated in a small subset of consumers across all FICO Score ranges.”

And it’s the metrics the FICO Resilience Index uses that can – according to FICO – determine the consumers most at risk of default, no matter their FICO score, during an economic downturn such as we’re seeing with the Coronavirus pandemic.

The timing of the FICO Resilience Index’s introduction is coincidental, I’m sure (sarcasm), considering the many loan forbearances and credit payment deferments of which some Americans have taken advantage in the past months.

And, an often unknown aspect of those breaks-from-payments is that lenders are not to report non-payment to the credit reporting agencies.

Which is fair, I guess, considering the situation – government-mandated shutdowns – that contributed, in part or full, to the reason consumers are requesting assistance.

But, on the other hand, lenders are now completely in the dark when it comes to some consumers – with no up-to-date FICO score data to guide them – as to whether a borrower is in dire financial straights, or just utilizing a “benefit” to ease their normal financial situation.

Which is where the “predictive” FICO Resilience Index score comes into play.

According to the FICO press release, “The tool is now available to lenders from multiple credit bureaus.”

You can read more about the FICO Resilience Index and its scoring scale here.

While not yet available to consumers, FICO is planning on making the FICO Resilience Index score accessible to individuals at some point in the future.

:max_bytes(150000):strip_icc()/GettyImages-1437931505-9ac20cc5add74f47a68e3c687a553939.jpg?w=150&resize=150,150&ssl=1)

:max_bytes(150000):strip_icc()/GettyImages-118433758-50a1684008bc46ea8e01b1f97c124de4.jpg?w=150&resize=150,150&ssl=1)