The Hilton Family of Credit Cards

Update 6/1/17: The Hilton family of credit cards has gotten a bit smaller. Hilton has announced that it is ending its co-brand credit card relationship with Citi and has made American Express its exclusive issuer of co-brand credit cards. The move is to begin January 1, 2018, however, it appears links to apply for Citi Hilton credit cards are no longer working. Current Citi Hilton credit card holders will be moved to a to-be-announced Citi credit card prior to the end of 2017. Until then, charges made on Citi Hilton cards will continue to earn Hilton Honors points.

Most hotels have one co-branded credit card, maybe two (if you count business credit card accounts) associated with their individual brand.

Hilton hotels, however, has four personal credit cards tied to its Hilton HHonors rewards program.

Which means there are four opportunities to obtain sign-up bonuses to increase your Hilton HHonors account balance, and four different cards onto which you can choose to put your everyday spend to increase your HHonors balance even further…if you value Hilton points that much.

Citibank offers two of the co-branded Hilton credit cards, with the other two being offered by American Express.

Let’s take a closer look at each of the cards and the associated benefits.

Citibank Hilton HHonors Cards

Citi Hilton HHonors Reserve Card

Sign-up Bonus:

Two weekend night certificates after making $2,500 in purchases within the first 4 months of account opening.

Annual Fee:

$95 (not waived the first year)

Hilton HHonors Points Earning:

- 10 HHonors points per dollar spent on Hilton hotel stays

- 5 HHonors points per dollar spent on airline and car rental purchases

- 3 HHonors points per dollar spent on all other purchases

Additional Benefits:

Hilton Gold Status – Includes 25% bonus on all HHonors Base points earned, 5th night free on Standard Room Reward stays of 5 nights or more, complimentary in-room Internet access, late check-out, access to fitness centers and two complimentary bottles of water per stay.

Earn one weekend night certificate after spending $10,000 on purchases.

Earn Diamond Status by spending $40,000 per calendar year on the card.

A variety of Citi related travel and purchase protections.

Citi Hilton HHonors Visa Signature Card

Sign-up Bonus:

75,000 Hilton HHonors points after making $2,000 in purchases within the first 3 months of account opening.

Annual Fee:

No annual fee

Hilton HHonors Points Earning:

- 6 HHonors points per dollar spent at Hilton hotels

- 3 HHonors points per dollar spent at supermarkets, drug stores and gas stations

- 2 HHonors points per dollar spent on all other purchases

Additional Benefits:

Hilton Silver Status – 15% bonus on all HHonors Base points earned, 5th night free on Standard Room Reward stays of 5 nights or more, complimentary in-room Internet, late check-out, access to fitness centers and two complimentary bottles of water per stay.

Hilton Gold Status after four stays within the first 90 days of account opening or after making $20,000 or more in purchases each calendar year.

Annual loyalty bonus of 10,000 HHonors points at the end of each calendar year in which $1,000 or more is spent on stays at Hilton hotels.

American Express Hilton HHonors Cards

Hilton HHonors Card from American Express

Sign-up Bonus:

50,000 Hilton HHonors points after spending $750 in purchases within the first 3 months of card membership.

Annual Fee:

No annual fee

Hilton HHonors Points Earning:

- 7 HHonors points per dollar spent at Hilton hotels

- 5 HHonors points per dollar spent at U.S. restaurants, supermarkets and gas stations

- 3 HHonors points per dollar spent on all other purchases

Additional Benefits:

Hilton Silver Status – 15% bonus on all HHonors Base points earned, 5th night free on Standard Room Reward stays of 5 nights or more, complimentary in-room Internet, late check-out, access to fitness centers and two complimentary bottles of water per stay.

Hilton Gold Status after spending $20,000 in a calendar year.

American Express travel and purchase protections.

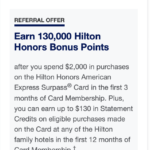

Hilton HHonors Surpass Card from American Express

Sign-up Bonus:

75,000 Hilton HHonors points after spending $3,000 within the first 3 months of card membership.

Annual Fee:

$75 (Not waived the first year)

Hilton HHonors Points Earning:

- 12 HHonors points per dollar spent at Hilton hotels

- 6 HHonors points per dollar spent at U.S. restaurants, supermarkets and gas stations

- 3 HHonors points per dollar spent on all other purchases

Additional Benefits:

Hilton Gold Status – 25% bonus on all HHonors Base points earned, 5th night free on Standard Room Reward stays of 5 nights or more, complimentary in-room Internet access, late check-out, access to fitness centers and two complimentary bottles of water per stay.

Hilton Diamond Status after spending $40,000 in a calendar year.

Priority Pass membership – access to over 700 airport lounges around the world. The $99 membership fee is waived, however, there is a $27 per person per visit fee associated with lounge access.

American Express travel and purchase protections.

All sign-up bonuses and spending requirements are current as of the writing of this post. Sign-up bonuses, and the requirements to obtain them, do change. Check the Citibank and/or American Express websites for the most current information.

My Take

Having access to four different Hilton HHonors points earning cards is definitely a positive for those playing the Miles and Points game.

If you were to apply, and be approved, for all four cards, you would have 200,000+ Hilton HHonors points and two weekend night certificates to use for your next excursion.

Hilton’s award chart is not the most generous when it comes to the number of points required for redemptions.

However, that is partially offset by the sizable category earnings associated with the co-branded credit cards.

And if you coordinate use of one of the co-branded credit cards with actual paid stays at Hilton hotels, your HHonors balance can really grow at a fairly brisk clip.

Still, Hilton awards are not cheap. 70,000 or more points for a one-night award stay at a higher-level property is a lot.

To maximize Hilton points, I always look to the Points & Money option – if available. While you’re still paying for a room, the dollar amount is much lower, and the points redemption more manageable.

So there are ways to get fairly good value out of the Hilton HHonors program.

Before you try to obtain the bonuses on all four cards, though, there are some Citi and Amex restrictions of which to be aware.

Citibank

- Can only apply for one personal card every eight days and not more than two in a 65-day period.

- Restrictions on how much credit can be extended based on personal financial situation. Can request credit be moved from an open card to obtain approval of a new card.

- Cannot receive a sign-up bonus if you’ve had the exact card, open or closed, in the past 24 months.

American Express

- American Express is now limiting sign-up bonuses to once per lifetime. This means, if you’ve previously received a sign-up bonus for one of the currently offered Hilton Amex cards, you will not receive the sign-up bonus again, even if you are approved for the card.

- You may be able to apply for both Amex Hilton cards on the same day, however, an automatic approval for both would be unlikely. A better route would be to wait – a month or so – to apply for the second Amex card.

Wrap up

Hilton hotels can be found throughout the world. Pretty much any destination you can imagine will have a Hilton at which points can be used to stay.

The sign-up bonuses associated with these four co-branded Hilton credit cards can go a long way to lowering, or even eliminating, hotel expenses on your next get-away.

All you need to do is select your destination, determine the points needed to achieve your travel goal, and select the credit cards that will make it happen.

After that, enjoy your chosen travel experience with a lot more excess cash in your pocket.

logo image courtesy of Hilton.com