The 2018 Stock Markets Gave Investors a Stomach Churning Ride with a Final Plummet That’s Left Many Wondering What’s Next?

The 2018 stock market performance was not what many expected, and definitely not what anyone wanted.

In my quarterly wrap-up post on the 2017 markets, I finished the update with “We can hope these outsized returns continue so that these issues [underfunding of public and private pension plans and lack of retirement savings by many Americans] are lessened, but I wouldn’t bet a large sum on that.”

And, as it turned out, it really was a good thing I didn’t bet money on the “good times” continuing to roll with respect to outsized stock market returns.

The juice just wasn’t there to continue the inflation of stocks beyond the levels already reached.

The reasons for the pull back are many.

I’ll touch on a few, as well as take a peek at what 2019 might bring to the U.S. economy as well as the stock market overall below.

But first let’s look at the cold, hard numbers, to see exactly what happened to the markets in the fourth quarter of 2018, and then the full year, for the big picture view.

2018 Fourth Quarter Returns

The Dow Jones Industrial Average declined 3,130.85 points or 11.83%.

The S&P 500 dropped 407.13 points for a 13.97% decline.

And the Nasdaq tumbled 1,411.07 points for a whopping 17.54% loss.

2018 Stock Market Results

Any one quarter can be a clunker for various reasons, which is why it’s always good to consider a longer-term perspective.

In this case, how the markets performed for all of 2018.

The Dow Jones Industrials lost 1,391.76 points for the full year, a drop of 5.63%.

The S&P 500 declined 166.76 points for a percentage loss of 6.24%.

And on a slightly brighter note, the Nasdaq was off only 268.11 points, equating to a 3.88% decline for the year.

Negative numbers for both the fourth quarter of 2018, as well as the full year. Not good at all.

What Happened?

So, what exactly happened to cause such a robust stock market to take such a turn?

Psychology and concern over what might happen in 2019, were contributing factors to the end-of-the-year selloff.

It was during October/November of 2018 that signs of a global economic slowdown became more pronounced.

Many of the overseas economies, China being a major one, began reporting lower than expected economic growth numbers, and, in turn, lowering growth forecasts for 2019.

But why would the U.S. stock market take such a big hit based on foreign economic conditions and projections?

Because slowing economic growth in countries in which U.S. companies do business will equate to lower growth for those American businesses.

Apple is a prime example of this. Its stock has taken a huge hit, dropping 37% in the last three months. Its recent announcement that revenue growth will be lower than expected due, primarily, to slow growth in China hasn’t helped.

So, a slowing worldwide economy has U.S. investors nervous about what might come, resulting in a movement of money out of potentially dangerous investments (stocks) into what may be considered safer alternatives…cash primarily and bonds to a lesser extent.

This movement of money has resulted in the market turmoil and downward pressures we’ve seen the last few months of 2018 and now into 2019. And the more the markets drop, the more investors cash out for fear of what might be coming next, making the selloffs even greater.

And then, of course, someone will decide the markets have dropped sufficiently that a quick profit can be made and the buying nudges the markets back up for a modest gain at which point the profits are taken and another percent or two is shaved off the markets’ price once again.

It’s quite a rollercoaster ride the markets are on right now.

But worldwide economic growth fears are only partly to blame for this wild ride.

The main factor associated with the U.S. stock market volatility is rising interest rates.

The Federal Reserve had kept U.S. interest rates at record low levels for much of the last decade. An unprecedented fiscal move. And one whose consequences were, and are, unknown.

Except for one, obvious, result.

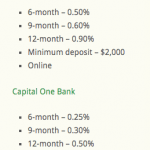

When interest rates are kept near zero, the rates paid to investors in the bond market is next to nothing.

While bonds are considered one of the safest investments available, if you’re effectively not making anything on your money once inflation is factored in, is it really a worthwhile place to put money?

Many investors said no to that question, and poured money into stocks instead.

This huge influx of funds, which normally would be kept in the more safe bond market, boosted the stock markets beyond normal levels.

Add in the fact that many corporations took advantage of the

That is the obvious consequence of the Federal Reserve keeping interest rates at record low levels for, what many believe to be, far too long.

And now, as the Federal Reserve attempts to bring interest rates back to a more “normal” level, the air is being let out of the artificially inflated stock markets.

Where a real “normal” stock market level truly is, really is anyone’s guess.

We can hope it’s in this current range, approximately 20% down from the markets’ ultimate highs. But it really is an unknown due to the “propping up” of the economy for the last 10 years.

A slowing of the worldwide economy, a reduction of economic assistance from the Federal Reserve, coupled with the fact that the business cycle hasn’t seen an appreciable slowdown in almost 10 years (when the average time period between slowdowns/recessions is approximately 10 years) and the hope for a return to a roaring stock market just might be that, a hope, not a reality.

In my 2018 first quarter

Take a quick look at one of my previous quarterly updates Have You Been Riding the Stock Market Rocket Ship? in which I present a few bull/bear market stats to illustrate how long increasing markets usually maintain that momentum.

The stats in that piece are partly why I would not have been surprised to see significantly greater losses this past quarter [Q1 2018]…or to see larger downturns in quarters to come.”

And boy did the larger downturns show up.

So, going forward into 2019, what might we see from the stock markets?

Well, it depends. Will we see a significant economic slowdown in the U.S.? And if so, how bad will it be?

Or, will the currently strong U.S. economy stave off a major downturn?

Bottom line, I don’t know that it matters that much the degree to which our economy slides, or doesn’t, the markets have seen their heyday, and growth will likely be negligible – in the mid to low single digit range – if we’re able to eke out gains at all.

Which is a bad thing in the bigger economic picture.

Keep in mind, most Americans with money saved for retirement, have those dollars invested in the stock market. And the returns the markets provide are the difference between having sufficient money during retirement or not.

And, as I’ve mentioned in most of my quarterly updates, both public and private pension funds require a 7 to 8 percent annual gain from their investments to be able to continue paying the amounts retirees have been promised.

Many public pension funds (government workers) are significantly underfunded as it

This past year of negative returns did not do pension funds any favors.

Luckily, annual market returns for 2016 and 2017 beat the 7% – 8% range by wide margins. But those days are gone for the foreseeable future.

So, without the markets hitting those outsized gains in the years to come, increased taxes (or cuts to the promised pension payments) will be the only option to cover pension obligations.

And the U.S.’s ever-growing debt – now at $22 trillion and rising – will become a drag on economic growth, requiring some sort of fiscal remedy that will most assuredly burden the budgets of everyday Americans.

America is facing an interesting economic time right now. To ease through the headwinds that are blowing, we need strong economic growth and a stock market that continues to rise…even if it is at a modest pace.

I’m not sure either of those things are in the offing.

Which brings me to my usual close to these quarterly reports…

We at Savings Beagle are not investment advisors. It’s not our goal to encourage you to put your money into the markets, or to sell if you already have invested.

Rather, it’s to provide information to help illustrate the current state of the U.S. markets which can help guide your financial decisions.

Saving money – whether by investing in stocks, bonds or by simply putting a set amount into a savings account on a regular basis – is critical to your future financial well-being.

And we’re here to relay money saving deals and tips to make finding that excess cash that you can put to work a little easier.

If you haven’t already, bookmark our site, follow us on Facebook, join us on Twitter or subscribe to our posts to ensure you receive every savings opportunity we’re able to pass along.

Saving money and planning for the future’s hard – we’re here to help make it a little easier.

Stock charts courtesy of Morningstar.com