One Example of Why the Stock Markets are So High

Last week I was doing my regular site housecleaning, primarily updating information that can change from month to month to provide readers the most up to date information available.

In this case, specifically, I was reviewing and updating the High Yield Savings Account and High Yield Certificates of Deposit pages readers can use as reference when looking for options to increase their earnings rate safely.

High Yield Accounts

As I scanned the latest interest rates for the High Yield Savings Accounts we list, it hit me how ridiculous the “high yield” rates really are these days.

For accounts with few to no restrictions with regard to deposit amounts and length of deposit, you’ll be lucky to earn 1.00% on your deposited money.

We do list a few accounts that will pay as high as 1.20%, but it was interesting to see that every account had lowered the amount of interest paid as compared to its rates just last month (June 2020).

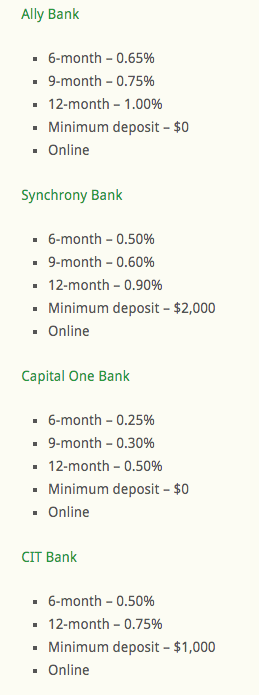

And the High Yield Certificates of Deposit weren’t much different.

Of course, CDs are more restrictive, requiring investors to choose a specific period of time to commit their money to receive a specific interest rate.

And the majority of “reasonable,” in my book, periods – 6 months to one year – saw interest rate decreases from last month as well.

Let’s just take a look at what these interest rates would earn over a one year period of time.

We’ll use $1,000 as a deposit example. A nice round sum, equal to a nicely-funded emergency fund.

Deposit that $1,000 in a “High Yield Savings Account” earning 1% interest compounded monthly, and your month 12 ending balance would be a whopping…$1,010.05.

To keep the full $1,000 in that account for 12 months, you’d earn $10.05. Yes, it’s better than nothing, but not by much.

Now let’s take a look at a High Yield CD.

Remember, a CD requires you to keep your money in the account for the full period of time or you’ll lose the interest that specific CD will pay.

And, looking at 12-month CDs on our page, there’s only one that pays above 1%. So, to be gracious to our money, we’ll use that one as an example, since we’ll have to lock up our $1,000 for that 12-month period.

The $1,000 deposited in the 12-month CD paying 1.10% would pay you $1,011.00 when the CD matures (at the end of month 12).

A total of $11.00 earned for keeping your money locked up for 12-months.

And if you might want access to that money earlier, the 6 and 9-month CDs pay even less.

Again, any earning is better than nothing, but…

And let’s not even talk about traditional savings accounts. You’ll be lucky to earn $0.70 on that $1,000 over a year’s time.

The Stock Market

Which brings me to the main point I wanted to make with this post.

Because of the Federal Reserve Bank’s low interest rate policy for the past 10 years or so, but especially since March when it lowered interest rates to effectively zero, it has pushed money into U.S. stocks.

For anyone wanting to get any kind of return on their money, the stock market has been the only place to do so.

And, bear with me, as I provide one final example of how monies have been forced into the more risky investment environment of stocks.

Traditionally, U.S. Treasurys have been a fairly safe investment, paying a respectable return on invested money.

But, to get a decent rate, you have to commit money to a longer period of time.

Which was fine in the days of “normal” interest rates.

Right now, though, the 10-year Treasury note is paying 0.64%. Yep, that’s right, to keep your money locked up for 10 years, you’ll get paid less than 1%. Much less.

Which are you going to choose? A 10 year Treasury? Or go for a stock, mutual fund, or ETF that’s potentially going to earn 3%, 7%, maybe even over 10%? And you can get out at any time.

Most are going to pick stocks, without a doubt.

Which is a primary reason why we’ve seen the markets climb as high as they have…and especially recover so quickly after this past March’s significant decline due to Covid-19.

But there is a downside.

And that is, if a majority of money is invested in stocks in order to obtain a decent return, what happens to those invested dollars if there’s a market correction?

And especially if that downturn occurs right when you need that money?

Like if you just retired…or, on a smaller scale, your furnace just conked out?

The stock market is a great option to grow money. Most definitely so if your investment horizon is years and decades in length.

But it’s not without risk, and right now it’s at levels that are not completely justified.

Some will call the markets over-inflated bubbles, just waiting to pop.

And with that pop, very well may go a significant amount of money that should have been invested in much safer investment vehicles…like High Yield Savings Accounts, High Yield Certificates of Deposit, U.S. Treasurys and the like.

If they paid even the remotest of decent returns, that is.

This isn’t to advise investment actions one way or another.

Rather it’s just to illustrate how Federal Reserve policy has influenced the investment environment. And not entirely in a positive way.

Just be aware of the potential financial risks that have been created over the years and make informed decisions, using that knowledge, to keep your money as safe as possible while still growing it for the future.

What are your thoughts on the investment landscape? Where do you put your shorter-term money to keep it safe while earning some return?

Considering the low interest yield of all mentioned in your article we are seriously considering investing in the nuemisticcoins in gold and silver. Perhaps even investing in Krugerrands.

Gary,

Thanks for reading and taking the time to comment.

Yes, gold and silver, especially in coin form, are good additions to any well-rounded investment portfolio. Especially so if we begin to see the negative consequences of higher to hyper inflation as a result of the low interest rates we’ve seen for the past decade and the corresponding extremely high government debt and deficits that show no signs of changing direction.

The key is getting the mix right, enough that provides growth and safety should things turn bad, but not too much to crowd out other investments that are still performing above average.

I can’t completely vouch for the accuracy of this document, but it is an interesting comparison of U.S. annual asset performance from 1980 – 2019 with a focus on gold. Something to add to your research when considering where to invest your money.

http://banners.bullionvault.com/en/us-annual-asset-performance-comparison-1980-2019.pdf