Chase Freedom’s 2018 1st Quarter Bonus Categories are Out and Wow!

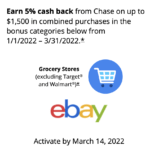

The 2018 first quarter bonus categories for the Chase Freedom credit card are out and points/cash back earning for spend on those categories can now be activated.

Bonus Categories

Freedom’s first quarter bonus categories include:

- Gas Stations

- Internet/Cable/Phone Services

- Chase Pay, Android Pay, Apple Pay and Samsung Pay

All purchases made in these categories earn 5% cash back – or my favorite, 5 Ultimate Rewards points per dollar spent – on up to $1,500 in combined purchases.

Bonus earnings at the bonus categories will begin January 1, 2018, and run through March 31, 2018.

If you haven’t received your activation email yet, you can activate the first quarter categories here.

These categories are interesting in that the Internet/Cable/Phone Services category mirrors that found on some Chase business credit cards. The ability to earn 5 Ultimate Rewards points per dollar spent – or 5% cash back – on these highly valuable categories can really boost your UR balance. Most people have at least one of those bills monthly, if not all three, making that category an easy way to earn a number of Ultimate Rewards points on a regular basis. Or, in this case, for the next three months.

And, as I’ve mentioned in a few previous posts, we’re seeing more and more of an effort to get consumers familiar with using digital wallet systems. Which is exactly what Chase is doing by giving 5% cash back/5x Ultimate Rewards points on purchases made with not only Chase Pay but the other three digital payment systems that are listed, too.

How to Play It

Chase has given us a taste of how to play the Chase Pay category bonus with its two recent Chase Pay/Walmart promotions.

You can read our posts on the promotions here and here.

In case you don’t want to read the old posts, here’s what you do.

A Walmart Example

Simply purchase Visa gift cards from Walmart – online, using Chase Pay to checkout – and use your Chase Freedom card to pay within Chase Pay.

A $200 Visa gift card comes with a fee of $6.88, which is about as low a fee as you’ll find for a $200 card. And that $200 gift card will get you 1,034 Ultimate Rewards points (or $10 cash back, effectively wiping out the fee and “making you” $3.12).

Then, use the gift card(s) to pay for things that don’t earn a credit card spending bonus.

For me, it’ll be groceries and other household goods. Or for dining out. Or for any other purchases that don’t earn at least 5x miles or points with some other credit card.

And if you don’t want to pay the gift card fee, Walmart sells a number of merchant-specific gift cards that do not include an additional fee.

Grab a bunch of gift cards to retailers you’ll be buying from anyway and earn the extra cash back/UR points in the process.

Gas Stations

The gasoline bonus category usually isn’t a huge earner for many. Maybe, for most, it accounts for a few hundred each month, chipping away at about half of the $1,500 quarterly spend. Or none if you live in a major city and use mass transit.

But, many gas stations sell gift cards, too, making that another way to maximize the quarterly bonus categories.

In fact, some grocery store gas facilities sell their own grocery gift cards, fee-free, making it easy to indirectly earn the 5x bonus on your grocery spend.

Cell Phones, Landlines, Cable and Internet

Add in payments for your cell phone bill, cable bill, and especially your Internet bill, and there goes a large chunk of that $1.500 quarterly spend amount.

Mobile Wallets

The mobile payments option, though, is a game changer. Especially when Chase is offering 5x for so many systems – Chase Pay, Android Pay, Apple Pay and Samsung Pay. Find any retailer who accepts mobile payments – online or in-store – and you can earn 5x/5% for each dollar spent.

For some, the mobile payments option alone will allow them to maximize this quarter’s bonus categories.

However, many people are not yet familiar, or comfortable, with mobile payments. If that’s you, wade in slowly, it just takes a little getting used to. And, likely, you’ll find it’s a fairly convenient way to pay. Which is the exact reason Chase has been offering so many mobile payment promotions. Slowly moving customers to this new way of paying.

And as long as Chase – and other entities – keep incentivizing the mobile payment purchases, I’ll keep doing it.

Bottom line, those with a Freedom card should have absolutely no problem maxing out the bonus categories this quarter and adding 7,500 Ultimate Rewards points to their balance or $75 cash back to their account.

My only gripe…why couldn’t Chase have spread these fantastic bonus categories throughout the year!