Changes are Coming to How the FICO Score is Calculated

According to a recent Wall Street Journal article, changes are coming to how the FICO score is calculated, and consumers should take note.

In multiple articles over the years, I’ve stressed the importance of the FICO score and provided insights on how to get and keep a strong FICO score.

A few of the key points associated with a solid FICO score, which I’ve stressed in previous posts, will become even more important with the introduction of the Fair Isaac Corporation’s new scoring model.

The updated FICO scoring model will weigh more heavily missed payments and changes to an individual’s debt levels while also factoring in any personal loans a consumer may have outstanding.

Changes to FICO Score Calculation

Ideally, consumers want to carry no debt.

In the real world, that’s just not realistic for most.

Credit card and personal loan debt are often a part of the average American’s financial situation.

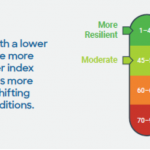

When it comes to your FICO score, your credit utilization rate – the percentage of the credit lines you actually use – played a large part in your FICO score calculation.

The higher your credit utilization rate, the more your FICO score would be negatively impacted.

With the new FICO score calculation, in addition to the credit utilization rate, how a consumer’s debt levels have changed during the past two or so years will come into play.

Increasing debt levels will likely lead to a lower FICO score.

Making payments on time has always been the number one factor affecting an individual’s FICO score.

The new scoring system will place even more emphasis on missed or late payments, leading to bigger FICO score declines than may have been seen under current and previous scoring models.

And personal loans – often considered unsecured debt – may be a trigger for some consumers that results in reduced FICO scores.

Why These Changes?

Risk, or rather the mitigation of risk, is the reason why changes are being made to how the FICO score is calculated.

The U.S. economy has been humming along for over 10 years now…longer than is typically normal between down cycles…and lenders are nervous about what may be coming.

U.S. consumers have accumulated debt levels which are at historic highs.

And lenders want to know that the consumers to whom they’ve lent money are good risks for paying it back.

Additionally, lenders want to continue expanding their loan volume in an effort to increase revenue, but not to consumers who may be questionable when it comes to repaying what is lent.

Thus, a request for a FICO score which will – potentially – be more accurate at identifying less risky borrowers.

Which is what the soon-to-be-introduced FICO scoring model intends to do.

Many FICO Scores

What is often left unsaid, or even unknown, is that there are a few FICO scores lenders can utilize when deciding to lend money.

They range from the current FICO Score 9, through the FICO Score 2, with some lending-specific options as well.

The new version is called the FICO 10 T.

And there is, of course, the VantageScore, an alternative to the FICO score, which uses different financial criteria when calculating its score.

Some of the older versions of the FICO score may still be used for certain financial transactions.

As may the VantageScore should a lender find it better fits its desired financial view.

So, just because FICO is changing the way its score is calculated, doesn’t necessarily mean that that specific FICO score will be used in all instances.

Wrap Up

The Fair Isaac Corp. is changing how its FICO score is calculated.

More weight will be placed on personal loans, potentially penalizing some consumers.

Consumers with high credit utilization rates will likely see scores lowered.

And debt levels, and how they’ve changed over the previous few years, will now be part of the FICO score calculation.

For some – especially those with already high FICO scores – impacts will be negligible, and scores may even increase under the new model.

Individuals who have missed or late payments, increasing debt levels with high utilization rates and who have taken out personal loans will likely see lower FICO scores as a result.

If you happen to fall into that latter category, you may want to give our Money Management Series a look for suggested changes that could help you move toward a better financial path.

image courtesy of Stuart Miles at freedigitalphotos.net