An Overview of the U.S. Economy and Markets During the Third Quarter of 2020

Well, here we are, seven months into the coronavirus pandemic, and an overview of the U.S. economy and markets for the third quarter seemed appropriate.

Long-time readers of Savings Beagle are familiar with my quarterly updates, in which I look at how the markets performed during the previous quarter and what broader economic insights, if any, can be discerned.

But, as with the past two updates, this one will be tinted with a bit more Covid-related commentary owing to its “elephant in the room” nature.

First, let’s look at how the markets performed in Q3

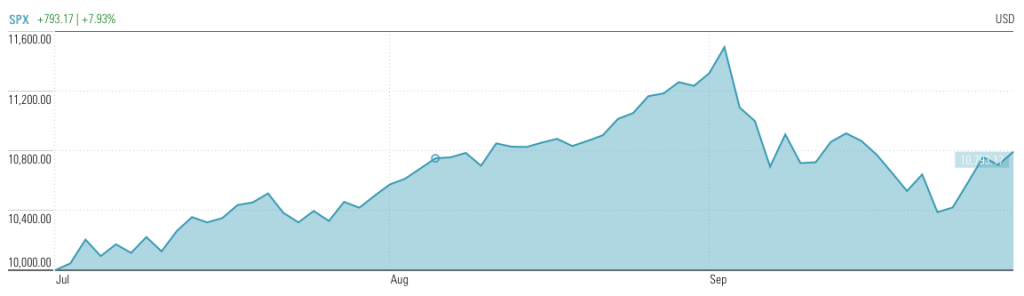

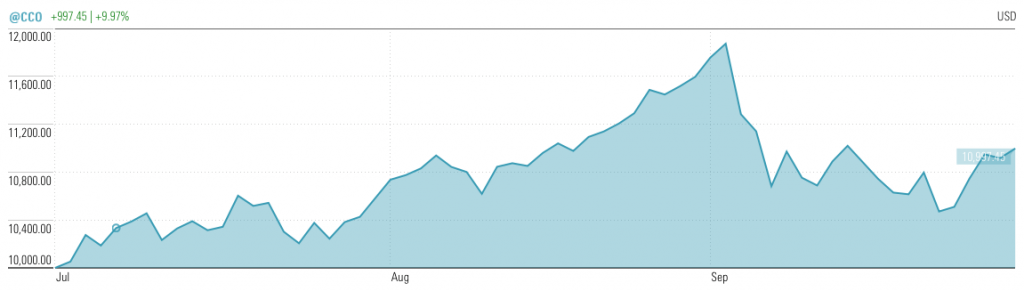

2020 Third Quarter Returns

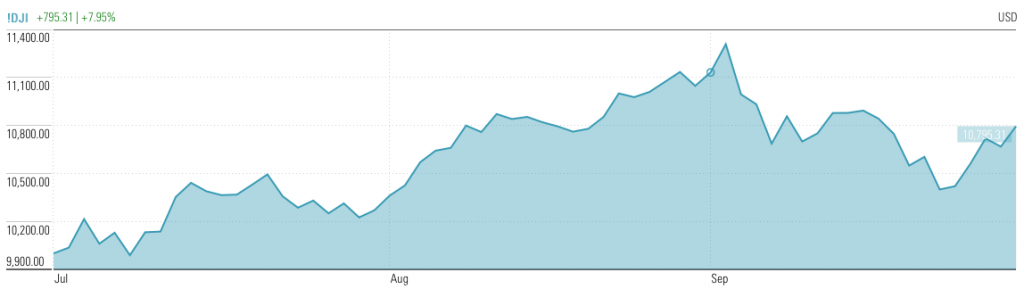

The Dow Jones Industrial Average rose 795.31 points or 7.95%.

The S&P 500 increased 793.17 points for a 7.93% gain.

And the Nasdaq climbed 997.45 points for a positive percentage return of 9.97%.

Obviously, as illustrated by the charts above, the third quarter was a combination of market gains and losses throughout the period, culminating in a decent overall increase for all three indices once the quarter came to an end.

I always like to clarify why I include the market actions in my quarterly reports when comparatively few Americans actually hold individual stocks.

While the stock markets are most definitely not an indicator of economic strength or weakness on Main Street, they are something to factor in when looking at the bigger picture.

And while large numbers of individuals may not hold stocks, their retirement plans, in the form on IRAs, 401(k)s and public and private pension plans most definitely do. And how those retirement vehicles perform matters greatly to how you as an individual will do once working is no longer an option, and the country will do in the larger picture, especially if retirement income is scarce.

And, of course, there are a number of businesses who rely on a strong investment portfolio to keep costs reasonable for customers…insurance companies being one.

So, now that I’ve disabused the idea that looking at how the markets have done is only for fat-cat investors, let’s consider the third quarter returns along side other economic measures of the U.S. economy.

The U.S. Economy Q3

The U.S. unemployment rate peaked in April 2020 at 14.7% due to government-mandated shutdowns related to Covid-19, and began a steady descent, hitting 7.9% in September.

Over 30 million Americans had filed for unemployment benefits in the first months of the pandemic.

That number is now approximately 25 million when regular continuing unemployment claims as well as the newly created Pandemic Unemployment Assistance program claims are considered. Better, but still bad.

And yet we continue to see the stock markets outperform in what no one would rationally consider a booming economy.

The reason, as I’ve mentioned numerous times in the past, is the Federal Reserve Bank’s intervention to literally spend whatever it takes to keep the economy from collapsing while keeping interest rates close to zero.

These moves by the Fed, effectively tell anyone – individuals, corporations, governments, etc. – hoping to make any decent return on their money, the stock markets are the only place to go.

And so they do, inflating the markets’ levels as they invest.

If only the money the Federal Reserve was using was real. It’s not. Neither the Fed, nor the U.S. government, actually has the money it’s using to keep the economy afloat.

But, that’s neither here nor there…[sarcasm].

We can just hope the negative consequences of both artificially inflated markets and outsized U.S. debt loads don’t rear their ugly heads anytime soon.

At least let us get past this Covid mess – both medically and economically – so that we have a fighting chance.

All that said, there are signs that we’re moving in that direction.

The unemployment numbers are slowly getting better. Although there does seem to be a plateauing of the numbers in recent weeks.

Economic activity is rebounding…somewhat. Many refer to it as a “fragile” recovery, with certain sectors performing well, others okay, and some not good at all (travel and tourism is one example).

Which illustrates that both the U.S. economy and many Americans, still need some help to “get over the hump.”

Unfortunately, we’ve seen the ugly side of politics in the past few months.

Early on Democrats and Republicans in Congress, and the White House, worked together to provide Covid-19 financial relief.

Significant portions of that relief (enhanced unemployment benefits from the federal government, primarily) ended in July, and there have been no consequential efforts to extend additional assistance since.

It boils down to political gameplay at its very worst.

Individuals and businesses need the financial help that the relief measures provided. Keep in mind, the primary reason so many are struggling is because of government actions to close large portions of the economy. Government must make those who’ve been affected whole as the negative consequences continue to ripple through the economy.

But it hasn’t. Because of politics.

Just this week, the Federal Reserve Chair, Jerome Powell, “…warned of potentially tragic economic consequences if Congress and the White House don’t provide additional support to households and businesses disrupted by the coronavirus pandemic.“

And he’s right.

The U.S. economy is slowly recovering, but there’s no guarantee that recovery will continue without additional support. Significant damage was done to the economy and a relapse is not out of the question.

In fact, I’d venture to say without significant relief and stimulus funding from the federal government (Congress and the White House) meaningful recovery is doubtful.

I worked in the political arena with a focus on government budgeting for over a decade, so I’m well aware of the political posturing that plays into policy-making.

But not during a crisis!

It truly is amazing our elected officials continue to play these ridiculous games when so many Americans are suffering. And especially since a cogent argument can be made that local, state and the federal governments had a strong hand in creating this economic suffering.

There’s still a glimmer of hope that a relief/stimulus deal will be worked out prior to November 3rd.

If not, there’s no excuse for a bill not being passed soon after Election Day once the associated lunacy has calmed.

If not, the economic progress we witnessed during the third quarter very well may be jeopardy of stalling at best or reversing course at worst.

Unfortunately, the fate is in the hands of our elected leaders…if we can still call them leaders, that is.