Deals Roundup: 20% Off at Amazon, Earn AA Miles, 20 Cents Off Gas at Marathon, and More

Rather than give each of these deals a post of its own, I thought I’d do a quick hit on each one and lump them all together.

Read through and take advantage of them all, or skip to the deal(s) that sounds the best to you.

Save 20% on Amazon Using Membership Rewards Points

This deal is similar to ones we’ve written about in the past, except previous deals have been a set dollar amount off of a minimum purchase amount, rather than a straight 20% discount.

As with the previous deals, you’ll have to have an American Express Membership Rewards earning credit card linked to your Amazon account. Linking your Membership Rewards Amex card can be done here.

Then you’ll need to see if you’ve been targeted for this deal. Clicking this link – when you’re signed in to your Amazon account – will show whether you’re targeted or not, and if so, activate the deal on your account.

If you do have access to the deal, a few points to keep in mind when taking advantage:

- The savings is only on items sold and shipped by Amazon.com

- You must use your linked Amex card to pay and use 1 Membership Rewards point (more if you want) to trigger the deal

- The 20% discount will be automatically applied to eligible items (sold and shipped by Amazon)

- It appears gift cards (including Amazon gift cards) are eligible for the discount

- Maximum benefit is $100 (which means $500 of eligible purchases)

If you have a purchase already in mind, this is a nice way to save 20%.

Another play is to buy gift cards for merchants with whom you do, or plan to do, business, and grab a 20% savings on purchases you were going to make anyway.

Just make sure the gift cards are sold and shipped by Amazon, which many of the retail gift cards (Netflix, Panera, Starbucks, etc.) are.

Savings Beagle is an Amazon affiliate, receiving a small commission from purchases made via our Amazon links. As always, we appreciate when you click through our links to make purchases, but you definitely do not have to.

Marathon Gas Savings and Southwest Airlines Rapid Rewards Points

Southwest Airlines has teamed with Marathon gas stations via the MakeItCount program to allow the earning of Rapid Rewards points when you fill your tank.

The earning rate, however, leaves a lot to be desired. You only get 1 Rapid Rewards point per gallon. So if you have a typical sedan, you likely won’t be earning more than 15 RR points each time you fill up. Additional points can be earned on select in-store purchases.

You do get 20 cents off per gallon on your first fill up after registering, though. Which isn’t too bad of a deal. Save 20 cents and earn a few Southwest points in the process.

If nothing more, the deposit into your Rapid Rewards account likely…although I haven’t confirmed this…resets your RR points expiration clock.

You can register here.

American Airlines AAdvantage Miles Promotion

American Airlines has begun its 5K Challenge.

No, you don’t have to do any running to grab these miles, but there are a few hoops through which you’ll have to jump to earn the max AAdvantage miles offered.

AAdvantage bonus miles will be earned for each of the 5 activities you complete after registering for the promotion. Completion can be in any order to earn miles.

- Shop: Make a purchase with AAdvantage eShopping

- Eat: Dine in or carry out with AAdvantage Dining

- Stay: Book and stay at a hotel through bookaahotels.com

- Drive: Rent and drive a car through aa.com/cars

- Fly: Fly on an American Airlines marketed and operated flight

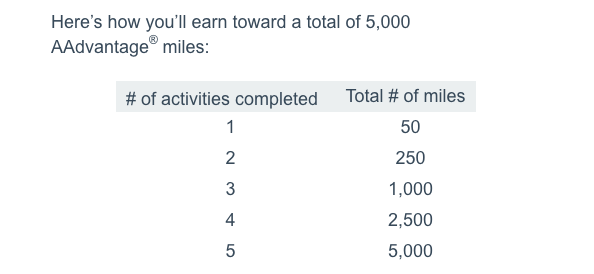

You can earn a total of 5,000 AAdvantage miles by completing all five of the above activities. Earnings for less than five are:

For some, this may be an easy – and worthwhile – way to earn some AA miles. For others, it just won’t be worth it.

If you do want to give it a go, you can register at this link.

American Express Platinum Cardholders Now Get a $100 Credit at Saks Fifth Avenue

The American Express Platinum Card is not for everyone. It’s a high annual fee – $550 per year for the personal version – card. But it comes with a large number of perks from which many travelers can benefit.

You can read my full write up of the American Express Platinum Card to get a better feel for all it offers. If you’re interested in the card for its benefits only – not a Membership Rewards sign-up bonus – be sure to read my thoughts on the Ameriprise version.

Now, in addition to all the other benefits the Platinum card offers, you can grab a $100 statement credit – $50 every six months – when you use the Platinum card at Saks Fifth Avenue.

This isn’t a fantastic savings deal considering the cost of most Saks items. However, if you shop at Saks anyway, why not use your Platinum card every six months and knock $50 off your purchase amount.

Enrollment is required – as is the case with most of the Platinum Card’s benefits – and can be done here if you’re already a cardholder.

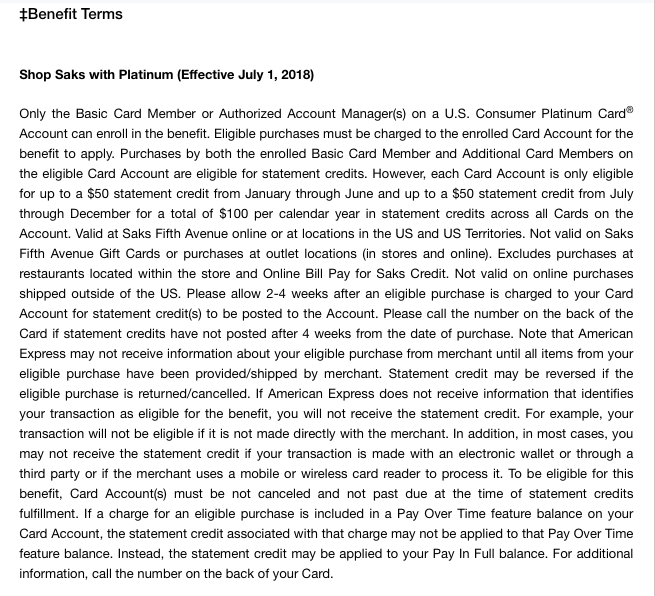

Below is the benefit’s fine print.

Which deals are you taking advantage of?