Weekly Unemployment Claims Were Up, Continuing Claims Were Down, But This Often Unreported Number is the Most Disturbing

Yesterday – Thursday, July 23, 2020 – was unemployment claims reporting day.

As is every Thursday.

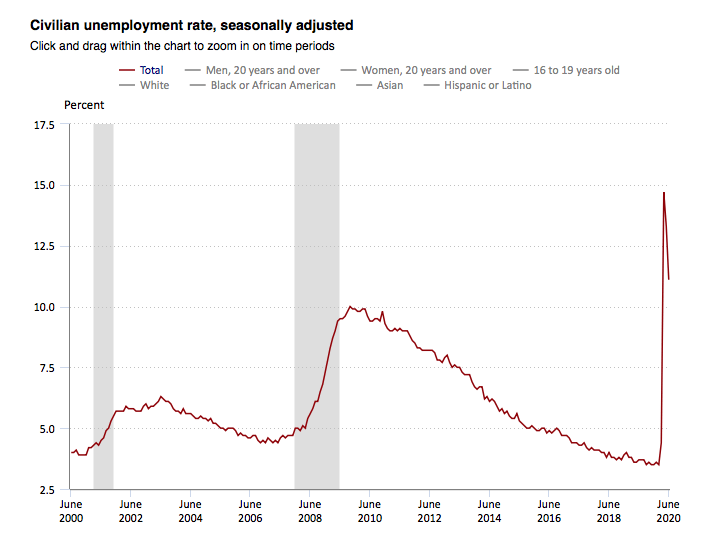

We’ve been seeing a slight decline in the first time unemployment claims filing numbers for the past 15 weeks. Unfortunately, that came to an end this week, with 1.416 million Americans filing initial claims for unemployment for the week ending July 18, 2020. That was up from last week’s 1.3 million.

This is the 18th straight week of initial claims totaling more than 1 million. An unbelievable number to be sure.

On a somewhat positive note, the continuing claims – people continuing to collect unemployment benefits – dropped by 1 million to a total of 16.2 million Americans for the week ending July 11.

So, we continue to see an up and down gyration to the unemployment numbers, likely due to the openings and then closings of various states and localities across the U.S. due to Covid-19 flare-ups.

To be blunt, these unemployment numbers are bad in themselves.

But there is another, often unreported, group of unemployed that the headline numbers exclude.

Pandemic Unemployment Assistance Program

The Pandemic Unemployment Assistance program, a newly created unemployment program within the CARES Act, provides unemployment benefits to individuals previously ineligible for regular state unemployment insurance payments.

Specifically, the PUA allows self-employed workers, including independent contractors, freelancers, workers seeking part-time work and workers who do not have a long-enough work history to qualify for state unemployment benefits, to receive benefits.

Because the program is new, individuals receiving benefits as a result of the PUA are not counted in the regular unemployment numbers.

Rather, a separate category has been established to keep track of PUA recipients.

And the most recent numbers for those receiving benefits under the Pandemic Unemployment Assistance program are 13.2 million.

When we combine the continuing claims of 16.2 million with the PUA claims of 13.2 million there are approximately 29.4 million Americans currently collecting unemployment benefits.

Thanks to Covid-19 and the government-mandated shutdowns that resulted, there are a significant number of Americans out of work.

Unemployment Benefits

Luckily, the federal government passed a number of relief bills during the early stages of the Coronavirus pandemic, most focused on helping individuals and businesses weather the shutdowns and early subsequent economic downturn.

One of the benefits included in the CARES Act was a federally subsidized $600 per week increase of benefits for those receiving unemployment payments.

This enhanced unemployment benefit is scheduled to end next Friday, July 31, 2020.

Which means for most individuals receiving unemployment payments, their monthly “income” will drop significantly.

Most states’ unemployment insurance payments are based on wages an individual was paid in his/her base year (previous year for most). The amount paid is a percentage of that base year wage number, somewhere in the range of 50% up to a set dollar amount which for most states is in the $400-$500/week range.

So, at $450 per week as an average example, an unemployed individual would receive approximately $1,800 per month.

With the federal $600 enhancement, unemployed workers were earning $2,400 from that benefit alone. Add the max benefit for most states and an individual was “earning” $4,200 per month or the equivalent of $50,400 per year.

A number which for many was significantly higher than what they were earning when working.

Creating, for some, a disincentive to go back to their job…if the employer for whom they worked opened that is.

And making it difficult for some employers to find enough workers to even try opening back up…if their state was allowing them to.

A Fix

So, Congress is right now working on a solution that will still provide some enhancement to the unemployment benefits roughly 30 million Americans are depending on to live, while removing the financial disincentive to actually go back to work.

And that’s one reason why we’re only a week away from unemployment benefits being lowered significantly with no legislative solution in place.

This, unfortunately, is not uncommon.

I worked in policy-making for over a decade, and for major pieces of legislation, the last minute was always the norm when it came to finalizing these bills.

So, we’ll likely see some resolution…or at least a temporary fix…passed and signed into law just before the July 31 end date.

The primary reason being, while the large number of unemployed individuals need the extra money the federal enhancement provides, the overall U.S. economy needs that money even more so that bills continue to be paid and extra spending is maintained.

Without it, you ain’t seen nothing yet as it relates to unemployment and economic hardship.