Citi Adds Citi Merchant Offers to its Credit Cards

Citi has added Merchant Offers to its lineup of credit cards, providing consumers one more way to make their credit card spend benefit them.

Citi is entering the “Offers” game similar to what Chase did a few years ago, and what American Express has been doing for quite some time now.

It took Chase a while to build momentum, but we’re finally beginning to see a better variety of meaningful Offers on its cards.

American Express has long offered quality money-saving Offers on its cards.

Now it’s Citi’s chance to show us what it’s got.

And a quick look at its early offerings show promise, but remind me of Chase’s early days in some ways.

Citi Merchant Offers

First off, Citi needs to make the Merchant Offers more visible on its main credit card page.

Currently, you’ll need to go to the main header bar, select Rewards & Benefits and then choose Offers for You.

Then select the Save with your Citi card option, clicking the See Your Offers button.

Finally, you’ll be on the page where all of the Offers available to you are listed.

Whew, that’s a lot of hunting and clicking.

Citi Offers

It looks as though Citi’s Offers are a mix of widely offered savings deals from nationally known retailers/businesses coupled with local dining and entertainment establishments based on your card’s address.

Local Offers

The local Offers provide 6% back as a statement credit. Not sure if that 6% will be the typical offer, or if it’s just a coincidence during the Offers rollout stage.

And, they uniformly expire in 45 days. Again, not sure if that’ll be standard or just coincidence.

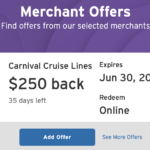

Other Offers

As you can see from the image above, there are a variety of retailers – these are just a few of the 79 on my account – with different savings offers available.

Some offer a percentage back, while others are a dollar amount when a specific spend amount is met.

The expiration dates vary from 29 days to 45 days for these Offers.

If they work anything like Chase Offers, even though they expire, some Offers return the next day with a new expiration date.

How to Use Offers

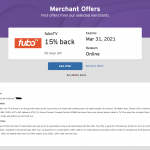

The Citi Merchant Offers work the same way Amex and Chase Offers work.

If you see an Offer you like, click the See Details button and then the Add Offer button on the page that follows.

The Offer is now added to that specific Citi credit card, and when a purchase at that merchant is made with that credit card, the associated savings will be triggered.

The savings will then show on your credit card statement as a credit.

How long the credit takes to post to your account is something we’ll have to see. Both American Express and Chase Offers’ credits usually post anywhere from a few days after purchase up to 10 days.

And, as with any credit card Offer, be sure to read the fine print prior to using.

Some Offers are only good for online purchases, while others will only be triggered if used in-store.

Always check the details of an Offer to be sure you can use it, and then that you use it correctly.

Wrap Up

It’s nice to see Citi adding Merchant Offers to its credit card lineup.

This is an easy way to save money at retailers you were going to shop at anyway.

Just add the Offer to your Citi credit card, use that card to pay at the retailer associated with the Offer, and save.

I can’t say I’m overly excited by any of the Offers currently on my Citi account, but the savings opportunities are better than were there before Citi launched the Merchant Offers.

And, if Citi’s Offers program is anything like Chase’s, it’ll take a little while to get up to speed with the quality of Offers that are available.

But you never know what Offer will pop up and when, so be sure to keep Citi’s Merchant Offers in mind when using your Citi credit card(s) and give them a look every once in a while.

We’ll do the same and post the better Offers – like we do with Amex and Chase – on our site.