Why Saving Now is More Important Than Ever Before

I wrote the article below about the importance of saving money, and why it is so vital, approximately three years ago. Since then, the message about why saving now is more important than ever hasn’t changed at all. In fact, in light of all that’s been done by the federal government and Federal Reserve Bank to keep the U.S. economy from collapsing, the message of self-reliance and having a financial cushion is even more important.

I’ve updated the financial numbers, but kept the previous ones as a reference. Keep in mind, the updated financial number are pre-coronavirus, so the current debt and deficit figures are much worse. And will grow to even greater levels over the coming months.

This is information every American should know and understand…please share.

Original Article with Revisions

Recently, an article titled, “A Baby Boomer Makes Peace with Less,” ran in The Wall Street Journal.

The subtitle of the piece, written by Timothy W. Martin, reads, “Facing five times the debt of previous generations and relatively small savings, many retirees are making fundamental lifestyle changes; Ms. Wolf [the primary subject of the article] trades California for Iowa.”

Like most Wall Street Journal articles, the full text is behind a pay firewall. If you’re a subscriber, you can access the full story here.

While Ms. Wolf’s story was an interesting and sobering one…she made a large amount of money in California real estate during the mid-2000s boom and then lost most of it during the 2008 crash…it was the article’s larger message that interested me.

To put it succinctly, the Journal states, “America’s 75 million baby boomers have piled up more debt while holding less savings than generations before them, a mix that is crimping their hopes of a comfortable retirement.”

When looked at in isolation – if you can when the number being considered is almost a quarter of the entire U.S. population – you might shake your head and say, “that’s too bad,” and move on, thinking it really doesn’t impact you.

Unfortunately, the increased debt levels and low savings rate of boomers does – and will – have a large effect on all Americans.

Let’s look at the bigger picture.

America’s Debt

The United States is currently in debt to the tune of almost $20 trillion dollars over $24 trillion dollars. A number I won’t even try to quantify. Suffice it to say, holding that amount of debt is by no means a good thing.

And the U.S. government continues to spend more than it brings in each and every year.

U.S. budget projections for 2017 show a $559 billion deficit U.S. budget projections for 2020 show a $1.1 trillion deficit – money that will be added to that $20 $24 trillion debt level.

Long-term federal budget projections show no reduction in that deficit number, and in fact, have it increasing, significantly, in future years.

America’s fiscal house is most assuredly not in order.

Major Drivers of the U.S. Budget

This infographic shows the expenditures and revenues of the 2015 federal budget.

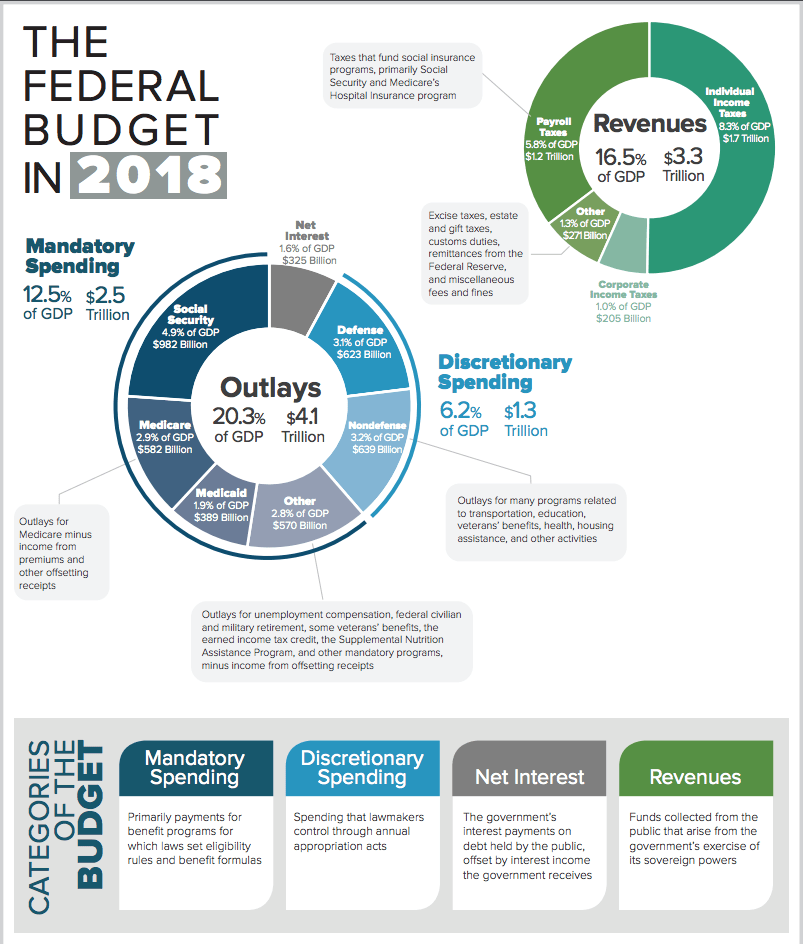

And here is an infographic showing the expenditures and revenues of the 2018 federal budget (latest available). Link to CBO pdf.

What should stand out most is that mandatory spending, specifically Social Security, Medicare and Medicaid, makes up close to half of all U.S. spending.

And those spending areas are being effected the most by an aging population – specifically the baby boomers.

Who, with their larger debt levels and lower savings are going to rely even more on government assistance to get by.

Underfunding

The problem with that scenario is that current funding levels for the largest drivers of the U.S. budget are not adequate to meet future needs.

The Social Security, Medicare (health insurance for those age 65+) and Medicaid (medical assistance for those with limited income/resources) programs were not designed to withstand large numbers of recipients living into their 80s, 90s and even past 100 years of age. Lower than normal U.S. birth rates, resulting in less taxpayer revenue, only exacerbated the funding problems.

As a result, without significant changes to the programs’ structures, benefits will be reduced. The money simply is not there.

Projections show that unless reforms are made to the Social Security program, benefit checks will need to be reduced by roughly 25% in 2035.

A $1,000 Social Security check will automatically become $750. Not a good scenario for those depending on the benefit checks to live.

As many of the current high-debt, low-saving boomers will be.

And, with an aging populace, without major health care reforms, costs to the government will continue to rise, and so too will health care spending’s percentage of the U.S. budget.

Not a pretty picture for America’s fiscal situation.

Pensions

Not to pile on, but we’re seeing more and more evidence to back up claims that both public (government) and private (business) pension plans are largely underfunded, too.

In previous posts where I discuss quarterly stock market performances, I’ve noted the problems facing the California Public Employees’ Retirement System, the Dallas Police Officer and Firefighter Retirement Fund and, more recently, the New York State Teamsters Conference Pension and Retirement Fund has sought permission to impose benefit cuts in an attempt to remain viable for the long term.

These are not isolated incidents. Many pension funds across the United States are facing similar financial problems.

Which means pension recipients may not receive benefits anywhere close to what was expected. Again, the money’s just not there.

And when you factor in the underfunding of Social Security, and the precarious financial state of Medicare and Medicaid, there’s a lot of work that needs to be done just to keep the status quo.

The Coronavirus Downturn

As of mid-April 2020, the federal government has appropriated approximately $2.2 trillion for coronavirus relief.

Money that will go to individuals, small, medium and large-sized businesses, state and local governments and more, simply to fill in the financial holes created by coronavirus and the efforts to mitigate its spread.

As efforts continue to address the financial damage done by coronavirus, expect those funding numbers to increase…likely significantly.

Which, as you consider the budget numbers above, will only add, even more, to America’s current debt levels.

Unfortunately, nothing can be done about that. The coronavirus relief funding is required to keep America’s economy from total collapse.

But, it’s important to keep in mind, the greater the debt levels a country carries, the higher the risk of negative economic outcomes.

What to Do

I wish there was an easy fix to all those fiscal problems. There is not.

Especially with the specter of coronavirus looming over the country and world for an unknown period of time.

Solutions, once coronavirus is behind us, will likely include increased taxes on all Americans, coupled with reductions to benefits.

We’re all likely to pay, one way or another.

And that’s if we make it out of this period of time with a normally operating economy intact.

I know, for some, especially now, this is difficult at best, but the primary way to mitigate future changes is to work toward building your own nest egg to reduce reliance on government programs and pension plans that may, or may not, be viable when it’s your turn to participate.

An easy task during normal times? Not at all. And now it’s even more challenging. But it’s a goal on which to focus.

Which is why we’re here. Which is what our focus and goal has always been for those who follow us.

Savings Beagle’s here to provide money management tips and strategies that will keep more of your money in your pocket, and, ultimately, into your nest egg, to help make your future a little brighter.

So, if you haven’t already, bookmark our site, check out our discussion board, follow us on Facebook, join us on Twitter or subscribe to our posts to ensure you receive every savings opportunity we’re able to pass along.

The financial future of America is more than a little uncertain. Let’s work together to make our individual futures a little more predictable.

infographics courtesy of the Congressional Budget Office