The Markets in the First Quarter of 2019 Brushed Off the Q4 Doldrums and Blasted Off

Wow. The markets in the first quarter of 2019 decided what happened at the end of 2018 was an aberation, reversed course, and continued the upward climb we’ve been seeing for the past years.

As I write this, the markets are just shy of their all-time highs, and will likely top those levels sometime soon.

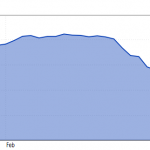

What caused the change of course from mid/late December 2018?

While there are many reasons that play into any market action, this reversal was primarily the cause of the Federal Reserve Bank changing its tune with regard to future interest rate increases.

In December, the Fed was all but stating it would continue to increase interest rates through 2019 and into 2020.

And while this action is, or perhaps better put, was, trying to move U.S. interest rates toward a more “normal” level, it ignored the fact that the U.S. economy has become accustomed to these low interest rates and will only tolerate so much increase.

Which is what happened in December.

The markets looked at the Fed’s plan for continued increases, then looked at slowing mortgage/housing data and car loan/sales numbers from the Fed’s previous actions and realized if interest rates increase

Not good for the U.S. economy as a whole.

And it’s then that markets began dropping. And dropping significantly.

The Fed took notice and in an effort to stem the bleeding, changed its message about future increases, making additional hikes less likely for the foreseeable future.

We then began to see the rebound as the markets digested an economic picture without the 2019 interest rate increases it had been fearing.

In fact, the Fed made a statement last month that there would be no interest rate increases in 2019, and likely only one in 2020.

Now, with the interest rate headwinds calmed, the markets can chug along.

Exactly how much markets will increase and for how long remains to be seen. But the bigger boogeyman, interest rate increases, seems to have been ameliorated for the time being.

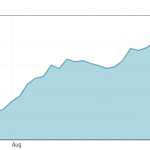

Now let’s take a look at how much the markets bounced back in the first quarter of 2019.

2019 First Quarter Returns

The Dow Jones Industrial Average jumped 2,601.22 points or 11.15%.

The S&P 500 rose 327.55 points for a 13.07% increase.

And the Nasdaq climbed 1,094.04 points for a whopping 16.49% gain.

2019 Going Forward

Should we expect this outsized growth to continue for all of 2019?

If I had to put money on it, I’d say no.

There are other issues that can dampen the markets going forward…slower growth overseas, potentially slower growth here in the U.S., issues associated with trade deals, political b.s., and the ever-present “unknown issue” that can rear its ugly head without notice.

Likely we’ll see continued market growth throughout 2019, with general market gyrations keeping the overall gains in the mid-single digits.

That’s as long as there are no major surprises and the Fed doesn’t re-think its current plan and decide to begin hiking interest rates once again.

If that happens, all bets are off.

And now to my typical close to these quarterly updates…

We at Savings Beagle are not investment advisors. It’s not our goal to encourage you to put your money into the markets, or to sell if you already have invested.

Rather, it’s to provide information to help illustrate the current state of the U.S. markets which can help guide your financial decisions.

Saving money – whether by investing in stocks, bonds or by simply putting a set amount into a savings account on a regular basis – is critical to your future financial well-being.

And we’re here to relay money saving deals and tips to make finding that excess cash that you can put to work a little easier.

If you haven’t already, bookmark our site, follow us on Facebook, join us on Twitter or subscribe to our posts to ensure you receive every savings opportunity we’re able to pass along.

Saving money and planning for the future’s hard – we’re here to help make it a little easier.

Stock charts courtesy of Morningstar.com