The Markets Had a Stellar Year in 2020 – How about the U.S. Economy and You?

As I researched the stock market returns for the fourth quarter of 2020, as well as the full year, I wasn’t too surprised with what I found. The story remains as it has been for many years now…the markets are largely disconnected from the Main Street economy.

Not that the U.S. economy is in bad shape. There is a decent portion of the economy that is doing fine, if not really well. And there is a smaller portion of the economy that is not doing well at all.

The pandemic and the various mitigation responses states have taken are primarily to blame for the challenging 2020 millions of Americans faced, and continue to face as we step into 2021.

The stock markets, though, have taken much of the challenges in stride, continuing to move higher throughout the year.

Which is a positive for those with retirement accounts invested in stocks and many of the pension funds and corporations who rely on appreciating stock markets to maintain viability.

Let’s take a look at the markets’ performance and then dig into the U.S. economy and where it may be headed.

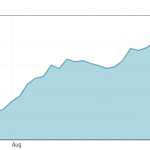

2020 Fourth Quarter Returns

The Dow Jones Industrial Average rose 1,002.84 points or 10.03%.

The S&P 500 increased 1,100.00 points for an 11.10% gain.

And the Nasdaq climbed 1,378.87 points for a positive percentage return of 13.79%.

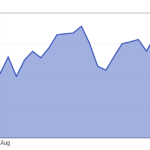

2020 Full Year Returns

And the 2020 full year returns for all three indices:

The Dow Jones Industrial Average rose 601.92 points for a full year percentage increase of 6.02%.

The S&P 500 increased 1,529.29 points notching a 15.29% gain for the year.

And the Nasdaq was the clear winner for 2020 with a 4,175.11 point jump equating to a percentage increase of a whopping 41.75%.

Tech was most definitely where a large portion of 2020’s gains were seen.

And the stock markets overall helped those individuals and entities who were invested feel a bit better about 2020.

But what about the U.S. economy?

The U.S. Economy in 2020

I mentioned in the intro that depending on which group you fall into, either the economy has been relatively stable as the pandemic has remained entrenched in the lives of Americans or it’s been a struggle as a result of closed businesses, lost jobs and reduced wages.

Over the summer I read an interesting narrative from an individual comparing his experience with the pandemic as compared to his brother’s. And it really hit home how different the experience can be depending on one’s occupation and the location in which one lives.

Here’s a quick overview of the person’s experience and how it likely is being felt across the U.S.

The individual relating the story indicated that he and his wife are government attorneys living in the suburbs of D.C. They’ve been able to work from home, with income unchanged and limited impediments to their everyday activities aside from being more cautious about outside interactions. They can still go to a variety of stores for food and necessities, drive to get takeout for meals and even mingle with neighbors at times.

His brother and wife have a different situation. The brother worked in a restaurant and his wife is a hairdresser. They live in New York City. Both occupations were dramatically affected by the pandemic and NYC’s significant lockdowns. He lost his job as did she, effectively, since indoor interactions were greatly limited due to government orders. Unemployment and savings were getting them through. But somewhat normal everyday activities were almost non-existent due to the restrictions put in place. They rarely left their apartment.

Life was dramatically different for the brothers and their families based on the jobs they held and where they lived.

And that same scenario is playing out across the country. Some are living a fairly normal (if that term can be used these days) life while others have been negatively affected in a variety of ways.

Luckily, when looking at the big picture, the economy has rebounded from the depths to which it sank in April/May.

Right after the shutdowns occurred, the unemployment rate was close to 15%…likely higher due to not all the unemployed being reported. As 2020 came to an end, the unemployment rate was down to 6.7%.

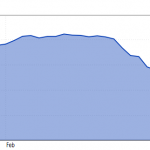

The economy contracted at a level never seen before – GDP was down 31.4% in the second quarter (April, May and June) of 2020, owing to the “complete stop” many sectors of the economy saw for a month or more during that time.

The third quarter of 2020 saw the GDP increase 33.4%. The economy, for the most part, had opened back up and many sectors were operating as normally as possible.

The GDP for the fourth quarter of 2020 is expected to come in at a bit over 8%.

The economy has rebounded from a drastic hit in early 2020, but it’s still not back to where it was in late 2019 and very early 2020.

And we’re beginning to see signs of economic weakening due to flareups of the virus and government actions in certain states to address the spread.

It’s been surprising how resilient the U.S. economy has been through this pandemic.

We can’t ignore a few significant actions that have contributed to that resiliency, though.

America has added, significantly, to its debt levels to shore up the U.S. economy. U.S. debt is currently $27.7 trillion, up from $22.8 trillion in 2019. These are astronomical numbers that could very well bode ill for America’s financial future.

But, not spending would have likely resulted in even more dire consequences now.

Congress passed significant Covid relief early on, as well as stimulus in the form of $1,200 checks to most Americans. This funding allowed Americans to keep spending. Which in turn kept the economy moving ahead after a major shock.

After a “political recess,” Congress passed additional relief and stimulus to ramp up much needed programs that had lapsed during the political game play associated with the presidential election.

Many Americans will be seeing $600 checks soon, if they haven’t arrived already, which will juice the economy a bit more as we move into 2021. And there are discussions even more stimulus will be sent to Americans in the coming months.

All told, the increased unemployment payments, government money for small and medium sized businesses to keep people employed as well as the stimulus payments all contributed to propping up the U.S. economy during a time that otherwise could have been disastrous.

Less known by most in America are the actions of the U.S. Federal Reserve Bank. In the spring of 2020, it effectively said it would spend whatever it took to ensure the economy remained stable. And it has. The thing about the Fed, as it’s commonly referred to, is it can effectively “print” as much money as it wants, injecting it into areas of the economy where it will provide the most effect – supposedly. The Feds words, and actions, early on, spared the U.S. from a very serious long-term economic downturn. History will tell us if the money was used effectively.

The significant inflow of money from the U.S. government and Federal Reserve Bank has kept the U.S. economy operating during this difficult time.

And has greatly contributed to a stock market that just goes up.

Likely, we’ll need even more relief – and possibly stimulus – in the coming months to ensure the economy remains headed in a positive direction.

But, considering this is all borrowed money at this point, it would be prudent that additional funding be focused on the areas of the economy most in need. The businesses and individuals who’ve been most hurt during this unprecedented time.

Such as the brother and his wife who live in New York City and similarly affected individuals across the U.S. rather than the attorneys living in the D.C. suburbs.

Considering Congress’ actions during the summer and fall, I’m not overly confident that the right thing will be done with the dollars that will only add to America’s debt.

And that’s a problem for us all.

In my previous Quarterly Update, I ended by stating our elected leaders needed to act, after months of not doing so, to ensure the economy remained healthy.

They didn’t…at least in a timely manner…and we’re beginning to see a slowing that may be partially a result of their inaction.

Politics, even during a time of crisis, is too much in play when what is most needed is sound public policy decisions focused on helping the country and all its citizens.

I ended the Update by saying, “Unfortunately, the fate is in the hands of our elected leaders…if we can still call them leaders, that is.”

And I’ll conclude this Quarterly Update the same way and leave it at that.