The Federal Reserve Bank Has Lowered Its Benchmark Interest Rate by Half a Percent

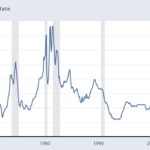

The Federal Open Market Committee (FOMC) held its latest meeting on September 17-18, 2024, and decided an interest rate cut was in order.

The Fed has been signaling that rate cuts are on the horizon due to moderated inflation and a cooling labor market, but the extent and pace of the easing remained uncertain.

It was decided that a 50 basis point (.50%) cut was appropriate.

The FOMC, the monetary policy-making arm of the Federal Reserve System, plays a crucial role in setting interest rates and financial policies that impact everything from savings account rates to borrowing costs for homes and businesses. The decisions made during FOMC meetings are closely watched by investors, economists, and policymakers alike.

Federal Reserve Chair Jerome Powell has made it clear that the central bank is prepared to cut rates to achieve a “soft landing” for the U.S. economy while balancing maximum employment and price stability.

This half percent cut is the first in what is likely a number of cuts to come over the next year.

This September meeting cut, and upcoming cuts, will have ripple effects on borrowing costs, asset values, and the direction of the U.S. dollar, making it a pivotal event for American consumers.