The Evolution of the U.S. Dollar as the Global Reserve Currency

The history of the U.S. dollar is a fascinating journey that dates back to colonial times when paper currency was first used to fund military operations. Fast forward to 1914, the first U.S. dollars were printed, marking the beginning of a currency that would eventually become the world’s reserve currency.

The U.S. dollar officially became the global reserve currency in 1944, following the Bretton Woods Agreement signed by 44 allied countries. This agreement pegged world currencies to the U.S. dollar, establishing fixed exchange rates and allowing countries to redeem dollars for gold on demand.

Over the years, the U.S. dollar’s status as the world’s reserve currency has been solidified by the size and strength of the U.S. economy and financial markets. Central banks around the world have accumulated reserves in U.S. dollars, with over half of their allocated reserves held in dollars as of the second quarter of 2024.

However, as countries aim to reduce their dependency on the U.S. dollar, the concept of de-dollarization has emerged. De-dollarization refers to the shrinking influence of the U.S. dollar on other economies, although the dollar remains the most widely held reserve currency.

De-dollarization is one of the reasons many central banks have been increasing their holdings of gold over the past few years. And this move to gold is partially responsible for its increased price.

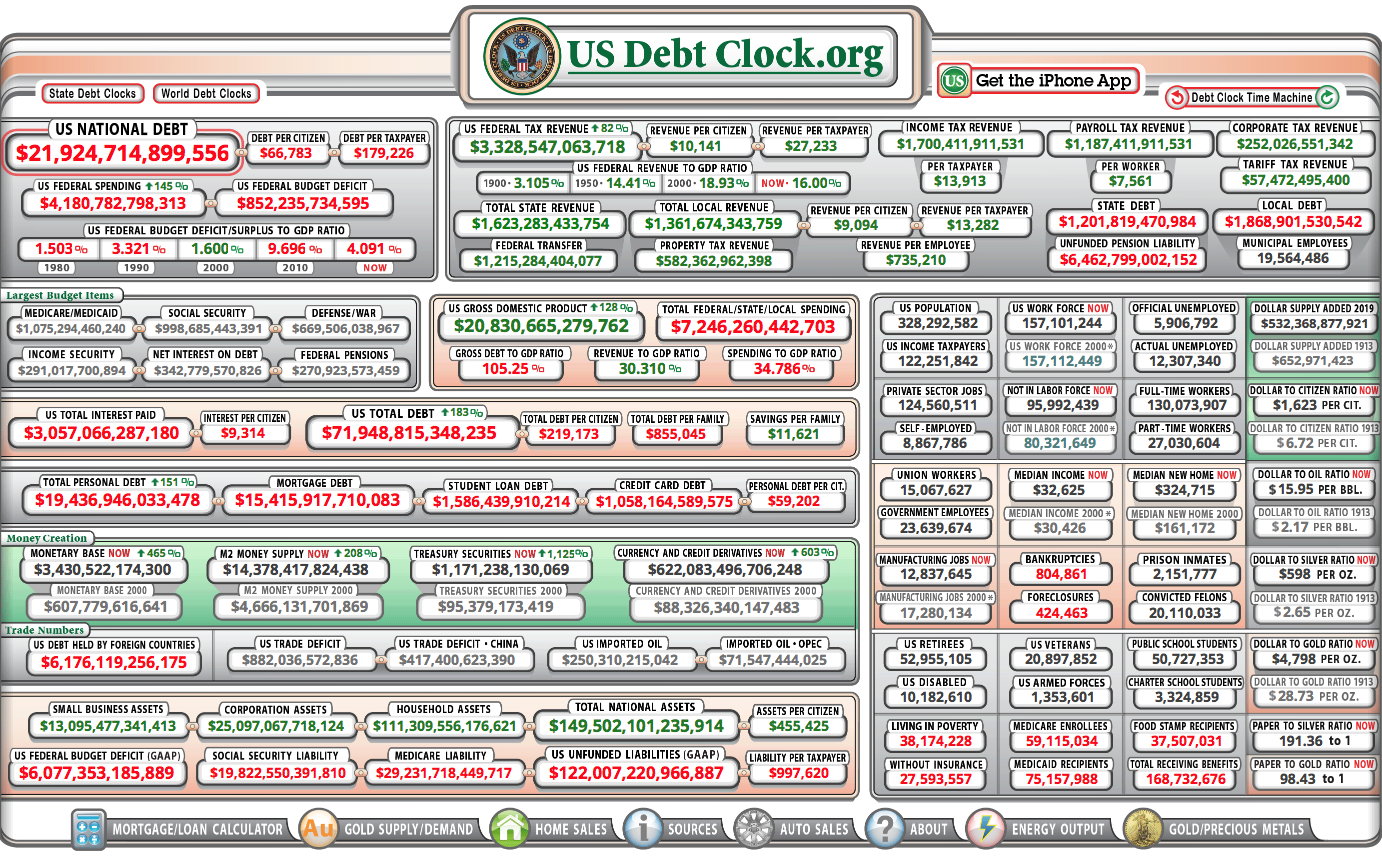

As America’s elected officials continue to ignore its precarious financial situation – $35 trillion in debt and growing by the day – whether the U.S. dollar will remain the global reserve currency in the coming years is in question. And if the dollar should lose that standing, the domino effect that will negatively affect all aspects of America’s financial situation, including your personal finances, will be staggering.

In conclusion, the U.S. dollar’s journey from colonial notes to global reserve currency is a testament to its enduring strength and influence in the global financial system. Despite challenges and shifts in the international monetary landscape, the dollar continues to play a dominant role in international trade and finance. Only time will tell whether that will remain the case moving forward.