The Economy Wants to Grow But Headwinds are Holding it Back and the Markets Have Reacted Accordingly

For a brief period, it looked as though Covid was receding in the rearview mirror late spring and early summer.

And then it wasn’t.

The actual illness aspect of Covid affected various parts of the country, resulting in slower economic activity in those areas.

The psychological impact of the spread likely affected even those areas of the U.S. that didn’t see large increases in cases, hospitalizations and deaths.

But the largest impact on the U.S. economy over this previous three-month period came from Covid fallouts that were a long time in the making.

Supply chain issues, inability to fill job openings and the spike of pricing across a wide range of goods and services are the primary drivers behind an economy that’s trying to grow but is being held back.

And these issues are also why we saw a less than stellar showing from the three major stock indices this past quarter.

Let’s take a look at the market numbers and then delve a bit into the issues that are playing into the current situation.

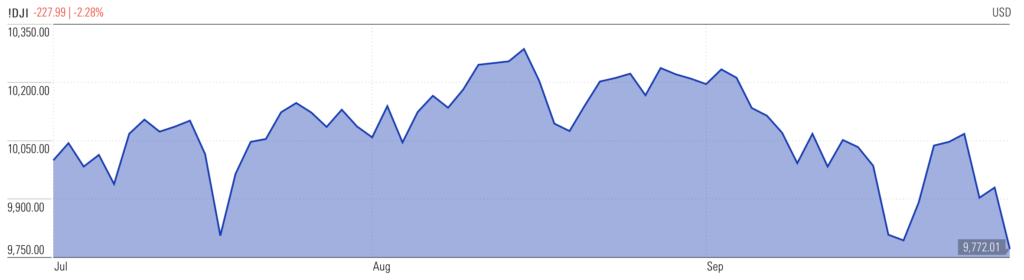

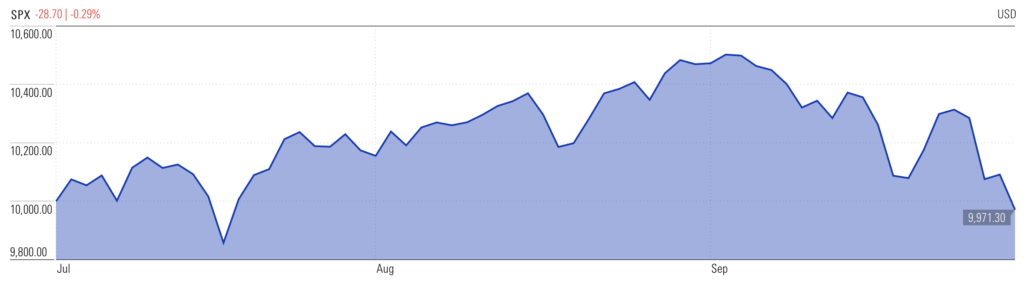

2021 Third Quarter Returns

The Dow Jones Industrial Average dropped 227.99 points or 2.28%.

The S&P 500 was off 28.70 points for a 0.29% decrease.

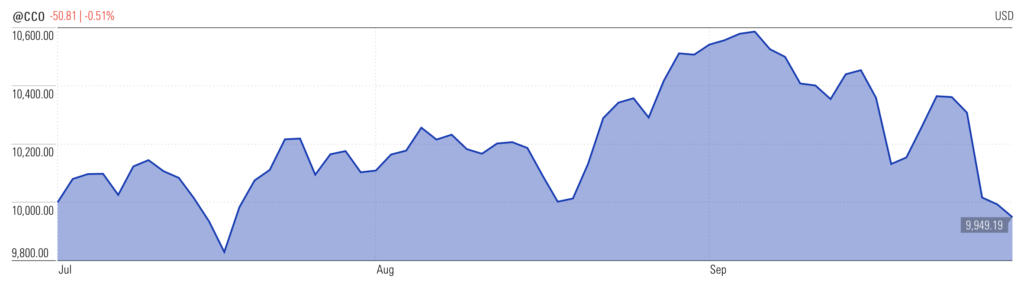

And the Nasdaq slumped 50.81 points for a 0.51% drop in Q3.

These are not the stock market numbers to which we’ve been accustomed.

Let’s lighten the mood a little and look at the returns for 2021 thus far.

2021 Market Results Through Q3

- The Dow Jones Industrials gained 1,197.74 points for the period, an increase of 11.98%.

- The S&P 500 climbed 1,639.96 points for a percentage gain of 16.40%.

- And the Nasdaq jumped 1,378.23 points, equating to a 13.78% gain from January 1 to September 30.

So, a much better view when factoring in the full year thus far.

But what can’t be ignored is the slowing we’re seeing in the real economy, represented by the third-quarter numbers.

Where We’re Headed

As I was reviewing some of my past Quarterly Updates, I found a quote from January 2020 that I had to include here.

“There are always areas of concern, but as of January 2020, there are no stumbling blocks in the foreseeable future that could keep the markets from going higher and the U.S. economy from steaming ahead.

That said, I can’t wait until I’m writing next year’s 2020 wrap up to see exactly what happened.

The continued growth is almost too good to be true.

It makes me worried there’s something lurking of which we’re not aware.

Only time will tell.”

Boy was there something lurking alright. And its name was Covid-19. And it reared its ugly head just a few short months later.

To this day, we’re still feeling the economic reverberations that resulted.

Which is largely why we’re beginning to see momentum from the quick economic snapback wane.

Supply chains for a huge number of goods are having a hard time keeping pace with demand, leading to limited supplies of products consumers want and need.

While the unemployment numbers have eased back toward pre-pandemic levels, employment numbers are remaining stubbornly low. Everywhere you look, help wanted signs beckon to potential new hires with little response. The reasons are many, but the continued concern over Covid is high on the list.

And with lack of workers to fill open jobs, growth, both at the individual business level, and the larger U.S. economic level, stagnates.

Couple the supply chain issues with the checks on employment growth and you can see why the markets’ returns were less than stellar the last three months.

Add in a sprinkle of the Delta variant and inflation beginning a run to levels not seen in over a decade, and the lackluster returns make even more sense.

Inflation

Inflation may be the most significant issue the U.S. economy will face in the coming months.

Just this week the Social Security Administration announced it will be increasing Social Security payments a whopping 5.9% for 2022. That’s an increase not seen in almost four decades.

And an illustration of how challenging inflation is going to be for Americans’ budgets in the coming months and possibly years.

As the economy recovered from the coronavirus downturn, the talk was inflation would be “transitory,” or temporary. Transitory is no longer being mentioned as inflation shows it’ll be around for a while.

The big question is for how long? And, possibly, more importantly, to what extent?

The inflation we’re seeing now is due to supply issues and a large amount of money looking to be spent as a result of the past year’s government spending/bailout/relief bills.

The problem is, there is no step-by-step roadmap on how inflation should behave. All it takes is a little economic hiccup here, or miscalculation of policy directives there, to have the inflation rate get completely out of control.

That is not something the U.S. wants to see. Especially considering the significant debt levels we’ve allowed to accrue. Holding large amounts of debt, in itself, can lead to high inflation…but more dangerously, hyperinflation, when economic safeguards are not taken.

And the safeguards are primarily implemented by the Federal Reserve Bank in the form of interest rate policy. Unfortunately, due to the Federal Reserve Bank keeping interest rates abnormally low the past decade or so, options are limited if inflation and the economy get out of hand.

So, keep an eye on the inflation numbers as we wrap up 2021 and move into 2022. And hope for a stabilization of the inflation rate with a preferred decrease as 2022 unfolds.

If that’s not what happens, expect more market returns like we saw in Q3 of this year…and that’s if we’re lucky.

We at Savings Beagle are not investment advisors. It’s not our goal to encourage you to put your money into the markets, or to sell if you already have invested.

Rather, it’s to provide information to help illustrate the current state of the U.S. markets, and economy, which can help guide your financial decisions.

Saving money – whether by investing in stocks, bonds or by simply putting a set amount into a savings account on a regular basis – is critical to your future financial well-being.

And we’re here to relay money saving deals and tips to make finding that excess cash that you can put to work a little easier.

If you haven’t already, bookmark our site, follow us on Facebook, join us on Twitter or subscribe to our posts via the box at the top right of this page to ensure you receive every savings opportunity we’re able to pass along.

Saving money and planning for the future’s hard – we’re here to help make it a little easier.

Stock charts courtesy of Morningstar.com