The 2022 First Quarter Bonus Categories for the Chase Freedom and Freedom Flex Credit Cards are Grocery Stores and eBay – And Here’s How to Use the Categories as an Offset to Price Inflation

The 2022 first quarter bonus categories for the Chase Freedom and Freedom Flex credit cards are out and points/cash back earning for spend on those categories can now be activated.

Bonus Categories

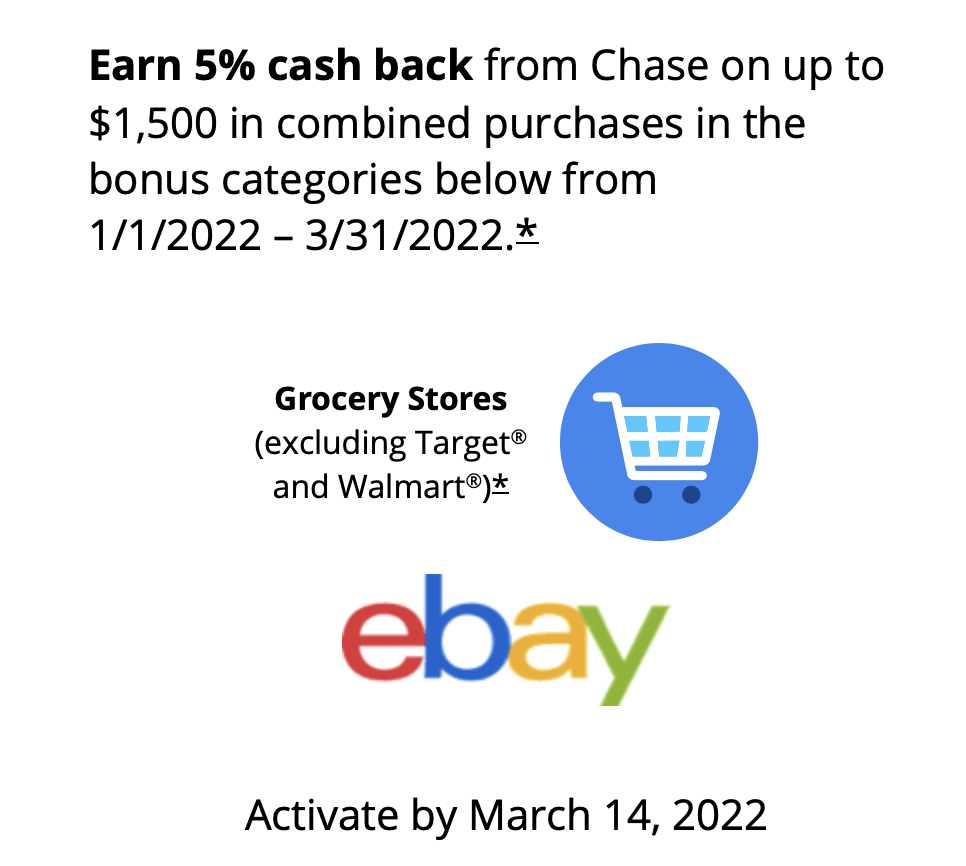

The Freedoms’ 2022 first quarter bonus categories include:

- Grocery Stores

- eBay

All purchases made in these categories earn 5% cash back – or my favorite, 5 Ultimate Rewards points per dollar spent – on up to $1,500 in combined purchases.

Bonus earnings will begin January 1, 2022, and run through March 31, 2022.

If you haven’t received your activation email yet, you can activate the third quarter categories here.

Obviously, you can activate your first quarter bonus categories at any point between now and March 14, 2022, to ensure you earn the bonus cash back/Ultimate Rewards points. I usually get it out of the way as soon as it becomes available to make sure I don’t forget.

How to Play It

The grocery store category is typically an easy category to max out by many cardholders. the eBay category is new, and likely one that will appeal – and hold value – to a select number of cardholders.

Here are a few thoughts on each.

Grocery Stores

The most obvious way to take advantage of this category is to make sure your Freedom or Freedom Flex card is the payment method for all your grocery shopping January through the end of March.

Just keep in mind, grocery shopping at Target and Walmart are excluded from earning 5%/5x with this category.

If you don’t see yourself spending roughly $500 per month on groceries, don’t forget that many grocery stores sell third-party gift cards, the purchase of which will trigger the 5%/5x earning, too.

Buy gift cards to restaurants and retailers from which you’ll be buying anyway, and earn the bonus amounts on that spend.

And, occasionally, grocery stores will offer fee-free Visa or Mastercard gift card deals, the purchase of which will allow you to earn the bonus points on a gift card that provides purchase flexibility. Use the Visa/Mastercard gift cards anyplace a Visa or Mastercard credit card is accepted.

The grocery category is one of the easier categories to max out due to most people buying at least some items from grocery stores each week, in addition to the large variety of gift card options that are available.

eBay

The eBay category will be valuable for those who regularly shop and/or sell on eBay.

This is the first time that I’m aware Chase has offered eBay as a 5x bonus category, so we’ll have to see exactly what qualifies as an eBay purchase. Hopefully, what triggers the 5x earning is straightforward.

Meaning, if you sell on eBay, any fees or other charges that must be paid in conjunction with your transactions would earn 5x when the Freedom/Freedom Flex card is linked as your payment method. For those who sell a significant amount on eBay, this could be a large chunk of the $1,500 quarterly spend limit.

Regular consumers who use eBay to purchase items will, obviously, benefit from 5x earning on those purchases.

And if you’re not buying specific products, there are eBay sellers offering third-party gift cards at slightly reduced prices. Another option for maxing out the 5x categories for the quarter.

Of course, caution is always advised on a platform like eBay. Check the review history of sellers to gauge reliability and don’t buy if there are red flags.

Wrap Up

The 2022 Q1 bonus categories for the Chase Freedom and Freedom Flex cards are Grocery Stores and eBay.

For many, the grocery store category alone will allow earning the full $75 cash back (or 7,500 Ultimate Rewards points) during the January through March period.

How to Offset Inflated Grocery Pricing

Most consumers are already well aware of the increased inflation rates we’re seeing in the U.S. Prices on all goods, including groceries, are increasing at rates not seen in decades.

The percentage rates associated with inflation right now are in the 5%-8% range, potentially higher.

One way to offset those higher costs is to use a credit card like the Freedom or Freedom Flex to offset part of that price inflation. In this case, 5% of the grocery price inflation for the months of January, February and March of 2022.

But, you can save even more, and possibly outpace the inflation rate by adding a new Freedom card to your credit card arsenal.

Right now, new applicants to the Freedom Flex and the Freedom Unlimited can receive 5% cash back on grocery store spend for the first year of cardmembership as part of the sign-up bonus. You are limited to a max of $12,000 of spend earning 5%/5x that first year.

But, the real deal is that when Chase has grocery stores as the quarterly bonus category for the Freedom Flex, cardholders with the annual 5x/5% bonus will earn a total of 9% cash back! To clarify why 9% and not 10%, the card earns 1% as a base rate and each bonus amount is 4% (quarterly grocery and annual grocery). When added together, you get 9% total.

And, 9% cash back just might fully offset the grocery inflation that will be with us into 2022.

Here’s a quick overview of the Freedom Flex and the Freedom Unlimited (if you don’t want to bother with quarterly bonus categories) credit cards.

Chase Freedom Flex

- Earn 5% on up to $1,500 on combined purchases in bonus categories each quarter you activate

- Earn 5% on travel purchased through Chase Ultimate Rewards

- Earn 3% on dining at restaurants, including takeout and eligible delivery services

- Earn 3% on drugstore purchases

- Earn 1% on all other purchases

Annual Fee: None

Freedom Flex Sign-Up Bonus

Earn a $200 bonus after spending $500 on purchases within the first 3 months from card approval. Plus earn 5% cash back on grocery store purchases (not including Target or Walmart) on up to $12,000 spent in the first year.

Chase Freedom Flex Information and Application Link

This is Savings Beagle’s referral link providing us a points bonus for approved applications. Thank you if you use our link to apply.

Chase Freedom Unlimited

- Earn 5% on travel purchased through Chase Ultimate Rewards

- Earn 3% on dining at restaurants, including takeout and eligible delivery services

- Earn 3% on drugstore purchases

- Earns 1.5% cash back on all other transactions

This card will not earn the 9% cash back on grocery store spend during Q1.

Annual Fee: None

Freedom Unlimited Sign-Up Bonus

Earn a $200 bonus after spending $500 on purchases within the first 3 months from card approval. Plus earn 5% cash back on grocery store purchases (not including Target or Walmart) on up to $12,000 spent in the first year.

Chase Freedom Unlimited Information and Application Link

This is Savings Beagle’s referral link providing us a points bonus for approved applications. Thank you if you use our link to apply.

As you can see, if you’re going to use these credit cards as an inflation hedge, you can really do well on the grocery category, in addition to offsetting a little of the price increases we’ll be seeing on dining out and drugstore purchases.

True, using the cash back earning power of these cards isn’t going to completely negate the inflation we’re experiencing, but it will go a way to keeping spending power in line with what we’re accustomed to.

What do you think? Is it worth trying to offset price inflation with strategic use of credit card bonus categories?