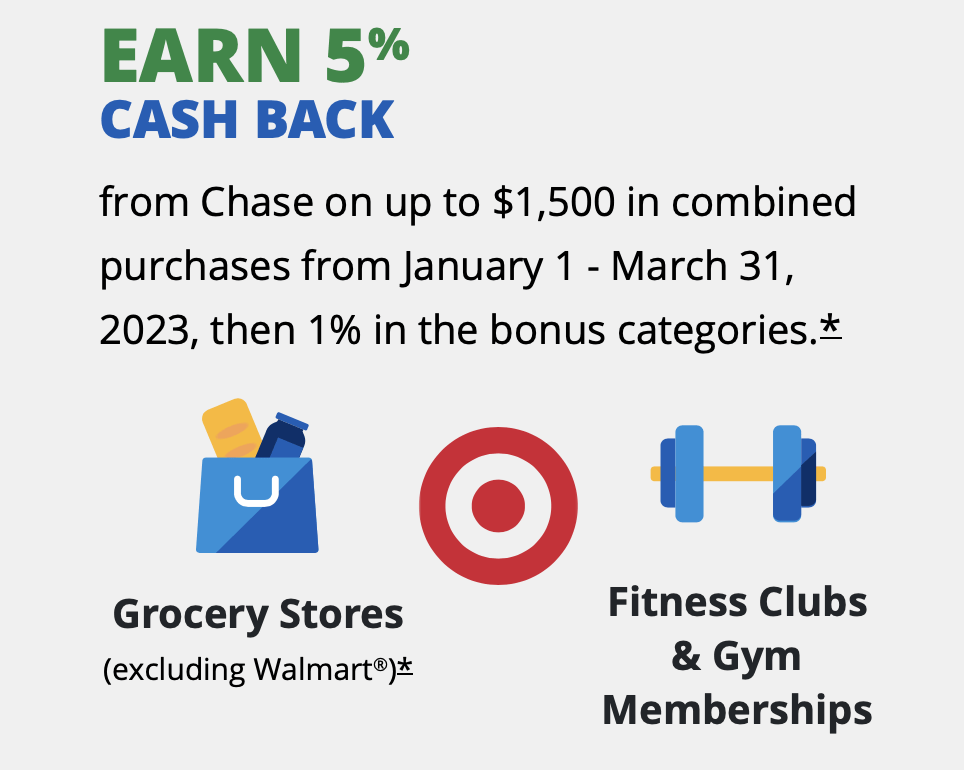

Save on Grocery and Target Purchases As Well As on Gym Memberships with the Chase Freedom Cards’ 2023 First Quarter Bonus Categories

The 2023 first quarter bonus categories for the Chase Freedom and Freedom Flex credit cards are out and points/cash back earning for spend on those categories can now be activated.

Bonus Categories

The Freedoms’ 2023 first quarter bonus categories include:

- Grocery Stores

- Target

- Fitness Clubs & Gym Memberships

All purchases made in these categories earn 5% cash back – or my favorite, 5 Ultimate Rewards points per dollar spent – on up to $1,500 in combined purchases.

Bonus earnings will begin January 1, 2023, and run through March 31, 2023.

If you haven’t received your activation email yet, you can activate the first quarter categories here.

Activation can be done at any point between now and March 14, 2023, to ensure you earn the bonus cash back/Ultimate Rewards points. I usually get it out of the way as soon as it becomes available to make sure I don’t forget.

How to Play It

The grocery store category is typically an easy category to max out by many cardholders. The addition of Target makes it really easy to max out the first quarter’s $1,500 spend. And if you’re joining a gym, or are already a member, charge those fees to your Freedom card and benefit, too.

This quarter is such a plentiful earning opportunity, you might want to have two Freedom cards to take full advantage.

Here are a few thoughts on each category.

Grocery Stores

The most obvious way to take advantage of this category is to make sure your Freedom or Freedom Flex card is the payment method for all your grocery shopping January through the end of March.

Just keep in mind, grocery shopping at Walmart is excluded from earning 5%/5x with this category.

If you don’t see yourself spending roughly $500 per month on groceries, don’t forget that many grocery stores sell third-party gift cards, the purchase of which will trigger the 5%/5x earning, too.

Buy gift cards to restaurants and retailers from which you’ll be buying anyway, and earn the bonus amounts on that spend.

And, occasionally, grocery stores will offer fee-free Visa or Mastercard gift card deals, the purchase of which will allow you to earn the bonus points on a gift card that provides purchase flexibility. Use the Visa/Mastercard gift cards anyplace a Visa or Mastercard credit card is accepted.

The grocery category is one of the easier categories to max out due to most people buying at least some items from grocery stores each week, in addition to the large variety of gift card options that are available.

How to Earn 9% Back on Your Grocery Purchases

Chase is offering the Freedom Flex credit card with a sign-up bonus that provides 5% back at grocery stores for the first year of cardmembership right now.

You can read the details in our post on the topic at this link.

A quick rundown, though, is that the grocery sign-up bonus stacks when grocery stores are a 5% bonus category for the Freedom Flex card…as it will be starting January 1, 2023.

Which means, the Freedom Flex card earns a standard 1% back, plus 4% for whatever bonus category is being offered at the time (grocery stores being one January-March 2023), plus another 4% if you have the grocery store sign-up bonus attached to your card, for a total of 9% cash back…or 9x Ultimate Rewards points per dollar spent at grocery stores if you prefer.

Now that’s a nice return!

Not sure when that sign-up bonus offer ends, but now would be a good time to jump on it if you’re interested. For money-savers during these high inflationary times, this is an easy way to save 9% every time you buy groceries January – March 2023. Just make sure it’s the Freedom Flex you’re applying for, not the Freedom Unlimited.

Target

Many Americans shop at Target regularly for household essentials. This is an easy way to save 5% on your Target purchases.

If you have a Target RedCard credit/debit card, this may not be as big a benefit since you’re already saving 5% on your Target purchases using one of those cards. But if you’re not a Target RedCard holder, this quarter’s bonus category is how you can save the equivalent amount.

Unfortunately, you won’t be able to stack the grocery sign-up bonus or grocery category bonus to earn more than 5% on your Target purchases.

And if for some reason you won’t be able to max out this quarter’s $1,500 spend with grocery store and Target purchases, be aware Target sells gift cards to retailers/restaurants you likely will be spending at already. Buy the appropriate gift cards at a 5% savings and use those when you shop/dine at those retailers.

Fitness Clubs/Gym Memberships

If you’re going to join an expensive fitness club in January, you just might complete the full quarter’s spend right there, earning 5% back in the process.

More likely, you’ll be paying a monthly fee, which can also trigger the 5% cash back.

Here’s an example list for fitness clubs/gym memberships. Likely, even though your gym is not on this list, it will still trigger the 5% due to its merchant code. As long as it’s a true gym, and set itself up that way when completing the credit card processing application.

Wrap Up

The 2023 Q1 bonus categories for the Chase Freedom and Freedom Flex cards are Grocery Stores, Target and Fitness Clubs and Gym Memberships.

For many, the grocery store category alone will allow earning the full $75 cash back (or 7,500 Ultimate Rewards points) during the January through March period.

And if you also shop at Target regularly and are joining a gym in January, you’ll wish you had two Freedom cards to really earn some cash back/Ultimate Rewards points.