Review: Chase IHG Rewards Club Select Credit Card

Update: The adage “all good things must come to an end” definitely applies to this credit card. Chase has discontinued this specific card, replacing it with two IHG credit cards, one with an $89 annual fee and the other with a $29. The biggest change, however, concerns the annual free night being capped at IHG properties that price at 40,000 Rewards Club points or less. A major reduction in the benefit considering properties at that point level are not of the higher end variety. And few, if any, Kimpton properties will fall into that point range, eliminating a number of quality hotels from the free night certificate benefit.

Update: The adage “all good things must come to an end” definitely applies to this credit card. Chase has discontinued this specific card, replacing it with two IHG credit cards, one with an $89 annual fee and the other with a $29. The biggest change, however, concerns the annual free night being capped at IHG properties that price at 40,000 Rewards Club points or less. A major reduction in the benefit considering properties at that point level are not of the higher end variety. And few, if any, Kimpton properties will fall into that point range, eliminating a number of quality hotels from the free night certificate benefit.

The Chase IHG Rewards Club Select credit card is InterContinental Hotels Group’s hotel specific credit card.

Spend on the card earns IHG points that are directly deposited into your IHG Rewards Club account and can be used for free night awards at IHG hotels around the world.

Not familiar with the IHG family of hotels? Here’s the list of hotel brands that fall under the IHG umbrella:

- InterContinental Hotels & Resorts

- Kimpton Hotels & Restaurants

- Hualuxe Hotels & Resorts (China)

- Holiday Inn

- Holiday Inn Express

- Avid

- Hotel Indigo

- Even Hotels

- Crowne Plaza Hotels & Resorts

- Holiday Inn Club Vacations and Resorts

- Staybridge Suites

- Candlewood Suites

As you can see, the IHG brand is quite extensive. And, where ever your travels may take you, you’re likely to find an IHG hotel.

The only knock on IHG is that, in the big picture, its hotels are a notch below those of the other major hotel chains such as Marriott, Hilton, Starwood and the smaller in footprint, Hyatt.

It’s because of this, that I’ve never given much consideration to the IHG brand or its co-branded credit card, instead focusing my hotel stays at Hyatts and Marriotts.

However, that’s recently changed with IHG’s acquisition and full incorporation of the boutique hotel company, Kimpton.

In addition to the typical IHG hotels – Holiday Inns, InterContinental, etc. – you can now use IHG Rewards Club points to book free rooms at all Kimpton properties.

Which makes the credit card a more enticing product.

Let’s take a closer look.

Chase IHG Rewards Club Sign-up Bonus

The Chase IHG Rewards Club card is currently offering a sign-up bonus of 60,000 Rewards Club points after you spend $1,000 on purchases in the first 3 months of account opening.

If you add an authorized user to your account who makes a purchase in the first 3 months of account opening, you’ll get an extra 5,000 bonus points.

While a 60,000 point bonus is nice, there have been higher sign-up bonuses in the past – 80,000 and even 100,000 point sign-up bonuses have been offered as recently as mid-2017.

So, it might pay to wait and see if an increased bonus comes along before applying for this card.

Annual Fee

The IHG card carries an annual fee of only $49 per year, but to make the deal even better, it’s waived the first year of card membership.

Ongoing Benefits

Credit card spend bonus categories:

- Earn 5 points per dollar spent at IHG hotels

- Earn 2 points per dollar spent at gas stations, grocery stores and restaurants

- Earn 1 point per dollar spent on all other purchases

The IHG card is one of the few credit cards that offer grocery stores as a regular bonus category for your credit card spend. Add to that gas stations and restaurants, and a typical family can rack up the IHG points fairly easily.

IHG cardholders will also receive IHG Platinum Elite status as long as you’re a cardmember. Some of the benefits of Platinum Elite status include: complimentary room upgrades, extended check-out, priority check-in, complimentary Internet, Welcome amenity and Raid the (mini) Bar (Kimpton properties) to name a few.

Additionally, you’ll automatically receive 10% of your redeemed IHG points back on up to 100,000 points each year as an IHG credit card holder.

But the absolute best benefit of holding this credit card, in my opinion, is the annual free night.

Each year, on your account anniversary, you’ll receive a free night certificate that can be used at any IHG property.

For only a $49 payment (the card’s annual fee) this really can’t be beat.

In the past, cardholders would maximize this benefit by using the free night at top-tier InterContinental properties whose per night rates can easily exceed $300 depending on location.

But with the addition of Kimpton hotels, the free night benefit can now be used at a much wider array of properties and locations to really extract full value from that $49 annual fee.

And it’s the Kimpton addition to the IHG brand that has me re-thinking the IHG credit card.

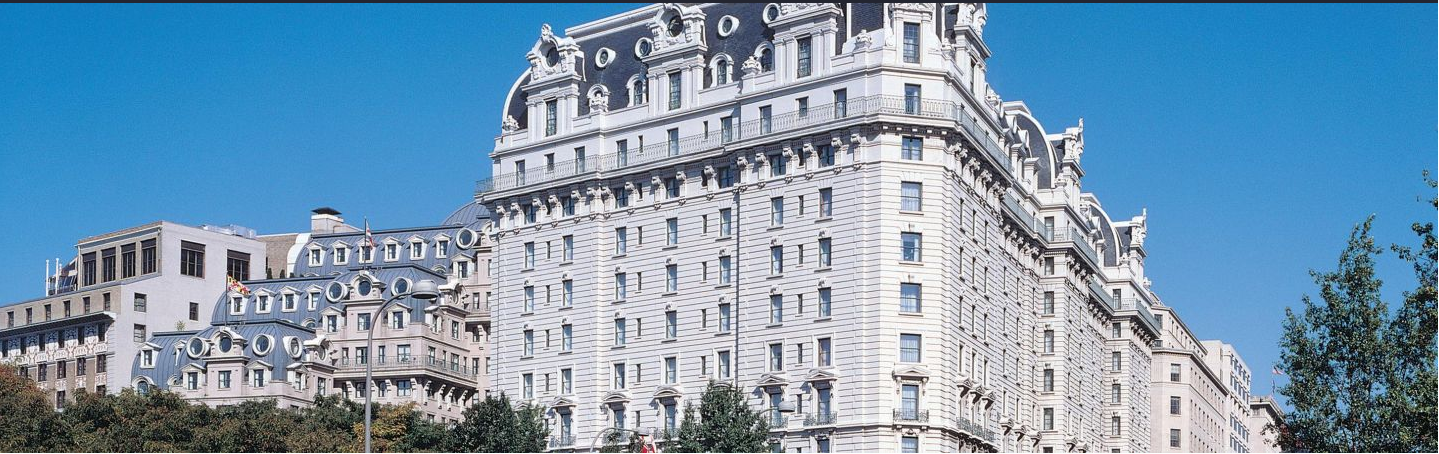

Kimpton Hotels

Kimpton currently has 66 hotels in 35 cities. Most are in the U.S., but Kimpton has a property in Grand Cayman and will be opening hotels in Asia, Paris, and Toronto soon. Its reach continues to grow, making IHG Rewards Club points and the free night associated with the IHG credit card even more valuable.

As mentioned earlier, Kimpton is a boutique hotel – as the company likes to say, “…a place where you could stay that was more like someone’s beautiful, livable and stylish home than a big, impersonal hotel where no one really cares if you come or go.”

Regarding Kimpton properties, the website states, “We have more experience turning interesting old buildings into great hotels than anyone…” And at every one of those unique properties, an evening wine hour is offered daily and pets are welcomed (fee free) regardless of size.

I’ve stayed at a Kimpton property and can attest to the unique aspect, as well as attention to service. They do tend to stand above, and the brand is a great addition to the IHG family.

But, as with most higher-end properties, they don’t come cheap, whether you’re paying with cash or points.

Kimpton properties just became available (mid-January 2018) for booking with IHG points, and depending on location and dates, will run 40,000 to 70,000 points per night.

But, don’t forget, free night certificates can be used at Kimpton properties as well. And you can definitely mix a free night certificate – or two- with points redemptions to extend your free stay.

Get More IHG Rewards Club Points

As you can see, the current IHG credit card sign-up bonus of 60,000 points would only get you one night at a Kimpton property. Even at the 80,000 or 100,000 point sign-up bonus levels, you’re still only looking at 2 nights max depending on the property. And that would apply to other IHG hotels as well, unless you’re planning a stay at one of the lower-tier properties.

So, outside of putting a lot of spend on the IHG credit card, how do you get more points?

Luckily, IHG is a transfer partner of the Chase Ultimate Rewards program.

If you hold an Ultimate Rewards earning credit card, such as the Chase Sapphire Preferred, Chase Sapphire Reserve, Chase Freedom, Chase Freedom Unlimited, or one of the Chase Ink business credit cards, those points can be transferred to your IHG Rewards club account at a 1:1 transfer rate.

Note: Only the Sapphire Preferred, Sapphire Reserve and Ink Plus cards can transfer directly to travel partners, the other cards must first transfer to one of those premium Ultimate Rewards earning cards and then onto a travel partner.

And, if you don’t yet hold an Ultimate Rewards earning credit card, each of the cards mentioned above comes with its own sign-up bonus, allowing applicants to grab a large chunk of points, quickly, after meeting the sign-up bonus requirements.

Chase Application Rules

Chase has become more restrictive with their credit card approvals in the past few years.

If you’ve applied, and been approved, for 5 or more credit cards in the previous 24 months from any credit card issuer (not just Chase) you will not be approved for a new Chase credit card.

And, Chase considers authorized user accounts within the past 24 months to be part of the 5 “approvals” which will disqualify you from getting new Chase credit cards. However, if an authorized user account or two have pushed you over the 5 new accounts limit, you may be able to call Chase customer service to get those waived and have your card application approved.

Keep the 5/24 rule, as it’s called, in mind as you plan your Chase credit card applications.

Interestingly, and on a positive note for those interested in this card, the Chase IHG Rewards Club credit card is one of only a few Chase credit cards that is excluded from the 5/24 rule.

However, if you are approved for the IHG card, it will count as a new account as it pertains to Chase’s 5/24 rule and could play into future Chase credit card approvals. Just something of which to be aware.

Wrap Up

The Chase IHG Rewards Club credit card has always provided value via its low, $49 annual fee and free night certificate that can be used at any IHG property.

Since IHG’s acquisition of Kimpton, however, I feel the card offers an even greater value as a result of the more extensive footprint and access to really unique properties.

If you’re a Kimpton fan, it’s almost a no-brainer to get the Chase IHG card, if for no other reason than to enjoy a free night at your favorite Kimpton hotel.

At which Kimpton property would you use your free night?