Our Annual “Tips” Post Can Help You Save on Your Upcoming Holiday Spending

We’ve published our annual holiday “Tips” post each year for a while now. Its goal is to refresh the various savings strategies we write about throughout the year so that you can maximize saving on your holiday expenses.

And, as we continue to battle higher inflation, saving anywhere you can is a benefit for sure.

Credit Cards

First off, if you carry a balance on any of your credit cards, your primary goal is to pay down that high-interest debt. We have some thoughts on how to do that in the discussion posts link here.

If your debt situation is under control, it’s time to make credit cards work for your benefit, not the bank’s.

Start with utilizing a cash back or rewards earning credit card whose benefits focus on your highest spend categories.

For many that will be grocery spend, especially with the increased food costs we’re all seeing.

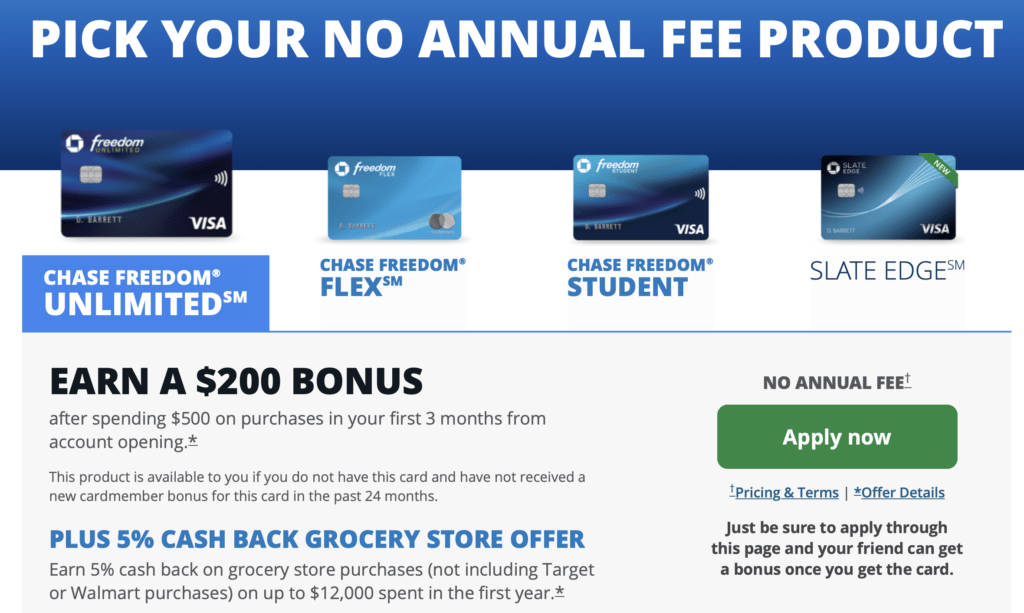

And one of the best credit cards to offset increased grocery costs is one from the Chase Freedom lineup of cards. Right now new applicants can receive 5% cash back on all grocery spend for the first year of cardmembership up to $12,000 in spend. That amount of cash back should offset a portion of inflation we’ve seen in grocery pricing.

American Express also has a few good credit card options for offsetting inflation costs.

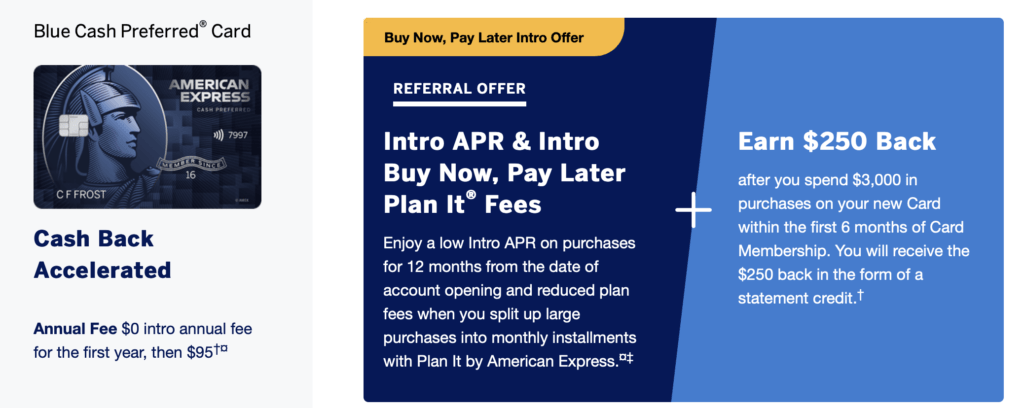

One is the Blue Cash Preferred which earns 6% cash back on groceries (up to $6,000 in purchases per year) and streaming services and 3% cash back on transit costs and gasoline purchases. It does have an annual fee of $95, but it’s waived the first year. Don’t want to pay it going forward? Downgrade to the no annual fee Blue Cash card at year two.

And, as one last example, the Citi Custom Cash card offers 5% cash back on your highest eligible spend category each month. Groceries is one of those categories, so it’d be an easy 5% savings each month up to $500 in spend monthly.

Each of the cards listed above come with a sign-up bonus that’ll add even more cash back to your account when the initial spend requirements are met.

These are just a few examples of credit cards that can work for you, helping to save money each and every month.

There are a wide variety of rewards cards out there from a number of banks, so if these rewards don’t fit your spend patterns, look for cards that do, apply, and then use that card to better your financial situation.

Credit Card Offers

Once you have the best credit card for your spend patterns in your wallet, scanning the card’s Offers is the next way to save money.

Chase, American Express and Citi, as well as a few other banks, each have an Offers program that regularly adds savings opportunities to select retailers to your credit card.

These Offers need to be added to your card prior to making a purchase to trigger the specific savings associated with the Offer you’re using.

Depending on the bank and type of credit card, Offers may include a specific dollar amount, a percentage of purchases price or even a number of rewards points that will be offered when the requirements of the Offer at met.

Dollar back and percentage back Offers typically will be provided as a statement credit a few days to a few weeks after the Offer has been redeemed, lowering the amount of your credit card bill.

We’ve written overviews of each of the major programs – Chase Offers, Amex Offers and Citi Merchant Offers – which can be viewed by clicking the links.

Utilizing Offers to businesses from which you’re going to buy is an easy way to save money.

Cash Back Shopping Portals

There are a number of cash back shopping portals that provide a variable savings percentage on purchases when you click through the main shopping portal first.

A few of the big-name examples are Rakuten and Top Cashback.

The cash back a shopping portal will offer varies, sometimes daily, depending on the specific retailer from which you’re going to buy.

So it’s always worthwhile to check a cash back and rewards points shopping portal aggregator like Cash Back Monitor to see who’s offering the best deal when you’re ready to shop.

Once you’ve found the best shopping portal for that specific purchase, click through its site to the retailer from which you want to buy and your purchase will be tracked with the appropriate amount of cash back credited to your account.

And if you’re new to a cash back shopping portal, you may be able to earn a bonus cash back amount on your first purchases. Anywhere from $10 to $30 in bonus cash back money is typical. Last year around this time Rakuten offered an all-time high $40 cash back sign-up bonus…we’ll have to see if it comes back this year.

This, again, is an easy way to save on your online shopping. And if you have a Rakuten account, you can even save on in-store purchases at select retailers, too.

Deals and Coupons

Of course, the traditional way of saving money is still applicable…look for coupons and deals that’ll save on the purchases you want to make.

We at Savings Beagle do our best to find deals that appeal to a larger audience and publish those on our site and/or our Discussion Board.

But, sometimes deals are sent directly to you based on past purchases. Keep an eye on your email, and even ads when you’re online. It’s no secret that online marketers know what you’ve been doing on the Internet, and, for better or worse, target promotions and deals to you.

Wrap Up

We’re in an economy that many of us have never seen before. And those who have, don’t remember it very well.

Costs are increasing on every product and service you can think of. And while some say this is temporary, they’re ignoring the fact that once prices go up, in many sectors of the economy, they do not come back down.

So, we’re going to be dealing with increased prices for a while…and for some goods and services, those higher prices will be the norm going forward, possibly the base from which additional increases will be added.

Will incomes keep up? So far they have not, eroding the purchasing power of many American households.

Luckily, there are options to counter these increased costs…at least somewhat.

Utilizing credit cards that provide cash back on the highest spend categories of your budget is a primary way to offset increased pricing.

Taking advantage of money saving offers, whether they be via those credit cards or more traditional routes such a coupons or weekly deals at grocery or big box stores.

And for those willing to take the time and put in the effort, all of these savings suggestions can be stacked – when applicable – to save big on select purchases.

Now is the time to take advantage of these savings opportunities to help your budget make it through these high-cost times.

And, of course, check Savings Beagle regularly to see what new savings suggestions, individual deals and strategies we’ve published.

Do you have any additional money-saving strategies to pass along? Please comment below so we all can benefit!

image courtesy of scottchan at freedigitalphotos.net