Why I Love Chase Ultimate Rewards Points and You Should Too

If your credit card spend isn’t providing significant benefits, you’re doing it wrong.

Whether you’re looking to travel for free, or simply offset your credit card bill with straight cash back, there’s one program that, I feel, stands above the rest.

The Chase Ultimate Rewards program.

In this post I’ll give a quick rundown of the Ultimate Rewards program and why I believe it’s so valuable no matter your goals.

Want a program that allows for wiping away credit card spend by applying points as cash back? Ultimate Rewards is your program.

Want to be able to transfer your points to a wide range of Travel Partners to ultimately travel for nothing? Chase UR points are what you’re looking for.

Or, want to be able to use your points to book travel directly, getting fantastic travel redemptions with no out of pocket dollars needed? Yep, you got it, Ultimate Rewards points can do that, too.

The program provides members significant value, value that will translate directly to your bank account.

Let’s take a closer look at all the options the Chase Ultimate Rewards program provides.

All You Can Do With Ultimate Rewards Points

Transfer Ultimate Rewards Points to Travel Partners

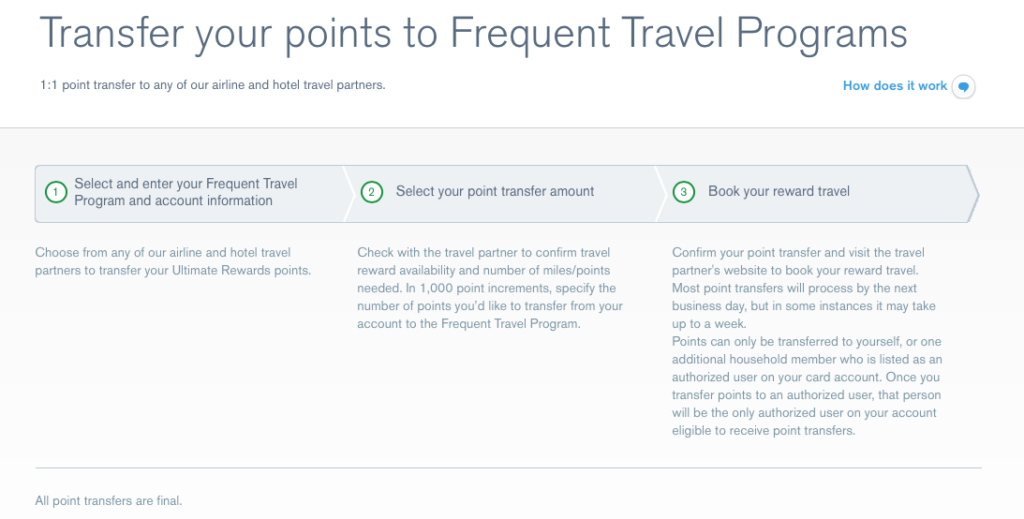

The Chase Ultimate Rewards program allows you to transfer points to a number of Travel Partners at a 1:1 rate. Transfers are made in 1,000 point increments and are final and non-returnable once transferred.

You can transfer UR points to your own loyalty programs, or the loyalty program of one additional household member who is listed as an authorized user on your card account. Once points are transferred to a specific person, that individual will be the only authorized user on your account eligible to receive point transfers.

An important point regarding the Ultimate Rewards program and transferring to Travel Partners, only Premium Ultimate Rewards earning credit cards can directly transfer UR points to Travel Partners.

Premium Ultimate Rewards earning cards include:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Preferred (Business credit card)

Non-premium Ultimate Rewards earning credit cards must first transfer points (more commonly known as cash back for those cards) to a Premium Ultimate Rewards earning card account, and then can be transferred to a travel partner.

These cards include:

- Chase Freedom

- Chase Freedom Flex

- Chase Freedom Unlimited

- Chase Ink Cash (Business credit card)

Now, on to all the Travel Partners to which you can transfer your Ultimate Rewards points.

Airlines – United Airlines, Southwest Airlines, JetBlue, Air Canada, Aer Lingus, British Airways, Air France/KLM, Iberia, Emirates, Singapore Airlines, and Virgin Atlantic.

Hotels – IHG, Marriott, and Hyatt.

Hyatt gives you the best award redemption options, in my opinion, out of all the hotel programs. However, the absolute best hotel transfer partner is the one that will give you a free stay at the property you want to visit.

And, with regard to the airlines, domestic awards can be found when transferring to Southwest, United and JetBlue. If international travel is of interest, United Airlines usually has good international award availability on its own aircraft and those of its alliance partners. However, each Travel Partner airline has its own award sweet spots, you just have to be familiar with utilizing airline alliances to find the itinerary that’s right for you.

Cash Back

If traveling isn’t your thing, you can always use your Ultimate Rewards points as cash back, and either have it directly deposited to a bank account, or used as a statement credit to offset your credit card balance.

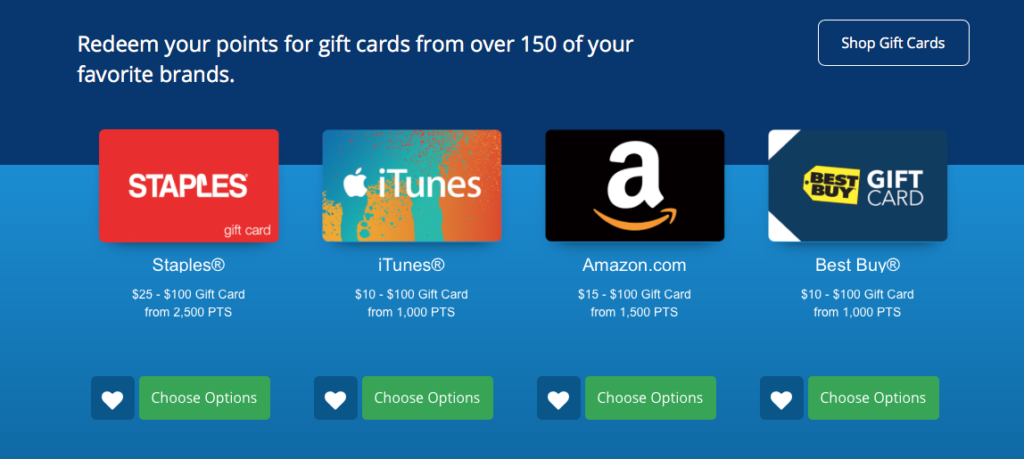

Purchase Gift Cards

Similar to cash back, you can use your Ultimate Rewards points to purchase gift cards. You’re getting a 1 cent redemption rate, so 1,000 Ultimate Rewards points will get you a $10 gift card, 10,000 UR points will get you a $100 gift card, and so on. Occasionally, Chase will offer percent-off deals on gift cards purchased with UR points.

Shop on Amazon with Points

This is the only Ultimate Reward redemption option that gives you less than a 1 cent redemption rate. The redemption page says, “the redemption value for your points at Amazon.com is subject to change.” Personally, I’d steer clear of this redemption option.

However, there is one situation where I would consider utilizing UR points for Amazon purchases. Occasionally, Amazon and Chase will run promotions where you can grab significant savings on Amazon purchases by using your linked Chase credit card to pay along with at least one Ultimate Rewards point.

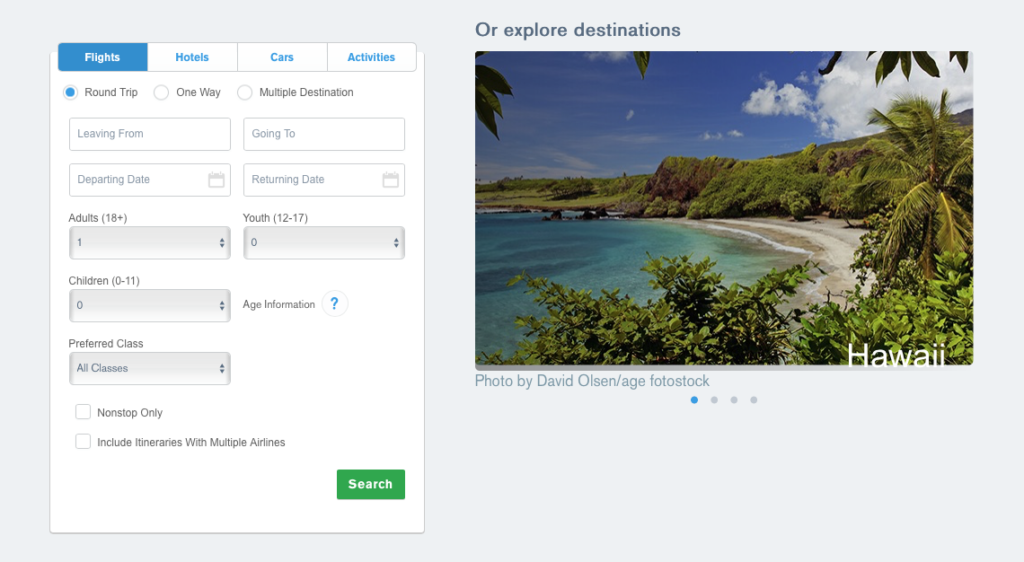

Book Travel on the Ultimate Rewards Travel Portal

Depending on the credit card you hold, your redemption rate on the Travel Portal will be different.

Chase Sapphire Reserve – 1.5 cents (meaning a $250 airline ticket would cost approximately 16,700 UR points)

Chase Sapphire Preferred – 1.25 cents (meaning a $250 airline ticket would cost approximately 20,000 UR points)

Chase Ink Preferred (Business card) – 1.25 cents (same as Sapphire Preferred)

Chase Freedom, Freedom Unlimited and Ink Cash (Business card) – 1 cent (meaning a $250 airline ticket would cost 25,000 UR points)

Those redemption rates apply whether it’s airfare you’re booking, hotel stays, car rentals, a cruise or purchasing activities.

The Ultimate Rewards Travel Portal is a great booking alternative when your travels will include travel providers that are not Travel Partners of the UR program. And, at times, you can even find less expensive (points-wise) redemptions using the Travel Portal than transferring to a Travel Partner.

Wrap Up

As you can see, Chase Ultimate Rewards points can be used in a variety of ways, some of which provide an incredible value when used strategically.

Whether it’s using your points to bolster your favorite loyalty program’s balance for an upcoming trip, booking that trip via the Ultimate Rewards Travel Portal, or simply offsetting your credit card spend, Chase Ultimate Rewards points can do it all.

But, to earn these extremely valuable points, you have to have at least one Ultimate Rewards earning credit card in your credit card arsenal.

In the next post, I’ll give a more detailed look at all the Ultimate Rewards earning credit cards, as well as some Chase promotions, past and current, that can boost your UR earnings significantly.

“Chase Ultimate Rewards Promotions and the Credit Cards to Take Advantage of Them“