It’s Been Four Years Since My Original Article and America’s Financial Situation Has Only Gotten Worse

I wrote the original article on America’s financial situation roughly four years ago.

My goal, first and foremost, was to highlight the excessive debt the U.S. had piled up.

And then to bring to light the significant underfunding of crucial safety-net and entitlement programs on which most Americans either currently rely or will in the coming years.

The outlook wasn’t good back then, and it’s only gotten worse in the ensuing years.

Our elected officials at the federal level have completely disregarded fiscal sanity and have put the country on an unsustainable financial path that at best will cost all Americans significantly via increased taxes and reduced access to health care and social security benefits or at worst will result in a complete collapse of the U.S. economic system.

I’ve updated the financial numbers but kept the previous ones as a reference.

In my last post, I said, “Keep in mind, the updated financial numbers are pre-coronavirus, so the current debt and deficit figures are much worse. And will grow to even greater levels over the coming months.”

I really had no idea how much greater those levels would turn out to actually be, and exactly how much worse the U.S.’s debt and deficit numbers would become.

Now we do.

THE ORIGINAL TWO ARTICLES WITH REVISIONS

Recently, an article titled, “A Baby Boomer Makes Peace with Less,” ran in The Wall Street Journal.

The subtitle of the piece, written by Timothy W. Martin, reads, “Facing five times the debt of previous generations and relatively small savings, many retirees are making fundamental lifestyle changes; Ms. Wolf [the primary subject of the article] trades California for Iowa.”

Like most Wall Street Journal articles, the full text is behind a pay firewall. If you’re a subscriber, you can access the full story here.

While Ms. Wolf’s story was an interesting and sobering one…she made a large amount of money in California real estate during the mid-2000s boom and then lost most of it during the 2008 crash…it was the article’s larger message that interested me.

To put it succinctly, the Journal states, “America’s 75 million baby boomers have piled up more debt while holding less savings than generations before them, a mix that is crimping their hopes of a comfortable retirement.”

When looked at in isolation – if you can when the number being considered is almost a quarter of the entire U.S. population – you might shake your head and say, “that’s too bad,” and move on, thinking it really doesn’t impact you.

Unfortunately, the increased debt levels and low savings rate of boomers does – and will – have a large effect on all Americans.

Let’s look at the bigger picture.

AMERICA’S DEBT

The United States is currently in debt to the tune of [2017]almost $20 trillion over [2020] $24 trillion [2021] $28.5 trillion. A number I won’t even try to quantify. Suffice it to say, holding that amount of debt is by no means a good thing.

And the U.S. government continues to spend more than it brings in each and every year.

U.S. budget projections for 2017 show a $559 billion deficit U.S. budget projections for 2020 show a $1.1 trillion deficit U.S. budget projections for 2021 show a $3 trillion deficit – money that will be added to that $20 $24 $28.5 trillion debt level.

Long-term federal budget projections show no reduction in that deficit number, and in fact, have it increasing in future years.

America’s fiscal house is most assuredly not in order.

MAJOR DRIVERS OF THE U.S. BUDGET

This infographic shows the expenditures and revenues of the 2015 federal budget.

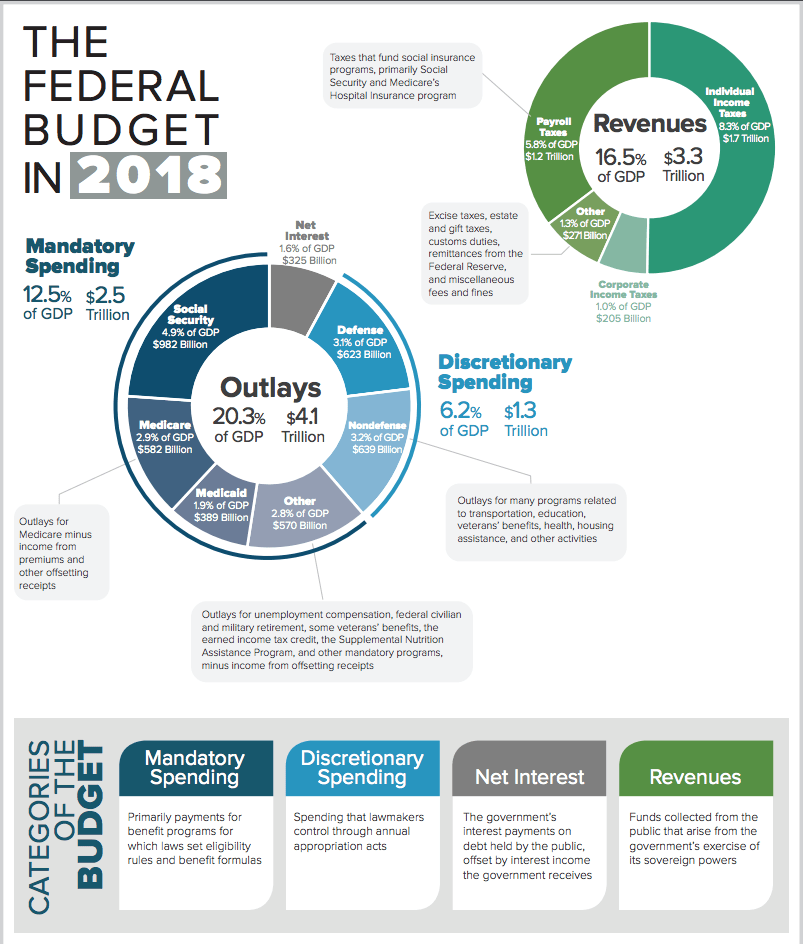

Here is an infographic showing the expenditures and revenues of the 2018 federal budget. Link to CBO pdf.

And an infographic for the latest version of U.S. expenditures and revenues for the 2020 federal budget.

What should stand out most is that mandatory spending, specifically Social Security, Medicare and Medicaid, makes up close to half of all U.S. spending.

And those spending areas are being affected the most by an aging population – specifically the baby boomers.

Who, with their larger debt levels and lower savings are going to rely even more on government assistance to get by.

Another area of the federal budget to keep an eye on, however, is the “Net Interest” section. That’s the amount the federal government pays in interest payments to those investing in U.S. bonds. Without investors (and the Federal Reserve Bank) purchasing America’s bonds, the U.S. government would not be able to spend more than it brings in each and every year.

The “Net Interest” payments have been growing, slowly, over the past four years…$224 billion in 2015, $325 billion in 2018 and $345 billion in 2020…thanks to the Federal Reserve Bank keeping U.S. interest rates unusually low.

Should interest rates begin to climb toward more normal levels, so too will the “Net Interest” payments the government will have to pay on debt that comes due and is reissued.

And at a certain point of increased interest rates, the government’s interest payments will begin to crowd out spending in other areas of the budget.

Just something to keep in mind as U.S. monetary policy begins to normalize.

Unless the Federal Reserve Bank decides it must keep interest rates at zero in perpetuity, that is.

UNDERFUNDING

The problem with the above scenarios is that current funding levels for the largest drivers of the U.S. budget are not adequate to meet future needs. And that’s before you factor in larger interest payments that may (or may not) be on the horizon.

The Social Security, Medicare (health insurance for those age 65+) and Medicaid (medical assistance for those with limited income/resources) programs were not designed to withstand large numbers of recipients living into their 80s, 90s and even past 100 years of age. Lower than normal U.S. birth rates, resulting in less taxpayer revenue, only exacerbated the funding problems.

As a result, without significant changes to the programs’ structures, benefits will be reduced. The money simply is not there.

Projections show that unless reforms are made to the Social Security program, benefit checks will need to be reduced by roughly 25% in 2035.

A $1,000 Social Security check will automatically become $750. Not a good scenario for those depending on the benefit checks to live.

As many of the current high-debt, low-saving boomers will be.

And, with an aging populace, without major health care reforms, costs to the government will continue to rise, and so too will health care spending’s percentage of the U.S. budget.

Not a pretty picture for America’s fiscal situation.

PENSIONS

Not to pile on, but we’re seeing more and more evidence to back up claims that both public (government) and private (business) pension plans are largely underfunded, too.

In previous posts where I discuss quarterly stock market performances, I’ve noted the problems facing the California Public Employees’ Retirement System, the Dallas Police Officer and Firefighter Retirement Fund and, more recently, the New York State Teamsters Conference Pension and Retirement Fund has sought permission to impose benefit cuts in an attempt to remain viable for the long term.

These are not isolated incidents. Many pension funds across the United States are facing similar financial problems.

Which means pension recipients may not receive benefits anywhere close to what was expected. Again, the money’s just not there.

And when you factor in the underfunding of Social Security, and the precarious financial state of Medicare and Medicaid, there’s a lot of work that needs to be done just to keep the status quo.

THE CORONAVIRUS DOWNTURN

Here’s what I said as the pandemic was just getting started.

“As of mid-April 2020, the federal government has appropriated approximately $2.2 trillion for coronavirus relief.

Money that will go to individuals, small, medium and large-sized businesses, state and local governments and more, simply to fill in the financial holes created by coronavirus and the efforts to mitigate its spread.

As efforts continue to address the financial damage done by coronavirus, expect those funding numbers to increase…likely significantly.

Which, as you consider the budget numbers above, will only add, even more, to America’s current debt levels.

Unfortunately, nothing can be done about that. The coronavirus relief funding is required to keep America’s economy from total collapse.

But, it’s important to keep in mind, the greater the debt levels a country carries, the higher the risk of negative economic outcomes.”

In total, the United States enacted six major bills totaling approximately $5.3 trillion to assist with managing the coronavirus pandemic and mitigate the economic impact on Americans and U.S. businesses.

It can be argued whether all of that $5.3 trillion was necessary. The bottom line no matter which side you come down on is that all of it was borrowed money, added to the U.S. debt.

New Thinking on Government Spending and Debt

Since the original piece on the U.S.’s financial situation was written – and, actually since the 2020 follow-up – new thinking on government spending, debt and deficits has become more mainstream.

Known as Modern Monetary Theory, the macroeconomic viewpoint effectively believes that there is no limit to the amount of debt a sovereign nation, with its own fiat currency, can carry.

Which, if believed, makes the amount of debt carried by the U.S. all but meaningless.

And, should, in theory, allow for the spending on various government programs to proceed at levels never seen before.

Which is why many on the far left – and a number of traditional Democrats – are backing significant spending proposals in the U.S. Congress.

If the MMT thinking is correct, there really is no reason to worry about U.S. debt, deficits and spending going forward.

If they are wrong, however, there will be a significant price to pay by all Americans.

And that’s the dilemma America is currently facing.

Add to the MMT theorists currently in key policymaking positions in Washington, D.C., more traditional budgetary advisors who believe we need to spend more (not MMT levels, though) now to ensure a strong and lasting recovery from the pandemic downturn, and financially responsible policy decisions are difficult to find in the party who controls both houses of Congress and the White House.

If Modern Monetary Theory could be proved a viable alternative to conventional economic beliefs then our entire economic system would be upended…potentially for the better…but it can’t.

However, it appears the Democrat Party and the far left that seems to be steering its agenda are doing their best to give MMT a try.

In fact, it could be argued that with $28.5 trillion of debt and growing, America is already past the point of no return and we’re testing the MMT waters.

What will ultimately happen is anyone’s guess.

Anything from economic nirvana to a complete economic collapse is on the table.

I’ll just say, for the near-term, watch inflation.

We’re already seeing an increase in the inflation rate. The primary reason is the pandemic and the economic disruptions it caused.

But carrying large amounts of debt can also lead to high inflation and hyperinflation in worst-case scenarios.

If inflation continues its upward trajectory without signs of abating, resulting in a significant economic downturn, we’ll know MMT is wrong and our debt levels were already too high.

WHAT TO DO

I wish there was an easy fix to all the fiscal problems discussed above. There is not.

Solutions, once coronavirus is completely behind us, will likely include increased taxes on all Americans, coupled with reductions to benefits.

And that’s to cover existing government programs, not the multitude of new programs that are currently being considered in the U.S. Congress.

We’re all likely to pay, one way or another.

And that’s if we make it out of this period of time with a normally operating economy intact.

I know, for some, especially now, this is difficult at best, but the primary way to mitigate future changes is to work toward building your own nest egg to reduce reliance on government programs and pension plans that may, or may not, be viable when it’s your turn to participate.

An easy task during normal times? Not at all. And now it’s even more challenging. But it’s a goal on which to focus.

Which is why we’re here. Which is what our focus and goal has always been for those who follow us.

Savings Beagle’s here to provide money management tips and strategies that will keep more of your money in your pocket, and, ultimately, into your nest egg, to help make your future a little brighter.

So, if you haven’t already, bookmark our site, check out our discussion board, follow us on Facebook, join us on Twitter or subscribe to the site to ensure you receive every savings opportunity we’re able to pass along.

The financial future of America is more than a little uncertain. Let’s work together to make our individual futures a little more predictable.

What are your thoughts on America’s financial situation?

infographics courtesy of the Congressional Budget Office