Interest Rates are Up on High Yield Savings Accounts and Certificates of Deposit, But There May Be a Better Option for Your Money Depending on Your Circumstances

This week I updated Savings Beagle’s High Yield Savings Account and Certificate of Deposit pages.

I hadn’t bothered for a period of time due to interest rates remaining extremely low causing even higher-interest-rate products to offer measly returns.

Then the Federal Reserve Bank began raising interest rates in an attempt to counter the extremely high rates of inflation Americans are experiencing.

In March 2022, the Federal Reserve raised interest rates 0.25%, and in May it increased rates another 0.50%. More increases are expected in the coming months.

These interest rate increases have resulted in an upward move in the rates paid on certain safe savings vehicles such as High Yield Savings Accounts and Certificates of Deposit. A benefit to those who want an option to safely grow their money…slightly.

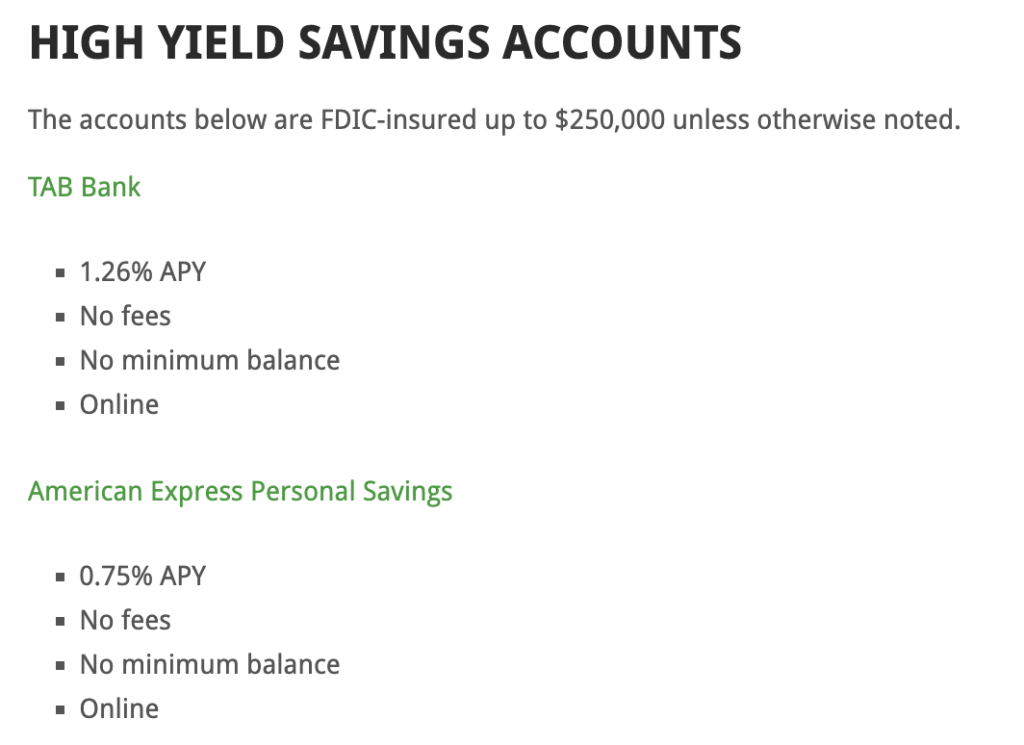

The best rates on High Yield Savings Accounts are now just above 1.00%. Better than earlier this year and in previous years, but still nothing spectacular by any means.

You can view our High Yield Savings Accounts page which lists a few options that may be of interest at this link.

Our list includes just a few of the many options available…the vast majority of which are online only account options. There may be higher interest rate savings account opportunities, but those often come with hoops through which to jump and/or limited time periods during which those higher interest rates are earned.

High Yield Certificates of Deposit (CDs) are offering a slightly better return than HY savings accounts, but only if you lock up your money for 12-months or longer.

You can view our High Yield Certificates of Deposit page at this link.

Again, these are just a small sampling of CD options that are available. Check your, or any other, financial institution, to see what rates they are offering.

But, for those who have money that they want to put to work in a safe product, and who are able to lose access to that money for at least 12 months, U.S. Series I Savings Bonds can’t be beat.

Right now, and through October 31, 2022, I Bonds are paying 9.62%.

You do have to commit your money for at least 12 months, and the rate will be re-calculated in October to determine the interest rate that will be paid for the next 6 months. But, those issues aside, this is a really good option for growing money to which you don’t need access in the near future.

You can get a better overview of I Bonds, as well as the link to set up an account to purchase I Bonds, in our post “U.S. Government I Bonds to Pay 9.62% Beginning May 2022.”

While there are definite downsides to the high inflation we’re experiencing and the interest rate increases the Federal Reserve Bank is implementing to cool that inflation, one positive is an increased rate of return that can be obtained on money you want to put to work.

Hopefully, these higher yield options can benefit you and your money as we move through a difficult economic period.

Know someone else who might benefit? Please pass this post along!

:max_bytes(150000):strip_icc()/do-cds-pay-compound-interest-5248340-final-8fb4721236964b8e8ac9622cdb9112ce.png?w=150&resize=150,150&ssl=1)