Inflation is Here – The Only Questions are for How Long and to What Extent?

The United States hasn’t seen significant, widespread inflation like we’re seeing now for quite some time.

The past few months Savings Beagle has asked readers via a popup box whether inflation has been seen in their everyday expenses. This is by no means a scientifically accurate study, but by a large margin respondents indicated that, yes, inflation is being experienced.

A limited number, four to be exact, indicated that inflation is not part of their consumer experience. To which I would ask, on what exactly are you spending money?

Because there are few areas of the economy right now that are not seeing price increases.

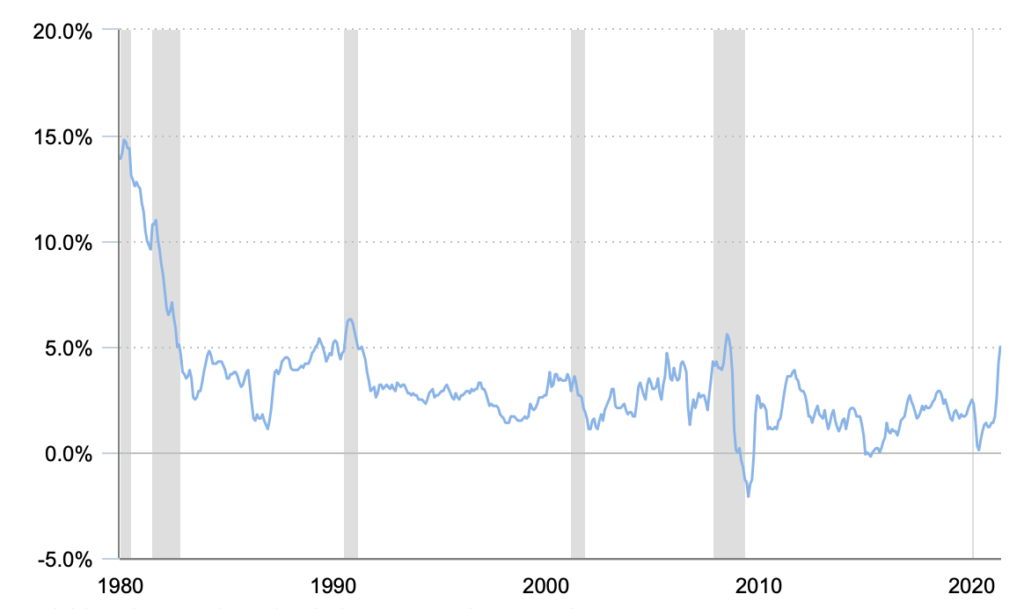

The official measurement of inflation is the U.S. Labor Department’s consumer-price index (CPI), which on Tuesday, July 13, 2021, noted a 5.4% increase from a year ago.

The index measures what consumers pay for goods and services such as groceries, restaurant meals, clothing and cars to name a few.

What must be recognized when looking at these inflation-related numbers, though, is that when year-over-year comparisons are being considered, we’re going to see inflated numbers due to the significant hole that was created in 2020 as a result of the economic shutdown and stagnation due to governments actions on Covid.

That said, there are numbers to consider that mitigate the 2020 economic anomaly.

The month-over-month look at the CPI – May 2021 to June 2021 – shows an increase of 0.9%, a significant monthly jump.

And when looking at 2019, a more appropriate comparison, overall prices are up about 3%. Again, a sizable increase.

So, yes, inflation is here.

A few of the reasons as to why include, strong, pent-up demand by consumers coming out of the pandemic lockdowns flush with unspent savings and government money, a limited supply of some product due to hampered supply chains not being able to produce enough product to keep up with demand and increased labor and material costs that funnel down to consumers.

Some of these inflationary pressures likely will subside in the coming months, which is why many leaders both elected and on the Federal Reserve Bank are calling these inflation numbers “transitory,” or temporary.

But there are other price increases that will stick around for the long term. In my final entry to our “How’s the Economy Doing?” post, I rhetorically asked, will employers lower wages that have been increased to lure workers back? Or will the makers of household essentials such as toilet paper, cleaning supplies, etc., lower the prices that are now being raised once six months or a year have passed? The answer is an obvious and resounding, No.

So, those permanent price increases will be a hit to Americans’ budgets going forward.

Will employers bring back the annual 3% cost of living increase that used to be fairly prevalent, but was largely dropped in the past 5-10 years when inflation was limited, to offset the price increases we’re seeing?

That will be the question, and something to watch.

Because, add wage inflation to the other inflationary pressures we’re seeing, and you may have a recipe for inflation rising more than is tolerable.

Which is where the Federal Reserve Bank comes in. One of the Bank’s missions is to “maintain the stability of the [U.S.] financial system,” and keeping inflation at a reasonable level through the setting of interest rates and other financial actions falls into that category.

Raising interest rates would be one way to curb inflation that’s deemed above acceptable levels – whatever those levels may be.

But it has to be recognized that raising interest rates will also impact the financial well-being of individuals through increased borrowing costs on things like mortgages, auto loans, credit card interest rates and more.

And a significant disadvantage to increased interest rates for the country as a whole would be much higher interest rate costs – the amount the U.S. government would pay to those investing in U.S. bonds – on the significant debt the U.S. has taken on over the past decade or so. And will likely add to in the coming years for that matter.

There’s a fine line that must be walked when it comes to inflation.

A little bit of inflation is okay, especially if employers offset some or all through increased wages.

But if not careful, things can get out of hand and the end result is not something the U.S. wants to experience as we edge toward a full recovery from the pandemic downturn.

Are you seeing inflation? What are your thoughts on how this might affect the U.S. economy going forward?