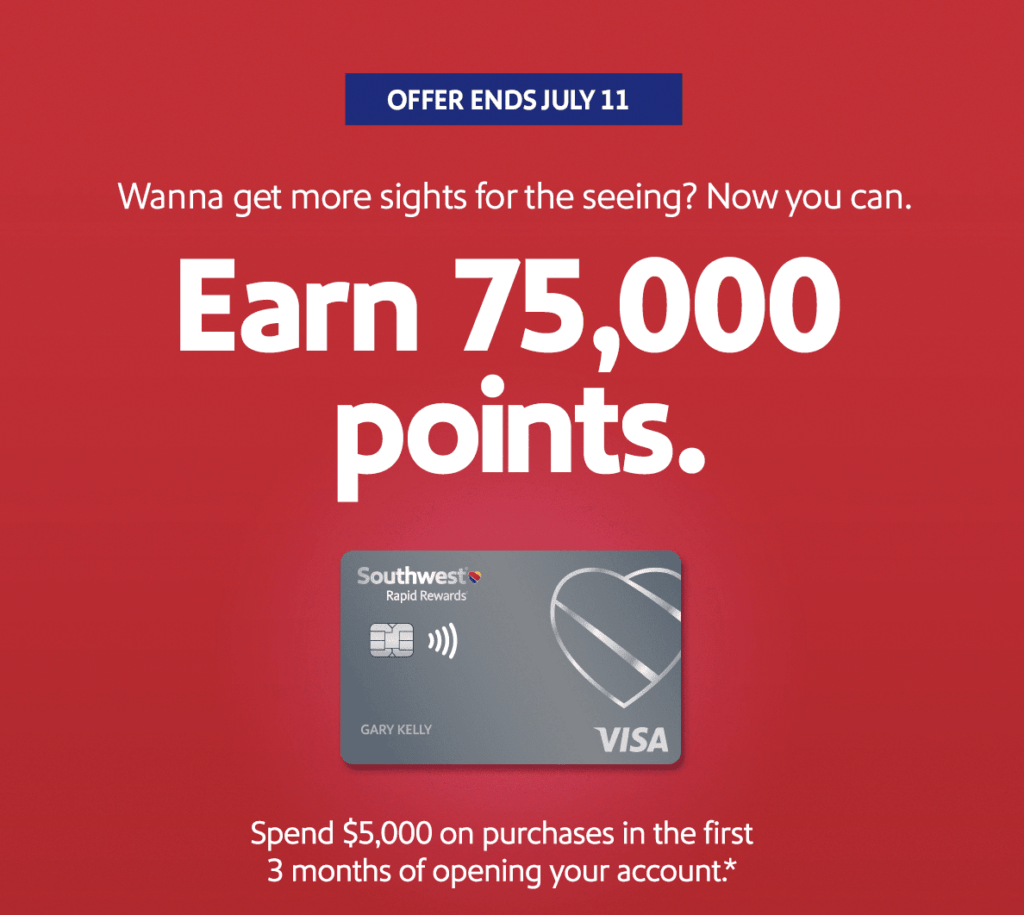

Increased Sign-Up Bonuses – 75,000 Rapid Rewards Points – on Each of the Southwest Credit Cards

Chase is offering increased sign-up bonuses on its Southwest Airlines co-branded credit cards through July 11, 2022.

The increased 75,000 point sign-up bonus can be found on each of the three Southwest personal credit cards that Chase offers.

And, while not the highest sign-up bonus we’ve seen for the Southwest personal cards, it’s pretty good considering the “reasonable” $5,000 minimum spend requirement to get the bonus. The previous high sign-up bonus was 100,000 points, but required a much higher minimum spend amount ($12,000) to get the full 100,000 points.

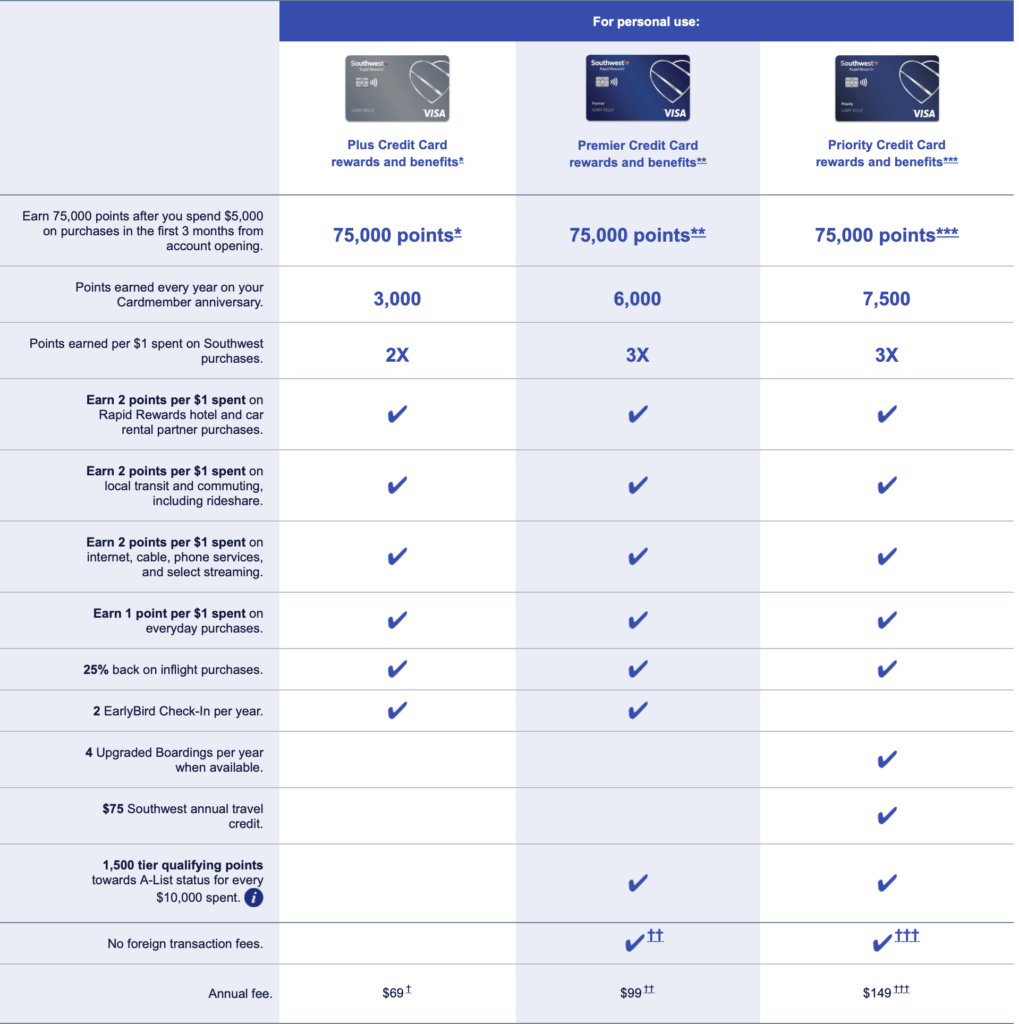

Below is the current Southwest personal card lineup and associated links for each card’s details and application page.

Chase Southwest Personal Cards

Chase Southwest Rapid Rewards Plus credit card – 75,000 Rapid Rewards points after $5,000 spend in the first 3 months from card approval – $69 annual fee

Chase Southwest Rapid Rewards Premier credit card – 75,000 Rapid Rewards points after $5,000 spend in 3 months from card approval – $99 annual fee

Chase Southwest Rapid Rewards Priority credit card – 75,000 Rapid Rewards points after $5,000 spend in the first 3 months from card approval – $149 annual fee

Each card offers slightly different benefits to justify the difference in annual fee. Below is a quick overview chart for all three cards. Click the chart to be taken to Chase’s Southwest credit card page for easier reading.

Keep in mind the Chase sign-up bonus rules associated with these cards…”This product is available to you if you do not have a current Southwest Rapid Rewards® Credit Card and have not received a new Cardmember bonus for this card in the past 24 months. This does not apply to Business Card and Employee Credit Card products.”

This Chase Southwest personal cards sign-up bonus promotion ends 7/11/2022.

Chase Southwest Business Cards

Chase Southwest Rapid Rewards Performance Business credit card – 80,000 Rapid Rewards points after spending $5,000 in the first 3 months. $199 annual fee

Chase Southwest Rapid Rewards Premier Business credit card – 60,000 Rapid Rewards points after spending $3,000 in the first 3 months. $99 annual fee.

Check the links above to see a comparison and highlights of each business cards’ bonus spend categories and benefits.

If you are able to apply for a business card, and are not over Chase’s 5/24 rule (approved for 5 or more credit cards from any issuer within the last 24 months) then you may be able to easily earn the extremely valuable Southwest Airlines companion pass (need 125,000 Rapid Rewards points) with personal and business card applications thanks to these increased bonuses.

While right now is not the ideal time to go for the Southwest Airlines Companion Pass via credit card sign-ups, it’s still not too bad. If you hit the minimum spend requirements in the next three months on both the personal and a business card, you’ll have the Companion Pass for the remainder of 2022 (roughly 4-5 months) and all of 2023.

These Southwest personal card sign-up bonuses are pretty good, and if you’re planning any Southwest flights, can definitely help offset your air travel costs.

And if you can swing the Companion Pass, you can really benefit from some reduced airfare costs.

Just remember, these personal card offers end July 11, 2022.