I Sure Hope You Didn’t Sell Your 401(k) Holdings in March – And What That Says About the U.S. Economy

The Coronavirus has really taken the U.S. stock markets and economy on a rollercoaster ride these past months.

Long-time readers of Savings Beagle are familiar with my quarterly updates, in which I look at how the markets performed during the previous quarter and what broader economic insights, if any, can be discerned.

And, let’s be honest, we’ve seen some things both from an economic and societal perspective these past months that we’ve never seen before.

Accompanying these actions are market results that were, themselves, completely unexpected.

Here’s a quick look at the markets from 2020’s first quarter.

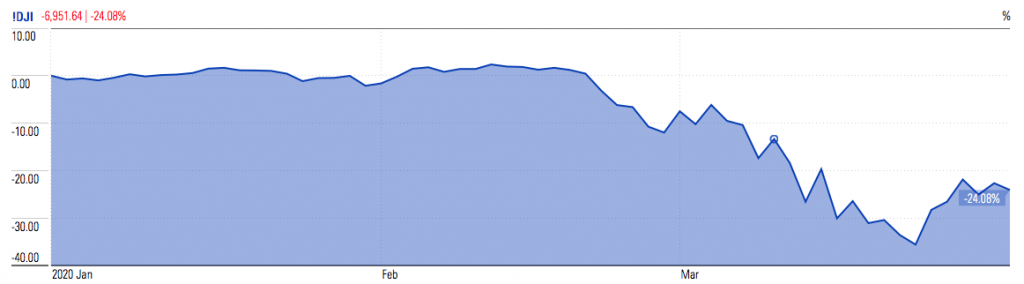

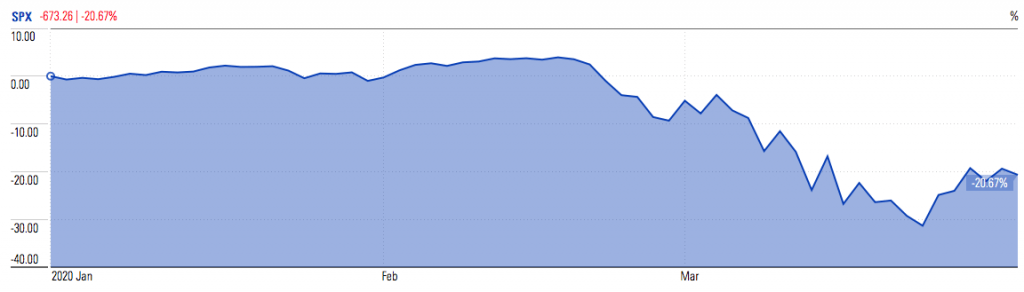

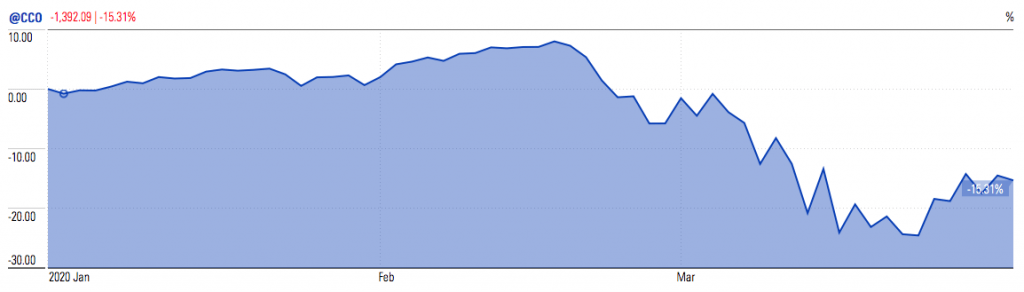

2020 First Quarter Returns

The Dow Jones Industrial Average plunged 6,951.64 points or 24.08%.

The S&P 500 dropped 673.26 points for a 20.67% loss.

And the Nasdaq declined 1,392.09 points for a decrease of 15.31%.

Significant losses were seen across all market segments.

And rightly so considering the economic shutdown that was mandated by local and state governments across the U.S.

When business is not able to operate at normal levels, the typical response from the stock markets would be to drop.

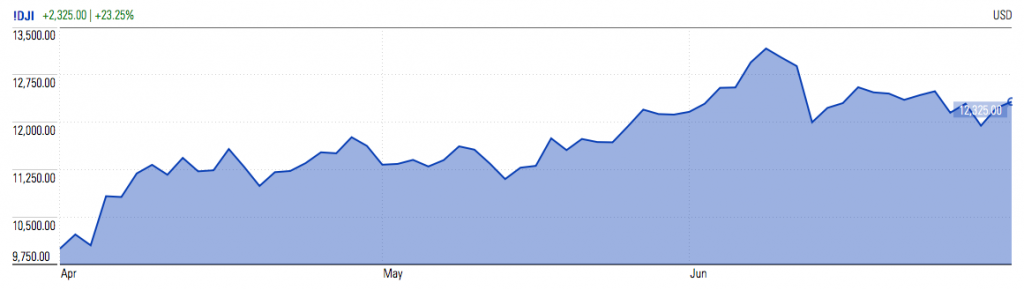

Oddly, though, those market losses – even with significant drags on business and economic activity continuing – didn’t last long.

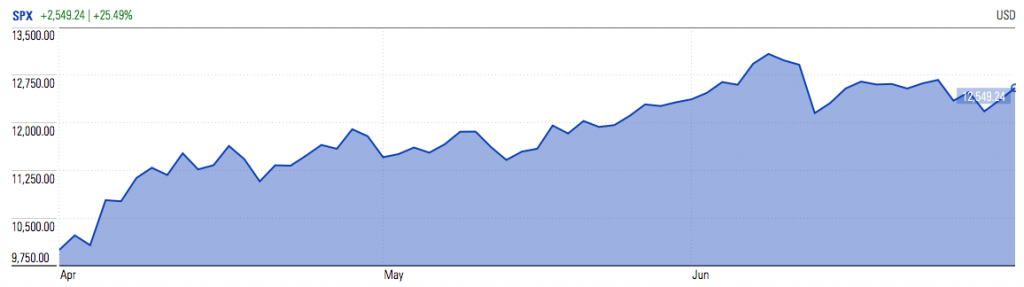

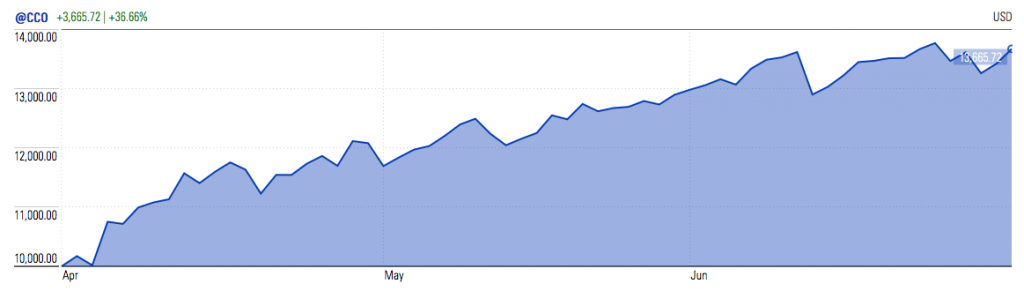

Here’s what we saw in the second quarter of 2020 from the major indices.

2020 Second Quarter Returns

The Dow Jones Industrial Average jumped 2,325 points for a 23.25% recovery.

The S&P 500 increased 2,549.24 points for a 25.49% gain.

And the Nasdaq rose a whopping 3,665.72 points or 36.66%. More than making up for its Q1 losses, and hitting all-time highs toward the end of the quarter.

All of this positive market action in the face of still-depressed economic activity as a result of the coronavirus pandemic.

What gives?

Your 401(k) and the U.S. Economy’s Grease

Well, it’s simple, actually.

The market actions hinge, primarily, on one factor that I’ve written about many times over the past years in my quarterly updates.

Federal Reserve Bank actions. Period.

The markets are bounding ahead for the sole reason that the Federal Reserve has said it “will spend whatever it takes” to keep the economy afloat.

If you want visual evidence of this, take a look at the Bloomberg chart below beginning February 2020, and ending June 30, 2020.

See any correlation?

Keep in mind, this isn’t actual money that the Federal Reserve Bank has in its possession.

Neither is this money being spent something the federal government has in its coffers.

You can view the bottom line U.S. budgetary numbers here.

No, the money that’s being used to keep the economy from collapse is literally just being created.

I won’t get into the specifics of the monetary system and how this works, just know that the U.S. – and countries around the world for that matter – is playing a dangerous game right now to stabalize the economy.

Unfortunately, there really isn’t a choice. These actions must be taken, or we literally could see a complete shutdown and collapse of our economic system.

But, make no mistake, the reason we’re seeing skyrocketing stock markets in the face of turbulent times is that the Federal Reserve has assured everyone that wide swaths of the economy will be protected. No matter what.

And with interest rates at almost zero, for those wanting to get any kind of return on their money, the stock market is the only opportunity to do so.

Thus, money floods into the markets and prices and value inflate.

Continuing a complete disconnect between the stock markets and the real economy every day Americans are living on Main Street.

At least, for now, it’s a positive for your 401(k) balance and all the other areas of our economy – pension funds, insurance companies, charity endowments, to name just a few – dependent on a strong and growing U.S. stock market.

But for how long is the question?

2020 Going Forward

I said the following in last quarter’s update.

“Unfortunately, the answer to where we’re going, both from a stock market perspective, and as it relates to the larger U.S. economy, is not an easy one determine.

Too many variables are at play right now, to make even an educated guess.

We, as a country, and a world, have never experienced anything like this during modern economic times.

The significant shut-down of large swaths of economic activity as a result of government-mandated efforts to mitigate the spread of Covid-19 are unparalelled.

How those economic stops will play out in the longer-term, simply aren’t known.”

And, outside of a stunning reversal for U.S. stock markets, pretty much that exact view still stands.

We are holding at approximately 20 million Americans out of work. An equivalent unemployment rate percentage of 11%.

Openings of states and businesses continue to go forward, but with a start and stop nature to them depending on the Covid-19 numbers and desires of elected officials.

Trillions of dollars have been either spent or used as government guarantees to prop up the finances of individuals, businesses and local governments.

So far, the economy has been somewhat stable due to the increased jobless benefits making many of the unemployed financially whole…and in some cases more than whole…and businesses receiving forgivable loans to stay operational.

The additional $600 per week unemployment benefits from the federal government are slated to end July 31, though, and could have a major negative effect on the U.S. economy if not continued in some form.

For a period of time, it looked like the sky was brightening.

Now with some forward momentum halted or even reversed, clouds have returned.

We’re already seeing the numbers of small businesses closed for good rise.

That’s not a positive for an economy.

Nor, with its cascading economic effects, would you think for the stock markets.

Yet, the markets continue to move higher.

Competing Market Viewpoints and the Path

There are multiple rationales why.

The ever-present, due to the no-interest-rate-environment, there is no other option when looking to grow your money.

And, with many investors cashing out of the markets just before or during the March downturn, there’s a lot of money wanting to be put to work.

All that cash looking for a home is trickling into the markets helping to move them higher now, and, potentially, in the future.

Those are positive views of what’s going on with the markets and what may happen going forward.

Then the pessimist’s take…get ready, when the markets see the “real economy” with continued lockdowns/restrictions, high unemployment and, now, civil unrest, the markets will lose the starry-eyed view of things and drop to levels more appropriate for what is happening.

But, of course, for the pessimist’s view to come to fruition, it would have to overcome the oh-so-powerful-force of the Fed.

And “unlimited funding” is a difficult force to overcome…for better or worse.

So, here we sit, early July 2020, and there really is no reliable answer as to what will happen with the U.S. economy and stock markets going forward.

Only guesses based on who knows what.

What Do You Think?

That said, what do you think? How’s the economy look from your vantage point? And is your position solid, without the potential for economic effect thanks to coronavirus and government actions meant to curb its impact?

Hearing from you is the best way to get a feel for not only real-world economic activity, but for the more important viewpoint of how you feel about all-things now and going forward.

Thanks for contributing your thoughts.

:max_bytes(150000):strip_icc()/rentingfirstapartment-8e70e8c6ff85462288d02e6f24d86d8d.jpg?w=150&resize=150,150&ssl=1)