How Much Did the Markets Make You This Past Quarter?

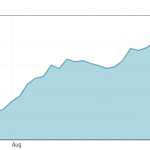

All three major indices continued to hit all-time highs this past quarter, with the Dow hitting its latest record high just yesterday.

While there have been some dips along the way, markets continue their upward climb.

Although, as I write this, we’re seeing a slight pull-back from these lofty levels, the reasons for which I’ll touch on in a bit.

But first, let’s look at the specific numbers 2018’s third quarter produced.

2018 Third Quarter Returns

The Dow Jones Industrial Average increased 2,186.90 points for a percentage gain of 9.01%

While the S&P 500 rose 195.60 points during the 3rd quarter for a percentage increase of 7.20%.

And the Nasdaq climbed 514.79 points for a percentage jump of 6.85%.

Will the Good Times Continue to Roll or Do the Markets Need a Break?

As I like to say, “If only I knew the answer to that question.”

Likely, we’re going to continue to see markets move up. The pace, however, may begin to slow.

You see, there’s a stiffening headwind that may pose a challenge, not only for the markets but the U.S. economy overall.

The Federal Reserve has continued raising interest rates from the extremely low levels we’ve seen for some time now, to a more “normalized” level. The most recent .25% point increase coming just last week.

An additional rate increase is anticipated in December, with the potential for 3-4 more rate hikes in 2019.

Why do interest rate hikes matter to the stock markets and the U.S. economy?

A detailed examination would be too lengthy for this “Quarterly Update.”

A quick overview is this:

Federal Reserve rate hikes translate to an increase in the U.S. 10-year treasury bond rate. When the Fed raises interest rates, the 10-year goes up as well.

And the 10-year treasury rate is loosely tied to mortgage rates, credit card interest rates, really any loan rate you can imagine.

So, as the Fed raises rates, the amount Americans will pay to borrow money will increase as well.

A mortgage payment may quickly move out of the affordability range for many Americans, especially with housing prices so elevated.

The monthly payment on an auto loan/lease will also increase for new buyers/borrowers.

As will the credit card payment on any outstanding balances.

All of these increased costs will cut into the average Americans’ monthly budget.

To put it simply, less money left over means less money to spend. Less money to spend means a slower economy.

And, a slower economy means a slower growing, if not declining, stock market.

While readers of this blog are primarily focused on his/her own financial situation, it’s important to note that increasing interest rates negatively affect the U.S. government’s budget too.

Right now the U.S. government is $21 trillion (and growing) in debt. It’s the fact that there are investors who are willing to buy U.S. treasuries that allows the U.S. government to not go bankrupt under that debt load. But investors don’t buy treasuries out of the goodness of their heart. No, they buy those treasuries – and fund America’s inflated spending – to earn a fairly safe return on their money.

As interest rates rise, the amount of interest the U.S. government must pay to investors on those treasuries rises as well. And, in turn, the U.S. government has less money each year to pay for services such as Medicare, Medicaid, defense, etc.

To put it bluntly, if interest rates rise anywhere close to historically normal levels, the U.S. government is in a lot of trouble.

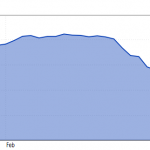

As you can see by the 10 Year Treasury chart above (2006 – current) we’ve got a ways to go for interest rates to move toward “normal” levels.

What’s a “normal” interest rate level?

The 200+ year average of U.S. interest rates is 5.18% on the 10-year treasury.

We’re currently hovering around 3.2% after a recent spike the last few days.

A lot goes into determining where the 10-year rate settles. It’s not solely determined by the rates set by the Federal Reserve.

But it’s also clear the Fed is going to continue raising interest rates over the next year or so, which will affect to some extent the 10-year rate, which, in turn, will affect the bottom line of both your budget and the budget (if you can call it that) of the U.S. government.

And the result will most assuredly not be a positive one.

Wrap Up

It’s important to understand, we at Savings Beagle are not investment advisors. It’s not our goal to encourage you to put your money into the markets, or to sell if you already have invested.

Rather, it’s to provide information to help illustrate the current state of the U.S. markets which can help guide your financial decisions.

Saving money – whether by investing in stocks, bonds or by simply putting a set amount into a savings account on a regular basis – is critical to your future financial well-being.

And we’re here to relay money saving deals and tips to make finding that excess cash that you can put to work a little easier.

If you haven’t already, bookmark our site, follow us on Facebook, join us on Twitter or subscribe to our posts to ensure you receive every savings opportunity we’re able to pass along.

Saving money and planning for the future’s hard – we’re here to help make it a little easier.

charts courtesy of morningstar.com and cnbc.com