High Yield Savings Accounts to Grow and Protect Your Money

High yield savings accounts just might be the financial vehicle you’ll want to add to your money-saving routine.

Many of the articles we publish relate to money-saving tips and tricks. Suggestions that will keep more of your money in your pocket.

However, while saving money is great, it’s only one piece of a sound financial plan.

Earning, or rather, growing, your money is another.

Which is why we’ve begun offering a regularly-updated listing of high yield savings accounts.

High Yield Savings Accounts

First, though, let’s take a look at what a high yield savings account actually is.

A high yield savings account is a type of savings account that pays a significantly higher return than traditional savings accounts.

Something most people can discern from the name alone, I know, but I thought I begin with that definition just to cover the bases.

Competition is the primary reason high yield savings accounts are available, and the Internet is what has allowed for that competition.

Most high yield savings accounts are going to be available online only. And they’re usually associated with Internet-only banks.

Your “hometown bank” may offer some form of a high yield savings account, but likely not.

So, to get the best return on your money – from a bank account, that is – you’re going to have to look to some form of Internet bank and associated online account.

For some, safety of your money may be a concern when dealing with an Internet-only financial institution. As long as the bank at which you’ll be doing business is a Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA) member, your money is insured, just as it is at your neighborhood brick-and-mortar bank.

The reason these online financial institutions can offer high yield savings accounts? Extremely low overhead, primarily.

Online banks typically have no buildings and associated costs, limited banking product availability (possibly only offering high yield savings accounts) and no ATM availability, requiring all money transactions to be done electronically.

With the availability of electronic transfers between financial institutions now the norm, utilization of these online-only accounts in conjunction with your traditional banking accounts is a fairly simple process.

Things to Look for in a High Yield Savings Account

- Interest Rate

- Required Initial Deposit

- Minimum Balance Requirement

- Fees

You’ll also want to consider ease of linking your current financial institution to whichever high yield savings account you’re considering and if deposits/withdrawals can be done in any other way.

And, for comparison sake, you’ll want to look at the compounding method that’s used for a specific account. If possible, compare accounts by APY rather than the annual interest rate. Doing so will allow the compounding factor (daily, monthly, quarterly, etc.) to already be taken into account.

Why a High Yield Savings Account

High yield savings accounts can grow your money more quickly while providing the same protections found with a traditional bank’s savings account.

Which, in today’s extremely low-interest-rate environment is a unique prospect.

Considering the current national savings account interest rate is 0.09% – according to the Federal Deposit Insurance Corporation (FDIC) – anything paying in the range seen with most high yield savings accounts – 2% APY – will provide a significantly higher return on your money.

So, if you’re saving towards a purchase goal, or are just looking for a safe place to park an emergency fund, high yield savings accounts are a great option to consider.

These accounts offer protection of your principal, the safety of federal insurance (FDIC/NCUA) and a return significantly higher than a regular savings account.

Obviously, if you have a sizable amount of money for which you won’t have a near-term need, other, somewhat more aggressive and riskier, investments would be a more appropriate vehicle.

But for an easy to access, shorter-term money-earning option, high yield savings accounts just might be what you’re looking for.

Savings Beagle’s High Yield Savings Accounts Page

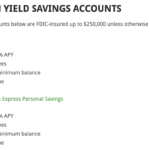

To make searching out high yield savings accounts a bit easier, we’ve compiled a shortlist of currently available accounts.

We include the currently offered APY, whether the account includes fees, balance requirements and if it’s online or available via a traditional brick-and-mortar bank, as well as, of course, a link to the account for more information and to sign-up.

Initially, we’re going to keep the listing manageable – maybe 10-20 accounts from which to pick.

We’re definitely open to increasing the list if that’s something readers want.

And we would greatly appreciate reader provided input by way of high yield savings accounts you’ve had personal experience with. Let us know the name of the bank/account and we’ll add it to the list so that other readers can benefit.

Pass along your high yield savings account suggestions in the comment section on this post, in the comments on the High Yield Savings Accounts Page, or via this contact link.

You can view our current high yield savings accounts page and account listings at the link below.

:max_bytes(150000):strip_icc()/INV_Tax_HighYieldSavingsAccounts-69031858f9d940618a5128bf6fad42f5.png?w=150&resize=150,150&ssl=1)

:max_bytes(150000):strip_icc()/how-to-open-a-compound-interest-account-7505889-final-89fd83cb3497479a93512ecb3c254325.png?w=150&resize=150,150&ssl=1)