Grocery Prices Continue to Increase as We Move Toward the End of 2022 – Here’s One Way to Ease the Burden of Higher Food Prices

Grocery prices continue to increase as we end 2022. But here’s a way to offset those higher food prices for the coming year.

Yes, this is a deal that includes getting a new credit card, but bear with me for a bit.

Credit cards can be used to better your financial situation, and in this case, lower your grocery costs for the first year you hold the card.

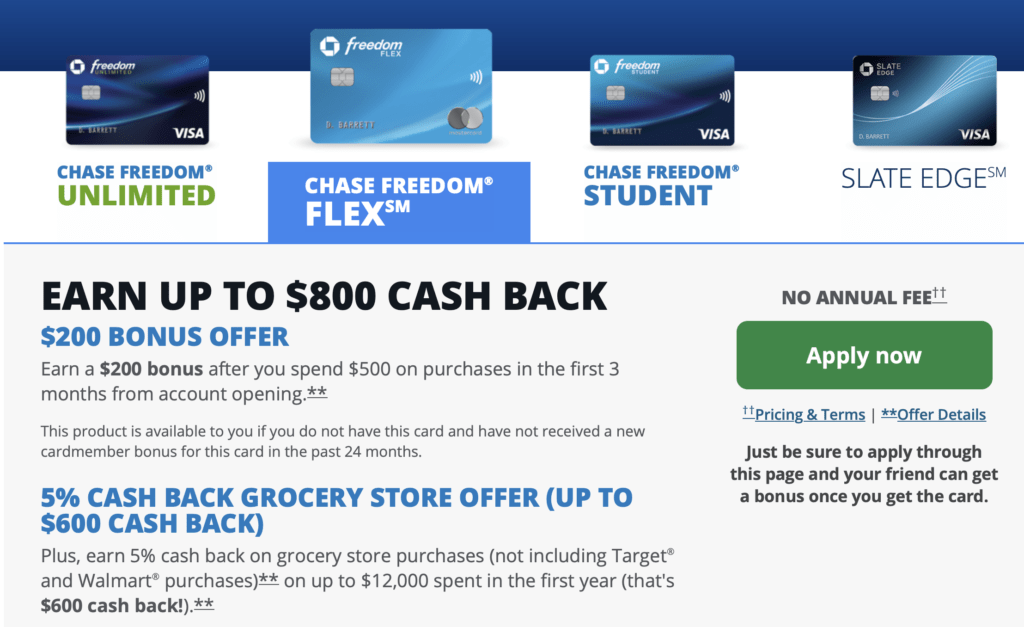

The Chase Freedom Unlimited and Freedom Flex credit cards are offering a $200 (20,000 Ultimate Rewards points) sign-up bonus for new applicants who spend $500 within the first 3 months from application approval.

That, alone, is a nice chunk of change during these difficult financial times.

The sign-up bonus is sweetened, however, with the card(s) earning 5% cash back or 5x Ultimate Rewards points on grocery store purchases on up to $12,000 of spend in the first year from card approval.

Now that is a really nice sign-up perk!

And for certain 3-month periods during that year, you may be able to earn 9% cash back on your grocery purchases with the Freedom Flex card. We’ll detail how below.

You can jump right to the Chase information and application page linked below if you don’t want to read any further. (referral link)

Chase Freedom Unlimited and Freedom Flex $200 and 5% Grocery Cash Back Application Promo

Savings Beagle will receive a points bonus for each approved application that uses the links in this post. You don’t have to apply using our links, but we appreciate when you do.

If a lot of your monthly spending is at grocery stores, this is a fantastic deal whether you want to earn cash back or the extremely valuable Ultimate rewards points.

In addition to the 5%/5x earning at grocery stores, here’s a breakdown of the Freedom Unlimited and Freedom Flex’s regular earning power.

Freedom Unlimited

The Freedom Unlimited card earns 1.5% cash back on all purchases.

There are three categories that will earn more than the 1.5% amount. They are:

- 5% cash back on travel purchased through the Chase Ultimate Rewards Travel Portal

- 3% cash back on dining

- 3% cash back at drugstores

Freedom Flex

The Freedom Flex is Chase’s most recent addition to its credit card lineup.

The Freedom Flex replaced the old Freedom card which is no longer available for new sign-ups.

Although, current Freedom cardholders can continue to hold and use the Freedom card under the traditional quarterly rotating 5%/5x earnings structure.

The Freedom Flex card is a mixture of the old Freedom card’s rotating 5% cash back categories and the new, fixed, earning categories that are part of the Freedom Unlimited.

So, the Freedom Flex offers 5% cash back on rotating categories that will change quarterly in addition to its fixed earning structure below.

- 5% cash back on travel purchased through the Chase Ultimate Rewards Travel Portal

- 3% cash back on dining

- 3% cash back at drugstores

The firepower of 5% bonus categories coupled with decent, fixed, bonus category earnings is a major plus for those wanting to maximize their cash back earning.

The Freedom Flex is a powerful ongoing earning card, especially considering the 5% cash back on groceries applicants can currently enjoy the first year.

Earning 9% Back on Groceries

And, occasionally, one of the 5% quarterly categories will boost the earning power of the first year’s 5% back on grocery purchases.

Like 2022’s fourth quarter category which includes PayPal. If you use PayPal (with your new Freedom card as the payment option within PayPal) to pay for your online grocery purchases – either via Instacart or a grocery’s own website – you’ll earn 9% back on each online grocery order.

And, should Chase offer grocery stores as one of the 5% back quarterly categories, it, too, will stack, making your earnings with this first-year grocery bonus 9%, whether your purchases are in-store or online.

Usually, two quarters in a year’s period, will allow you to earn 9% back on your grocery purchases with this current first-year 5% grocery bonus.

Cash Back

Once you’ve earned your cash back, you can redeem it in a variety of ways, including to offset your credit card bill as a statement credit, have it deposited directly to a checking or savings account, “purchase” gift cards (sometimes at a discount) to retailers you’ll be buying from and more.

It’s pretty easy to use the cash back you earn from your card’s purchases.

Ultimate Rewards Points

While all of the Freedom credit cards are advertised as cash back earning cards, it’s important to know that these cards also earn Ultimate Rewards points.

The terms “cash back” and “Ultimate Rewards points” are interchangeable for the Freedom lineup.

You’ll just need a premium Ultimate Rewards earning card in your arsenal to take full advantage of the Ultimate Rewards points earned via Freedom cards. Premium Ultimate Rewards cards include:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Business Preferred

If you’d like more information on Ultimate Rewards and how they can be used, read our post “Why I Love Ultimate Rewards Points and You Should Too.”

Wrap Up

Chase offered the 5%-back-on-groceries-for-a-year sign-up bonus last year, earlier this year, and now it’s back again.

You can get this extremely valuable bonus offer on both the Chase Freedom Unlimited and the Freedom Flex.

I’d recommend the Freedom Flex, though, to take advantage of its bonus boost of 9% back on grocery purchases when certain 5% quarterly categories are offered. That’s a nice savings on grocery purchases!

With food prices sky-high these days, this grocery store bonus on up to $12,000 of spend the first year is hard to pass up.

Grab one of these Freedom cards, and use it to better your financial situation.

Chase Freedom Unlimited and Freedom Flex $200 and 5% Grocery Cash Back Application Link

Questions? Just ask, we’re here to help you better your financial situation during these challenging times.