Federal Reserve Expected to Cut Benchmark Interest Rate, Impact on Consumers’ Debt, Savings, Auto Loans, and Mortgages

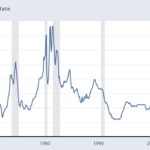

The Federal Reserve is gearing up to lower its benchmark interest rate from its 23-year high, which could have significant implications for consumers in terms of debt, savings, auto loans, and mortgages. Federal Reserve Chair Jerome Powell signaled the impending rate cuts in his keynote speech at the annual economic conference in Jackson Hole, Wyoming, stating that the direction is clear and the timing and pace of rate cuts will depend on incoming data and economic outlook.

Experts are predicting three quarter-point rate cuts in September, November, and December, with the possibility of even steeper cuts. For savers, this means it’s a good time to lock in attractive yields before the expected rate cuts begin. Chief credit analyst Greg McBride advises those closer to retirement to consider investing in Certificates of Deposit or bonds now to benefit from the relatively high rates.

When it comes to credit card debt and other borrowing, the rate cuts may eventually lead to better rates for borrowers. However, LendingTree’s chief credit analyst Matt Schulz warns that rates are unlikely to drop immediately after the next Fed meeting. He recommends exploring options like balance transfers or negotiating lower rates with credit card issuers for more immediate relief.

In the mortgage market, the Fed’s rate cuts could influence mortgage rates, which have already shown a decline in anticipation of the cuts. While the Fed’s benchmark rate doesn’t directly set mortgage rates, they tend to move in the same direction. This could be good news for homeowners looking to refinance their mortgages and potentially save on interest payments.

As for auto loans, McBride predicts that the beginning of rate cuts and the avoidance of a recession could lead to lower auto loan rates in 2024, especially for borrowers with strong credit profiles. However, those with lower credit scores may still face double-digit rates for the rest of the year.

Overall, the Fed’s rate cuts are a response to economic indicators like inflation and the job market. While inflation has been relatively low, recent employment data has raised concerns about a weakening economy. The Fed’s decision to continue cutting rates will depend on how these factors evolve in the coming weeks and months.

:max_bytes(150000):strip_icc()/GettyImages-1500340373-9a9166e04b064f1d926066341a5e27f8.jpg?w=150&resize=150,150&ssl=1)

:max_bytes(150000):strip_icc()/iZGmf-average-personal-loan-interest-rate-sep-2024-72cf9b78142e47f08e6a191b9ac0f94b.png?w=150&resize=150,150&ssl=1)