Evaluate Your Financial Situation and Make Changes Where Needed

Money Management Series

- This is Your First Step to a Successful Money Management Plan

- Knowing Your FICO Score is a Key Component to a Solid Financial Plan

- Evaluate Your Financial Situation and Make Changes Where Needed

In our series, we’ve discussed the first step – and its close second – to developing a successful money management plan. Now that you’ve worked up your budget, and have a good idea what your FICO score is, it’s time to evaluate your financial situation and make changes where needed.

Evaluate Your Financial Situation

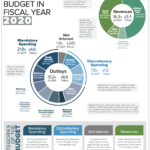

When you developed your budget, you were able to see spending patterns that will be important should changes be needed.

Obviously, the very first thing that should stand out is whether you have money left over once all your expenses are subtracted from your income.

Hopefully, you were completely honest about expenses, and the final number is an accurate representation of your typical monthly spending.

If your “net cash” number is positive, that’s great! You’re living within your means with some left over.

If your “net cash” number is negative, then it’s time to look at where your money is being spent and how expenses can be trimmed.

Or, how additional income can be generated if you feel that’s an option.

Reducing the Spend

Let’s be honest, if you completely cut out things you enjoy…dining out, a morning latte, gym membership, etc….it may work for a while, but after a few months the urge will hit and you’ll return to old habits.

A better way to go about cutting expenses is to seriously evaluate whether or not a specific activity or purchase is actually being used and provides enjoyment.

Do you really enjoy a morning latte? If yes, then keep it.

If you’re only grabbing that coffee drink out of habit, and it really isn’t something you care about, then cut it out.

Better yet, go without for a few weeks to see how you feel then. If you’re truly missing it, add that morning coffee stop back into your routine.

This plan of action can be used for pretty much any extraneous expense.

Re-evaluating subscriptions can be a great way to bolster your bottom line.

In this age of subscription services, it’s way too easy to sign up for something and continue paying a monthly fee whether or not it’s being used.

Look over your subscriptions and cut the ones you’re not using on a regular basis.

Once you’ve scoured your expenses and made some cuts, you’ll likely have a bit extra in the “net income” line than was there before.

But, the reality is, while the smaller expenses can add up, it’s the really large expenses that make the most difference when finding extra money is the goal.

If you have a mortgage, check your interest rate and see if refinancing to a lower rate may free up some extra cash. Unfortunately, in the current economic climate (2023), it’s unlikely that you’ll be able to save by refinancing. But, it’s something to keep in mind for when the Federal Reserve begins lowing interest rates again.

The same may be true if you have a car loan…but likely not until the Fed reverses its higher interest rate policy.

Student loans were another area that could have benefited from lower interest rates. Now, that’s probably not an option. Plus, we’ve seen significant government policy involvement since the pandemic that’s helped many borrowers. That’s unlikely to continue. The student loan forgiveness that’s been discussed will be hotly debated in the coming months, making the final outcome unknown. Student loans, at least in the near-term, are likely not an area from which to expect much relief.

Mortgages, car loans, student loans, these are the areas where larger savings can usually be achieved. And which can make a much larger difference to your budget if finding extra money is a focus. But only once interest rates are reduced.

Credit Cards

If you carry a balance on credit cards, consider ways to consolidate the debt into a lower interest rate option.

That may be a credit card with a no-interest-rate option for a period of time, or another, lower interest rate loan.

You can find a list of the best 0% introductory interest rate credit cards at this Bankrate.com page.

Credit cards lend money at extremely high interest rates. And, with the Federal Reserve Bank’s interest rate hikes, credit card interest rates are at levels not seen before. The goal is to get debt away from those astronomical interest rates and into more manageable options to make paying off the debt a less daunting task.

If moving your credit card debt to a lower interest rate card or loan isn’t an option, then focus whatever extra money you may have toward paying down the highest interest rate debt first.

And continue in that way until your credit card debt is paid off.

I fully understand that may be difficult for some, but the goal still remains, lower the interest rates you’re paying as much as possible, either by paying off the debt or refinancing to a lower rate.

Boosting Your FICO Score

We mentioned a few of these tips in the FICO post referenced above, but they’re worth looking at again.

If your FICO score is below 740, you want to take steps to inch it up so that you can qualify for the best interest rates possible.

Scores 740 and above – especially 760 and above – will make available loans with the best interest rates.

To boost your FICO score into the mid to high 700s you should:

- Make loan payments on time (one missed/late payment will lower your score)

- Keep your credit utilization rate low (the best way to do this is to pay your credit card balance in full each month)

- Keep old credit cards open to lengthen your credit history – the longer your credit history the better

If you have a short credit history, the first two points are that much more important to keeping a high score, or increasing a lower score.

You can increase your credit utilization rate by opening a new credit card, or two, but only if you’ll use them sparingly, and pay the balance off in full each month. Getting additional credit only to use a large percentage of it will definitely not help increase your FICO score.

And, as we also mentioned in the FICO piece, increasing your score may help you lower your car insurance rates as well as make you a more viable candidate for some employment opportunities.

Your FICO score – for better or worse – affects many aspects of your life.

This is why taking steps to raise your FICO score is such an important part of any financial plan.

Extra Money and a Good FICO Score

If your budget shows extra money each month, and your FICO score is where it should be, then you’re on your way to a sound financial plan.

The next step involves ensuring you have savings for those sure-to-come unexpected expenditures and a longer-term money management plan that will get you where you want to go.

We’ll delve into these topics at later dates.

Until then, evaluate your expenses to see what may be fair game to cut and look into cutting the interest you pay on any loans you may have.

Money image courtesy of nuchylee at freedigitalphotos.net