Considering a Mortgage or Refinance in the Near Future? Here’s an Amex Promotion to Keep in Mind

It was almost a year ago that we wrote about refinancing opportunities for your mortgage and how your financial situation could benefit.

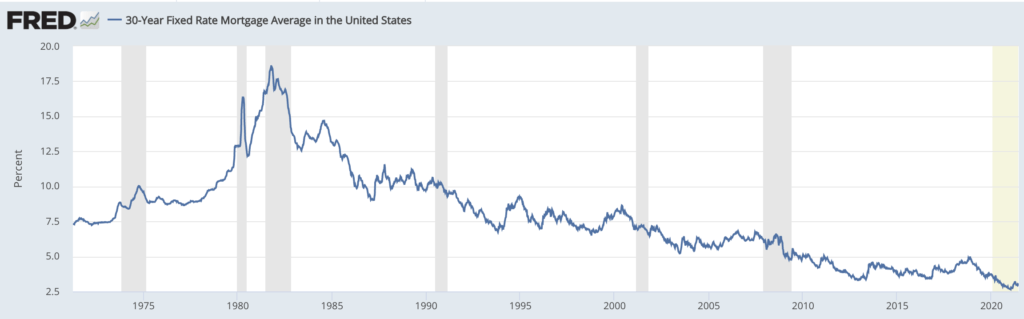

Since that time, we’ve seen mortgage rates fluctuate – mostly up a bit – but with the recent pullback of the 10-year Treasury rate (the rate on which most loans are based) 30-year fixed and other mortgage rates have dipped as well.

Last July the 30-year fixed rate was approximately 2.98%.

Now, June of 2021, the 30-year fixed rate is hovering around 2.96%.

So, not a huge difference, but if you didn’t refinance back then, or are looking for a mortgage now, options for lower-cost loans are good.

The Federal Housing Finance Agency’s Adverse Market Refinance Fee

There is one difference now, from last year at this time, however, for those looking to refinance.

That is the Adverse Market Refinance Fee which was instituted late last year as a way for Freddie Mac and Fannie Mae to recoup losses from forbearance defaults as well as help them manage the higher risk of lending as a result of the Covid-19 pandemic.

The fee is a 0.5% charge that adds approximately $1,000 to a refinance loan of $200,000 – or to easily calculate for your estimated loan amount, an additional $500 for every $100,000 borrowed.

Which means, unfortunately, the economics of a refinance have one more calculation to consider when deciding if refinancing is right for you.

A Refinance

There are only a few expenditures on a household’s budget that can make a sizable difference in available money when adjusted.

A mortgage is one.

And lowering the interest rate on a mortgage can free up a meaningful amount of cash, on a monthly basis, for the average household.

You do have to be aware of the fees and other charges associated with refinancing a mortgage to a lower interest rate, but as long as you work to keep those additional charges reasonable, a refinance oftentimes is a positive for a household’s bottom line.

I’m not going to get into the specifics of when to refinance and what to watch out for in this post.

Here is a link to a document by the Federal Reserve Board titled “A Consumer’s Guide to Mortgage Refinancings” if you’d like more details on refinancing specifics. I’d encourage everyone, even those who’ve refinanced before, to give it a look.

Rather, this post is just to alert readers to the fact that interest rates remain at extremely low levels and now may be the time to consider taking advantage of these low rates to better your financial situation.

A Few Refinancing Options to Consider

Let me start by saying Savings Beagle does not endorse any of the following banks/refinancing options.

We do not have any relationship with any of these financial institutions, and have not personally utilized any of their services.

Our knowledge of these banks and specific deals are a result of research and we present them as options to consider only as part of your own refinancing research.

Refinancing a mortgage is one of the, if not THE, most significant financial transactions a consumer can make. Do the research and only act once all the financial factors are right for you.

One thing that may help with that research is a Refinance Mega Thread on Bogleheads.org (a forum dedicated to investing/financial discussions based on John Bogle’s – founder of the Vanguard investment company – simple, low-cost investment philosophies) that provides a lot of good information and first-hand experiences regarding the current refinancing landscape.

Here’s a link to the Refinancing Mega Thread starting with posts in mid-June 2021. The thread actually began in September of 2019, so there’s a lot of beneficial information, both historical and current, of which you can take advantage.

I started the thread’s link at the June 2021 mark due to an American Express promotion that has resurfaced, and may be of interest to those with an Amex personal card.

A promotion is definitely not a reason to go with one financial institution over another. But, as long as the financial terms are similar, the incentive may be enough to move the needle in that lender’s direction.

Currently, Better.com is offering a deal to American Express credit card holders that provides either a $2,000 or $6,000 credit card statement credit with a home mortgage purchase or refinance with Better Mortgage. The $2,000 statement credit is for a conforming loan. If you’re applying for a jumbo mortgage (more than $548,250) then the credit is $6,000. The promotion is for applications created prior to 9/13/2022 and closed by December 17, 2022. So, you have a while to take advantage of this American Express / Better.com mortgage promotion.

You can view the Amex promotion and begin the application process at this Better.com link.

A few tips related to Better and this promotion.

To get the best rates from Better, you’ll first need to actually talk with a loan officer. The online application will likely not provide the best loan rates.

Second, to really get the best rates from Better, you’ll want to have shopped at least a couple other mortgage lenders and use those loan estimates to request a price match from Better – if the other banks’ loans are truly better, that is.

And only once you get the best mortgage loan deal possible should the Amex promo come into play.

Below are a few of the financial institutions contributors have mentioned as they shop for the best refinancing opportunity.

Aggregators which will provide rates from a number of financial institutions.

And a few financial institutions to contact directly.

- LenderFi

- Loan Depot

- Northpointe Bank

- Better

- Of course, your local bank and/or credit union

Not all of these financial institutions do business in every U.S. state, so keep that in mind as you check each site and/or make an application.

Again, you can see the Better Mortgage / American Express promo at the link below. Just be sure to scour the fine print before taking advantage.

Better Mortgage / American Express $2,000/$6,000 Statement Credit Promotion

Wrap Up

Mortgage interest rates are at some of the lowest levels ever.

Making now the time to consider getting, or refinancing, a mortgage.

Of course, there are a number of factors that need to be considered before making such a significant financial move like this.

But with some research, careful planning and consideration of options, you may be able to save yourself significant money by taking advantage of today’s low interest rates.

If you need some guidance, use the links above as starting points, and branch off from there.

Making smart financial moves is one of the ways to build financial stability, and taking advantage of historically low interest rates can definitely be considered a smart move.