Congress Tweaks the Retirement Savings Laws – Will These Changes Affect You?

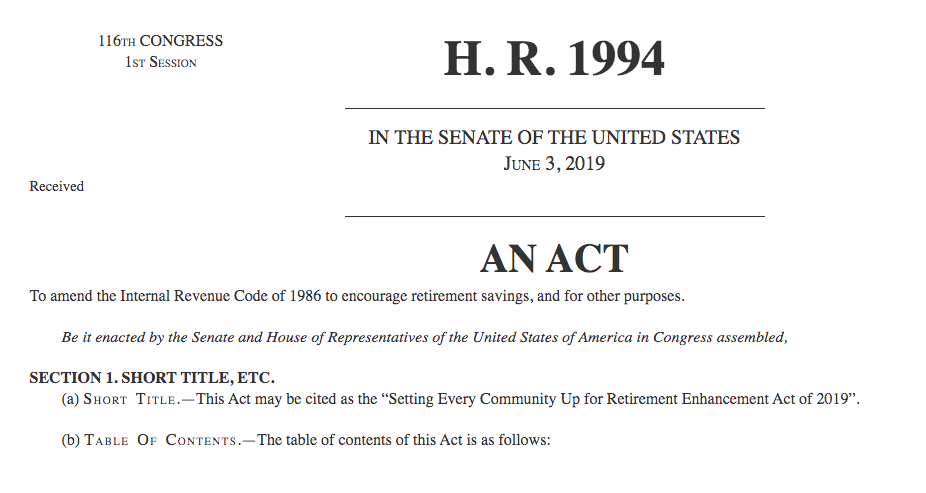

Lost in the political grandstanding and bickering we’ve become accustomed to hearing as of late was that Congress actually is working on and passing legislation important to many Americans. In fact, last December, Congress finally passed legislation that tweaks the retirement savings laws and sent it off to President Trump for his signature.

On December 20, 2019, the SECURE Act as it was called – otherwise known as H.R. 1994, but passed as part of the Further Consolidated Appropriations Act, 2020 – was signed into law by President Trump.

The provisions of The SECURE Act became effective January 1, 2020.

So, what exactly did Congress do to help – or hinder – Americans who are trying to save for retirement?

Here are the main points of the legislation:

- Allows Americans age 70 1/2 to continue contributing to pre-tax retirement accounts

- Increases the age to 72 for required minimum distribution payments from 401(k)s and IRAs

- Allows penalty-free withdrawals from retirement plans for expenses related to the birth of a child or adoption

- Creates a three-year tax credit for small employers for startup costs associated with new pension plans that include automatic enrollment

- Widens access to multi-employer retirement plans for small businesses

- Makes annuities potentially more available as investment options within 401(k) plans

- Effectively gets rid of stretch IRAs

And a quick rundown of what those points mean:

The first two – raising the age for allowing contributions and required minimum distributions – is an acknowledgment that the U.S. population is aging and for some/many, working later in life is becoming the norm.

The penalty-free withdrawals for expenses associated with children is self-explanatory…and possibly a commentary on the outrageous health care costs many in the U.S. face.

The small business concessions are a minimal, but potentially beneficial, effort to boost retirement savings in the U.S. Far too many Americans have limited, or even no, savings for retirement. Many small businesses provide no retirement savings plans due to costs associated with setting them up and managing them…the tax credits, and ability to partner with other small businesses to offset plan costs may help. And the automatic enrollment aspect is key.

Annuities within 401(k)s are a handout to the insurance industry, plain and simple. Yes, annuities can have a place in a retirement plan, but too often they charge extremely high fees and include burdensome requirements. If your 401(k) now includes an annuity option, please discuss this option in detail with an unbiased financial planner prior to signing up.

The change to stretch IRAs is something only an extremely limited group of individuals will feel, but the action itself may portend bigger financial changes to come.

The so-called stretch IRA allowed beneficiaries who did not inherit their account from a husband or wife to withdraw the required minimum distributions over their full lifetime. This was a tax loophole for the wealthy. Money was deposited into an IRA and passed on to children or other family members untaxed until distributions were taken.

Now, non-spousal beneficiaries are required to deplete IRAs over a ten-year period. The result? The government gets to tax the full amount of holdings that before the SECURE Act were taxed at a much slower pace, if at all.

The specifics of the SECURE Act aside, let’s not forget the tenuous financial position the U.S. government is in.

The federal government is currently $23 trillion in debt, and is spending approximately $1 trillion more each year than it brings in in taxes.

On top of that, the largest expenditures of the federal government – Social Security and Medicare/Medicaid – are unsustainable as they’re currently funded.

The financial outlook for America is not good. The government needs more money just to be able to keep the financial promises it has already made.

The only way that happens is to increase revenue – which is exactly what the elimination of the stretch IRA is. On a small scale, obviously.

My point isn’t whether the change is good or not, rather, just to highlight that the U.S. government is beginning to seek out additional revenue…and that hunt has just begun.

The other aspects of the SECURE Act are, for the most part, positive for Americans trying to save for retirement.

Although an argument could be made that they’re small potatoes when considered alongside the retirement savings crisis many Americans are facing.

Just be aware that significant changes both to U.S. tax policy and entitlements are coming. They have to, there are no other options. The only question is, how will the changes affect you?

:max_bytes(150000):strip_icc()/millennialsviewretirementsavingsdifferentlycomparedtooldergenerationsespeciallysociallysecurity-e34684b5f1824904b1bfab5f24f24c8f.jpg?w=150&resize=150,150&ssl=1)