Chase Freedom Flex and Freedom Unlimited Cards Offering $200 Cash Back and 5% Back at Grocery Stores for the First Year with This Sign-Up Promotion

The Chase Freedom Unlimited and Freedom Flex credit cards are offering a $200 (20,000 Ultimate Rewards points) sign-up bonus for new applicants who spend $500 within the first 3 months from application approval.

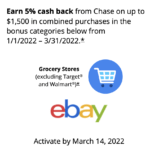

The sign-up bonus is sweetened, however, with the card(s) earning 5% cash back or 5x Ultimate Rewards points on grocery store purchases on up to $12,000 of spend in the first year from card approval.

Now that is a really nice sign-up perk!

And if you apply for the Freedom Flex card, it currently is earning 5% back on grocery purchases for this quarter (July-September) as part of its regular quarterly bonus categories. But, the sign-up bonus and the quarterly bonus earnings stack, making your savings a whopping 9% on grocery spend through the end of September! The 9% is only for the Freedom Flex card, though, not the Freedom Unlimited.

You can jump right to the Chase information and application page linked below if you don’t want to read any further. (referral link)

Chase Freedom Unlimited and Freedom Flex $200 and 5% Grocery Cash Back Application Promo

Savings Beagle will receive a points bonus for each approved application that uses the links in this post. You don’t have to apply using our links, but we appreciate when you do.

If a lot of your monthly spending is at grocery stores, this is a fantastic deal whether you want to earn cash back or the extremely valuable Ultimate rewards points.

In addition to the 5%/5x earning at grocery stores, here’s a breakdown of the Freedom Unlimited and Freedom Flex’s regular earning power.

Freedom Unlimited

The Freedom Unlimited card earns 1.5% cash back on all purchases.

There are three categories that will earn more than the 1.5% amount. They are:

- 5% cash back on travel purchased through the Chase Ultimate Rewards Travel Portal

- 3% cash back on dining

- 3% cash back at drugstores

Freedom Flex

The Freedom Flex is Chase’s most recent addition to its credit card lineup.

The Freedom Flex replaced the old Freedom card which is no longer available for new sign-ups.

Although, current Freedom cardholders can continue to hold and use the Freedom card under the traditional quarterly rotating 5%/5x earnings structure.

The Freedom Flex card is a mixture of the old Freedom card’s rotating 5% cash back categories and the new, fixed, earning categories that are part of the Freedom Unlimited.

So, the Freedom Flex offers 5% cash back on rotating categories that will change quarterly in addition to its fixed earning structure below.

- 5% cash back on travel purchased through the Chase Ultimate Rewards Travel Portal

- 3% cash back on dining

- 3% cash back at drugstores

The firepower of 5% bonus categories coupled with decent, fixed, bonus category earnings is a major plus for those wanting to maximize their cash back earning.

The Freedom Flex is a powerful ongoing earning card, especially considering the 5% cash back on groceries applicants can currently enjoy the first year.

Freedom Card

The Freedom card, as mentioned above, will stick around for current cardholders.

Current Freedom cardholders will be able to product change to the new Freedom Flex card – or the Freedom Unlimited – if either of those products are preferred.

And I would definitely recommend current Freedom cardholders consider moving over to the Freedom Flex card for its increased earning abilities.

Although, each Freedom card is considered its own product, so you can hold one of each if you want.

Ultimate Rewards Points

While all of the Freedom credit cards are advertised as cash back earning cards, it’s important to know that these cards also earn Ultimate Rewards points.

The terms “cash back” and “Ultimate Rewards points” are interchangeable for the Freedom lineup.

You’ll just need a premium Ultimate Rewards earning card in your arsenal to take full advantage of the Ultimate Rewards points earned via Freedom cards. Premium Ultimate Rewards cards include:

- Chase Sapphire Preferred

- Chase Sapphire Reserve

- Chase Ink Business Preferred

If you’d like more information on Ultimate Rewards and how they can be used, read our post “Why I Love Ultimate Rewards Points and You Should Too.”

Wrap Up

Chase made some really nice changes to its Freedom card lineup last year.

The Chase Freedom Unlimited received new bonus categories – dining and drugstores – which earn 3% cash back and 5% cash back on travel purchased via the Chase Ultimate Rewards Travel Portal, in addition to its regular 1.5% cash back earned on all other purchases.

The Freedom Flex keeps the 5% rotating categories earning structure of the Freedom card as well as the new 3% for dining and drugstores and 5% on travel via the Chase Travel Portal.

When you add in the 5% cash back at grocery stores up to $12,000 in spend the first year each card is offering to new applicants, it’s hard to pass up adding one of these cards to your credit card arsenal.

Chase Freedom Unlimited and Freedom Flex $200 and 5% Grocery Cash Back Application Promo