Chase Freedom Credit Cards Currently Offering a Really Enticing Sign-Up Bonus

The Chase Freedom credit cards (Freedom and Freedom Unlimited) are currently offering a really enticing sign-up bonus.

Both cards are offering a close-to-all-time-high sign-up bonus of $200 cash back after $500 is spent on the card in the first 3 months from card approval.

That in itself is worthy of consideration.

But Chase has sweetened the deal by adding 5% cash back on grocery store purchases on up to $12,000 in the first year of card membership.

With a quick back-of-the-envelope calculation, that’s a savings of $600 on your grocery spend if you hit the $12,000 mark in the first year.

And, in my book, $600 is nothing to sneeze at.

Especially with many of us spending more at the grocery store these days with restaurants either closed, or somewhat more inconvenient thanks to Covid-19 restrictions.

Making now a great time to apply for either the Freedom or Freedom Unlimited card to greatly benefit your financial bottom line…if you can apply, that is.

Chase Application Restrictions

Before you jump on that application, make sure you’re not running afoul of Chase’s application restrictions.

Unwritten restrictions which state: For most Chase cards, if you’ve been approved for 5 or more credit cards from any bank in the past 24 months, your application will not be approved.

And, if you have a credit card – or more than one – with Chase already, they will likely not approve a new card if your current credit line(s) is/are equal to or greater than 50% of your reported income.

If your application is denied due to too much available credit with Chase, you may be able to call after your application has been denied to request credit be moved from a currently open card in an effort to get an approval. Oftentimes, this works. It’s worth a try, at least.

And finally, we do have to keep in mind the current economic climate due to Coronavirus. Many are currently out of work, and the forward looking economic picture is hazy to say the least.

Banks know this and are less willing to take risk with extending credit.

Just know that the application approval process is likely a bit tighter than it’s been in previous years.

All that said, though, the sign-up bonus and benefit on these cards are definitely worth an application if saving money is of interest.

The Freedom Cards

I won’t get into great detail on the cards. I’ll just hit the high points on each so you have an idea before you go the the Chase site.

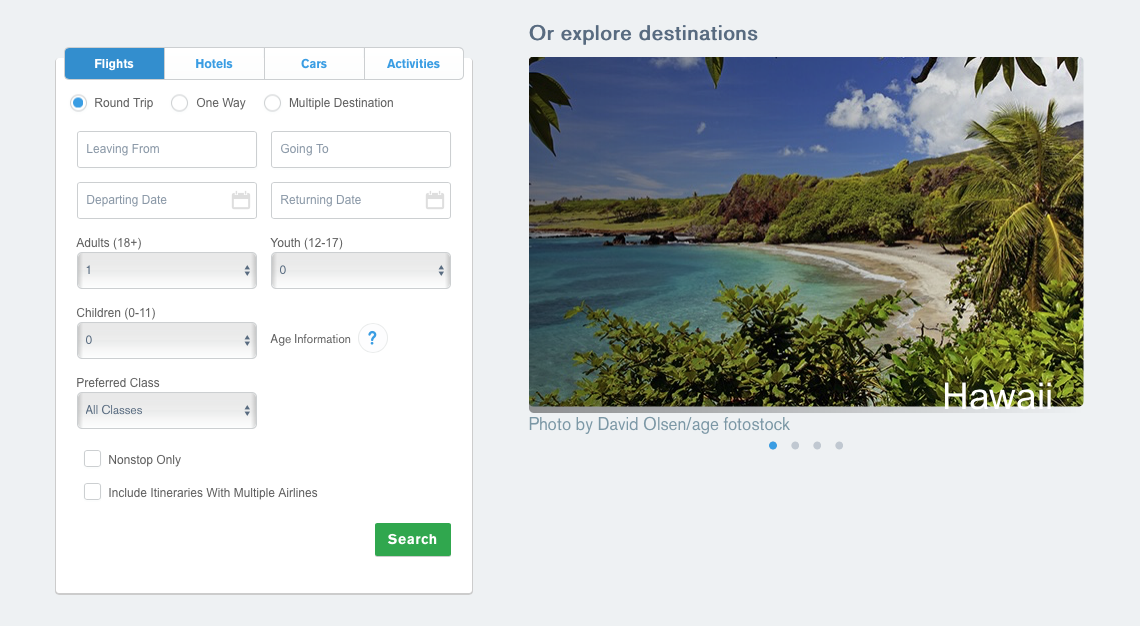

Chase Freedom Unlimited

- Earns 1.5% cash back on each transaction

- No annual fee

- And with the sign-up benefit, you’ll be earning 5% cash back the first year on all grocery store purchases up to $12,000

- You also can get a complimentary 3-month DashPass subscription if DoorDash food delivery is something you use

- Finally, if you use Lyft, you’ll earn 5% cash back on rides through March 2022

Chase Freedom Unlimited Application Link

Chase Freedom

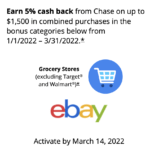

- Earns 5% cash back on up to $1,500 in combined purchases in rotating bonus categories each quarter

- Earns 1% cash back on all other spend

- No annual fee

- And with the sign-up benefit, you’ll be earning 5% cash back the first year on all grocery store purchases up to $12,000

- You also can get a complimentary 3-month DashPass subscription if DoorDash food delivery is something you use

- Finally, if you use Lyft, you’ll earn 5% cash back on rides through March 2022

Chase Freedom Application Link

You can read our review of the Chase Freedom credit card and learn more about using it, or the Freedom Unlimited, to turn earned cash back into Ultimate Rewards points to really maximize your return. Just don’t use the application links in that post…they won’t provide the 5% cash back on grocery sign-up benefit.

Wrap Up

Both the Chase Freedom and Chase Freedom Unlimited credit cards are offering a $200 cash back sign-up bonus in addition to an almost unheard of 5% cash back benefit on all grocery store spend for your first year of card membership up to $12,000 in spend.

If maxed out, that would be a significant savings on your grocery spend. And that’s not even counting the $200 cash back you’d earn once you spend $500 in the first 3 months from card approval.

Of course, some of us prefer earning Ultimate Rewards points in lieu of cash back, and with this increased sign-up bonus and benefit, earning significant amounts of points couldn’t be easier.

So, no matter your choice…cash back or Ultimate Rewards points…the current sign-up bonuses on the Freedom and Freedom Unlimited are hard to pass up.

Just be sure to keep the Chase restrictions (above) in mind before submitting an application.

If you know someone who might benefit, please pass this money-saving deal along.