Borrowers Benefit as Home Loan Rates Decrease: Latest Mortgage Rates as of Aug. 27, 2024

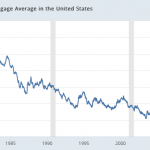

The average for a 30-year fixed mortgage is 6.53% today, a decrease of -0.05% from seven days ago. The average rate for a 15-year fixed mortgage is 5.96%, which is also a decrease of -0.05% since last week. This drop in mortgage rates comes as the Federal Reserve is set to make its first interest rate cut in September, aiming to help mortgage rates fall in the coming months. With inflation at its lowest level since spring 2021 and a weakening labor market, the stage is set for a potential decrease in mortgage rates.

Prospective homebuyers are starting to emerge from the sidelines, but it will take more than lower mortgage rates to address the current unaffordable housing market. The Federal Reserve’s upcoming interest rate cut is expected to have a positive impact on mortgage rates, offering some relief to those looking to purchase a home.

Experts predict a gradual decline in mortgage rates for the rest of the year, with the Fed likely to lower rates at its September meeting and potentially make additional cuts throughout the year. While a return to the ultra-low rates of 2-3% from a few years ago is unlikely, the overall trend is pointing towards more affordable mortgage rates in the near future.

For those considering a mortgage, it’s important to carefully consider the loan term and type that best suits their financial situation and long-term goals. Fixed-rate mortgages offer stability, while adjustable-rate mortgages may provide lower initial rates but carry the risk of rate adjustments in the future.

Overall, the current trend of decreasing mortgage rates is a positive sign for prospective homebuyers, offering an opportunity to secure a more affordable loan for their dream home. It’s advisable to explore multiple loan offers from different lenders to find the best mortgage rate for your specific situation.

:max_bytes(150000):strip_icc()/GettyImages-1294144619-045cc8f1fbb849ca98db5f9af2642ab2.jpg?w=150&resize=150,150&ssl=1)