America’s Debt is Getting More Attention – If Only it Were From Those Who Count

I’ve been warning about America’s unmanageable debt situation for well over a decade now.

Aside from the Simpson-Bowles Commission of 2010, which was really just a deliberative body established for show whose findings never were to be seriously considered, the U.S. debt and associated fiscal situation have largely been ignored by our elected officials and the media.

That has started to change.

The reason America’s debt situation is getting more of a look these days?

Two reasons, really.

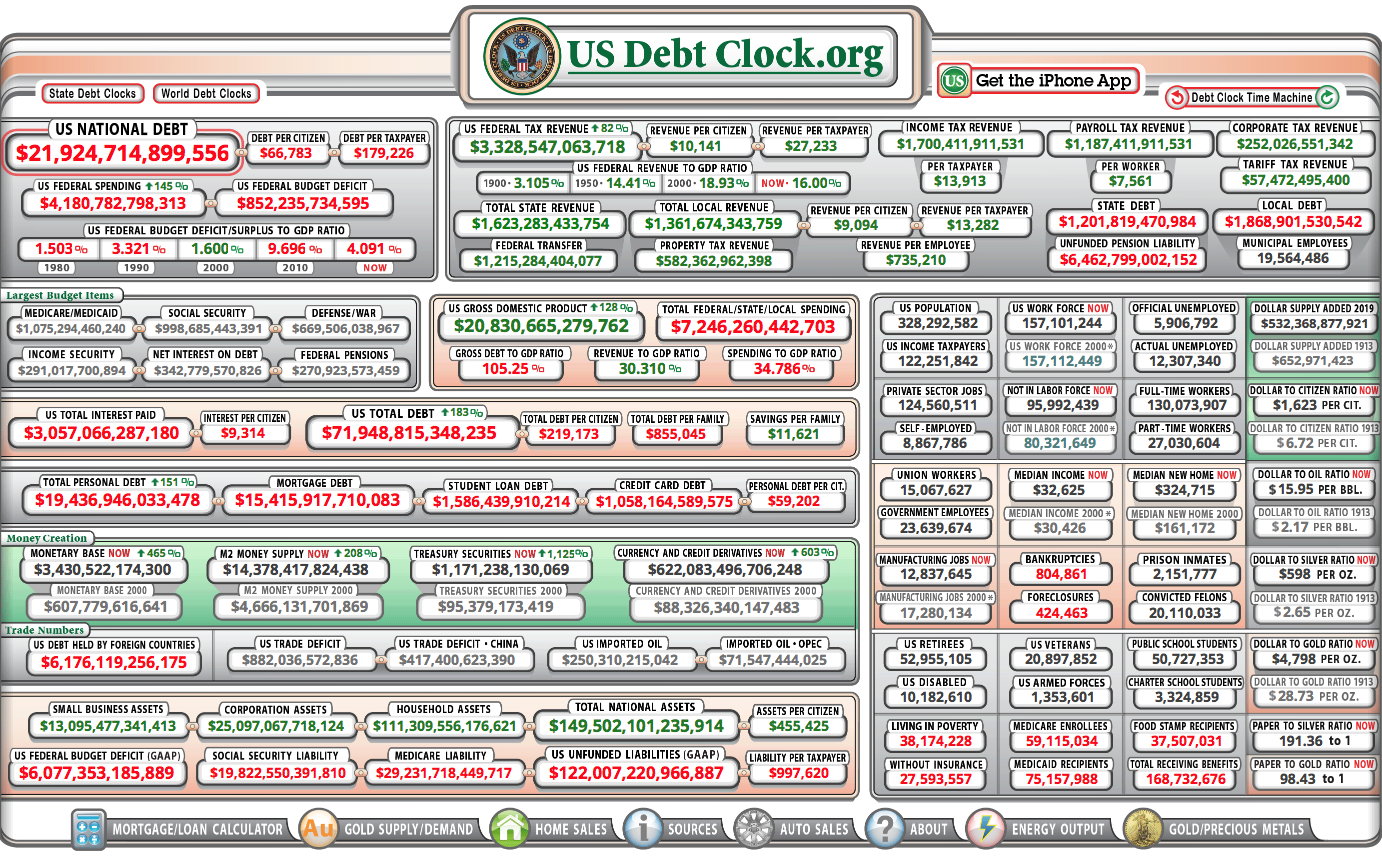

First, we’ve added a huge amount to our debt over the past few years. Roughly $6 trillion since 2020. And since numbers of this magnitude often mean nothing to the average citizen, here’s a graph to show its exponential growth.

Second, and more importantly, is that the sizable amount of debt the U.S. has accrued is costing the federal government significantly more in interest payments due to the increased interest rates the U.S. economy has had to weather over the past few years. Interest payments on U.S. debt are approaching $1 trillion annually…an amount that exceeds what America spends on defense.

The situation is unsustainable.

And yet our elected officials provide lip service to the issue, saying something to the effect, “yes, it’s an important issue that we need to look at and take action on,” never actually doing anything more. Unless you consider spending ever more dollars that we don’t have “taking action.”

More and more, however, the story of America’s fiscal situation is making its way into the news.

Below is an interview with Maya MacGuineas, president of the Committee for a Responsible Federal Buget on CNBC’s Squawk Box. It’s an interesting, and discouraging, discussion on where we are as a country, fiscally, and where we’re headed.

It’s well past time for Americans to understand the dire situation our elected officials have allowed the country to enter.

And for you, as an American, to tell your elected officials at the federal level to stop the excessive spending, develop a plan to restrain the debt growth (preferable to begin to reduce the debt) and along the way fix the Social Security and Medicare Trust Funds so that significant benefit cuts won’t be needed in the coming years.

As someone who worked on government budgets, I know this is a big ask. Constituents want to hear how much more their elected officials will give them, not what reductions and tax increases will be needed simply to stay afloat.

Let’s be completely clear on this matter, though, without a curbing of government spending and tweaking of the Social Security and Medicare/Medicaid programs, the pain all Americans will feel in the coming decade will be much greater than what addressing the problems now would entail.

The clock is ticking.