A Look at the 2019 Markets and How They Performed

I don’t think anyone expected the market returns that were seen in 2019.

After a very shaky end to 2018, it was unclear which direction the U.S. markets would take as 2019 began and proceeded.

For sure, though, there were few who expected continued double-digit gains for all three major indices.

Yet that’s exactly what we got.

Let’s take a moment to consider the numbers to see exactly how sizable the growth we saw was, both in the fourth quarter of 2019 and for the whole year.

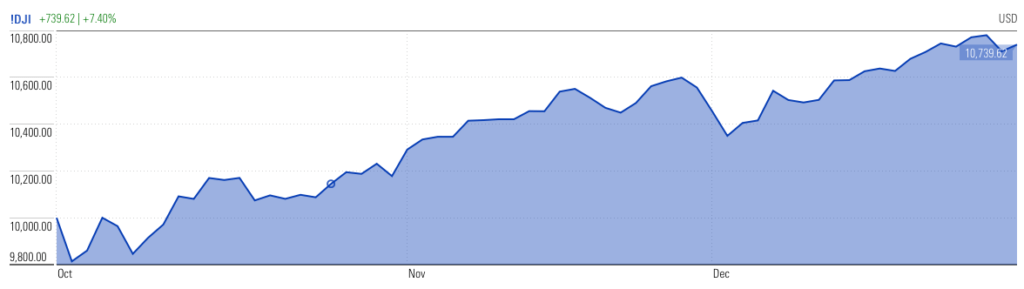

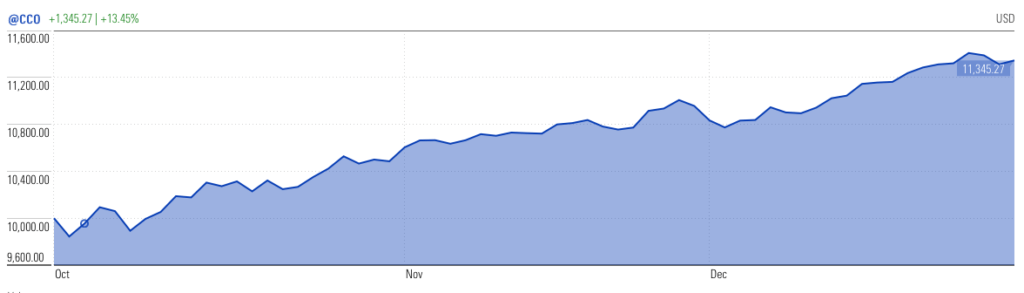

2019 Fourth Quarter Returns

The Dow Jones Industrial Average increased 739.62 points or 7.40%.

The S&P 500 rose 955.84 points for a 9.56% increase.

And the Nasdaq jumped 1,345.27 points for a whopping 13.45% gain in Q4.

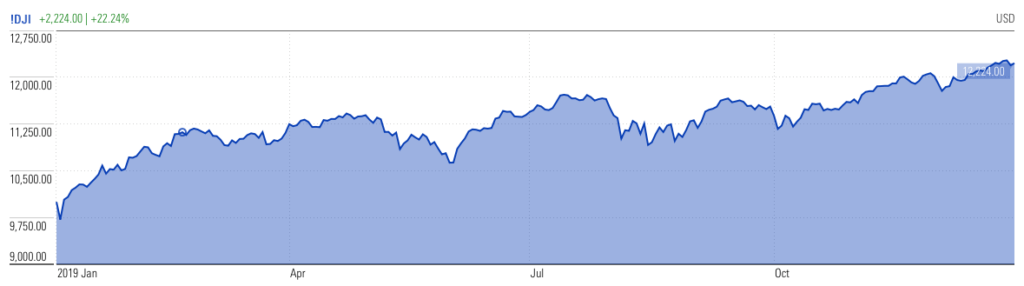

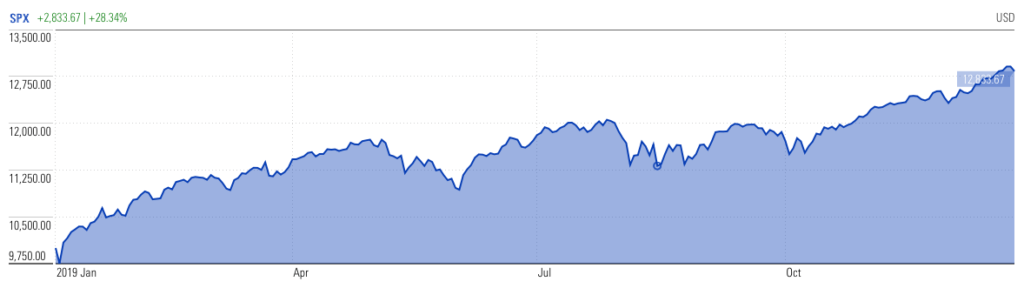

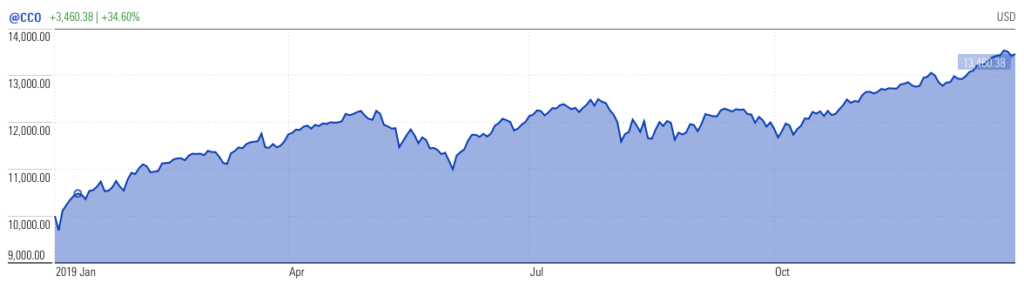

2019 Stock Market Results

The fourth quarter of 2019 was very solid, but did that translate to the full year?

The only way to know for sure is to look at the final numbers. <Hint, I kind of gave it away in the opener>

The Dow Jones Industrials popped 2,224.00 points for the full year, an increase of 22.24%.

The S&P 500 climbed 2,833.67 points for a percentage gain of 28.34%.

And the Nasdaq skyrocketed 3,460.38 points, equating to a 34.60% gain for the year.

A major difference from a year ago when we saw negative numbers for all indices, not only for that disastrous fourth quarter (2018) but for the full year, as well.

Talk about a rebound!

What Happened?

If you read my end-of-2018 recap, you know the primary reason for the downward pressure on the markets was Federal Reserve Bank actions (increasing interest rates to a point where the economy just said “no more.”) followed closely by global economic slowdown fears.

The slowdown fears, while warranted, soon appeared to be more fear than reality.

Many of the overseas economies stabalized, with a few even showing moderate growth.

And the Federal Reserve decided its course of normalizing interest rates was misguided and made an about-face, lowering interest rates three times in 2019 to a level of 1.5 to 1.75 percent.

And the U.S. economy cheered.

I won’t rehash why these low interest rates may not be the best. I’ve touched on that many times in past quarterly and year-end market updates.

Suffice it to say, low interest rates are here to stay…at least for a while…and they are a positive for many Americans as they can translate to lower borrowing rates on things like mortgages, car loans and the such.

It is interesting, though, that in some areas, the Fed’s cuts didn’t fully translate. Credit card interest rates are one, with reductions in interest charged on card balances barely moving following the Fed’s 2019 cuts.

As 2019 ended, the “official word” on future Fed action is that it shouldn’t be expected, either in the form of rate increases or decreases.

Which, I guess, is a good thing since market movements the past few years have been significantly based on Fed actions.

Having the Fed on the sidelines should allow markets to behave in a more normal fashion…for better or worse.

But, even with the Fed staying out of the limelight, it can’t be ignored that its low-interest-rate policy is a large part of why we’re seeing all-time highs continue to be reached on all three indices.

In my 2018 market wrap-up piece, I said it was unlikely we’d see 2019 market gains of more than low-to-mid single digits.

Boy was I wrong.

The U.S. markets and economy just continue to outperform.

And right now, there is no end in sight.

There are always areas of concern, but as of January 2020, there are no stumbling blocks in the foreseeable future that could keep the markets from going higher and the U.S. economy from steaming ahead.

That said, I can’t wait until I’m writing next year’s 2020 wrap up to see exactly what happened.

The continued growth is almost too good to be true.

It makes me worried there’s something lurking of which we’re not aware.

Only time will tell.

We at Savings Beagle are not investment advisors. It’s not our goal to encourage you to put your money into the markets, or to sell if you already have invested.

Rather, it’s to provide information to help illustrate the current state of the U.S. markets which can help guide your financial decisions.

Saving money – whether by investing in stocks, bonds or by simply putting a set amount into a savings account on a regular basis – is critical to your future financial well-being.

And we’re here to relay money saving deals and tips to make finding that excess cash that you can put to work a little easier.

If you haven’t already, bookmark our site, follow us on Facebook, join us on Twitter or subscribe to our posts to ensure you receive every savings opportunity we’re able to pass along.

Saving money and planning for the future’s hard – we’re here to help make it a little easier.

Stock charts courtesy of Morningstar.com

:max_bytes(150000):strip_icc()/GettyImages_116661034-56a895ed3df78cf7729ef594.jpg?w=150&resize=150,150&ssl=1)