Financially Responsible Borrowers Will Have to Pay More for Home Loans Thanks to This Soon-To-Be-Enacted Federal Regulation – This is Not Good Government Policy

A new federal rule is set to go into effect May 1, 2023, that will impose a fee on Americans buying or refinancing a house.

The kicker of this new fee? It’s only imposed on those with a good or better credit score (680 FICO or higher) to subsidize borrowers with lower credit scores.

Are you kidding me!?

This federal regulation is reinforcing the complete opposite of financially responsible behavior.

We at Savings Beagle, and any reputable entity discussing financial matters, will stress the importance of getting and maintaining a solid FICO score to better your financial situation.

And now the federal government, at the direction of the Biden Administration, is implementing a regulation that will punish those who’ve been financially responsible so that those who have not can benefit?

If you’re not paying very close attention to the laws, rules and regulations coming out of this administration and being put in force by the federal government, then you need to start. Now.

The actual dollar amount of the punitive fee is relatively small…estimates are in the $40 more per month on a home loan of $400,000 range.

It’s more the message that’s being sent both to those who work hard to be responsible with their finances and to the populace overall that those who are responsible will be penalized to benefit those who are not.

The message matters. A lot. And this message is not a good one.

In the article “Biden to hike payments for good-credit homebuyers to subsidize high-risk mortgages” the following quote sums up the rule nicely.

“Under the new mortgage financing rules, homebuyers with riskier credit ratings and lower down payments will qualify for better mortgage rates and discounted fees.”

The phrase, “Be careful what you wish for,” should be applied to this rule.

Homeownership is an expensive endeavor no matter your income level. A monthly mortgage payment with its accompanying taxes and insurance costs is just one part of owning a home.

Upkeep can get very expensive, very quickly when a new furnace is needed, or your roof is on its last legs.

When you shoehorn those with questionable finances into homeownership…as this new rule is attempting to do…that’s a recipe for financial disaster. Not only for the individuals buying the home, but for the country’s bigger financial picture.

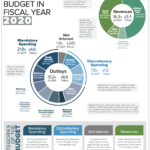

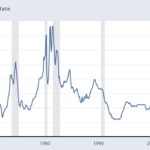

You may remember that a similar attempt to expand low-income home ownership by the federal government partially contributed to the 2008 Great Recession when borrowing constraints became non-existent resulting in an implosion of the housing market. There was much more to that crisis, but government involvement in home ownership was at the top of that slippery slope.

The Wall Street Journal Editorial Board chimed in on this new rule this past weekend saying in part, “The biggest problem here is fairness. Taxpayers already subsidize mortgages for low-income borrowers through the Federal Housing Administration. Now they want to punish those who have maintained good credit while rewarding those who haven’t. In the name of making housing more equal, they are pursuing an inequitable policy.”

And they address the point I made above with, “The Biden Administration may want more homeownership, but selling people houses they can’t afford has never been a good idea. See the subprime loan collapse of 2008.”

This rule is bad public policy on a few different levels.

But, as we’re seeing more and more, government rules don’t have to make practical sense as long as they just sound like good policy.

Until the day of reckoning arrives, that is.