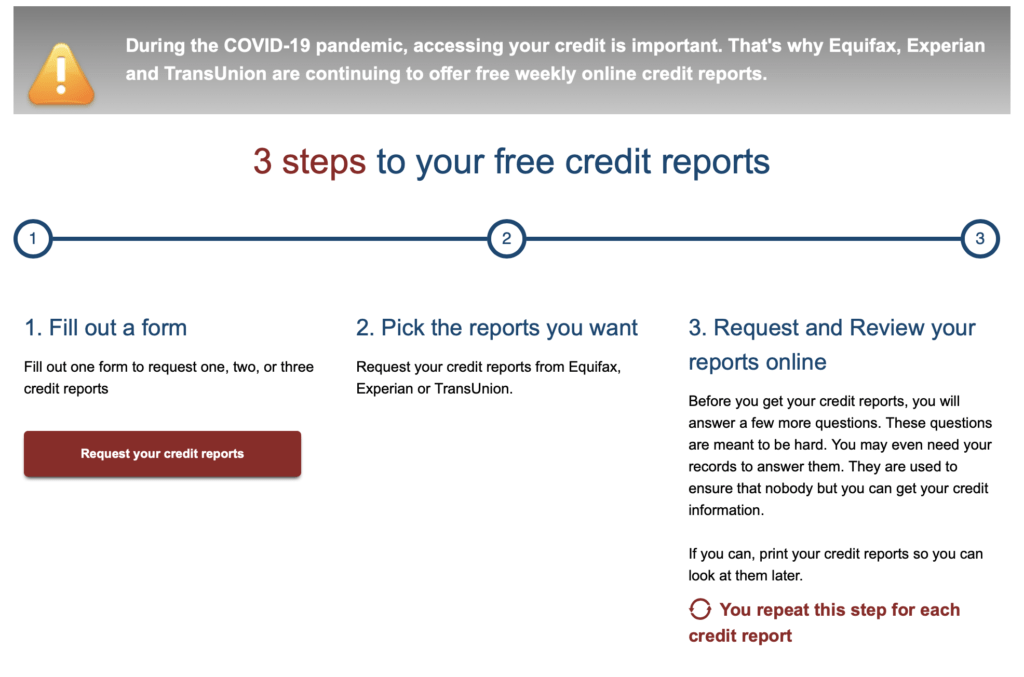

Free Weekly Credit Reports From Equifax, Experian and TransUnion to Continue Through the End of 2022

It was announced earlier this year that the three credit reporting agencies, Equifax, Experian and TransUnion, would continue offering free weekly credit reports through the end of 2022.

They were originally set to end April 30, 2022.

This is a continuation of a policy that was first instituted by those agencies early in the Covid-19 pandemic to help consumers better manage their financial health during times of fiscal uncertainty.

Previous to this change, you could only access three free credit reports annually.

With this change, you can keep a much closer eye on your credit report to watch for any irregularities that may negatively affect your credit score.

You can access your free, weekly credit reports via this link, or by Googling “Annual Credit Reports.”

Just be aware, the free credit reports do not provide a credit score. Typically, you’ll be solicited once you receive your free credit report to pay a certain amount (usually around $20) to get your credit/FICO score.

There are better, free in most cases, ways to get your credit/FICO score, though.

FREE CREDIT SCORES

In addition to its now weekly, free credit reports, Experian allows you to sign up, free of charge, to see your FICO score. Just be aware there will be plenty of sales pitches within the Experian process. But to get access to, and check as often as you please, your FICO score…that’s absolutely free.

Additionally, there are two online options for checking a close approximation of your FICO score…otherwise known as a FAKO score…Credit Karma and Credit Sesame. You’ll need to create accounts for each and input personal information so that your credit information can be accessed to provide you your FAKO score. Both have been around for a while and are as safe as any online repository can be. I have used both for years without issue.

And, over the past few years, more and more credit card companies have begun offering FICO scores to cardholders for free. American Express, Barclays, Discover, Capital One, Chase and Citibank provide cardholders free FICO/FAKO scores. If you have a credit card from one of these banks, sign in to your account and look for the FICO score option, usually found in the products, account or card benefits sections.

FREE CREDIT REPORTS/SCORES WRAP UP

Having access to both free credit reports and credit scores is a powerful tool for maintaining your financial well-being.

The reports can show you activity, both past and present, pertaining to your financial actions.

And your credit score can show, in one number, how those actions are affecting your personal financial health.

Being able to check both on a more regular schedule is definitely a positive when it comes to ensuring your finances remain in order.

Please share this post via the social media links at the side so others can benefit.