Increased United Airlines Credit Card Bonuses to Help with Your Travel Expenses

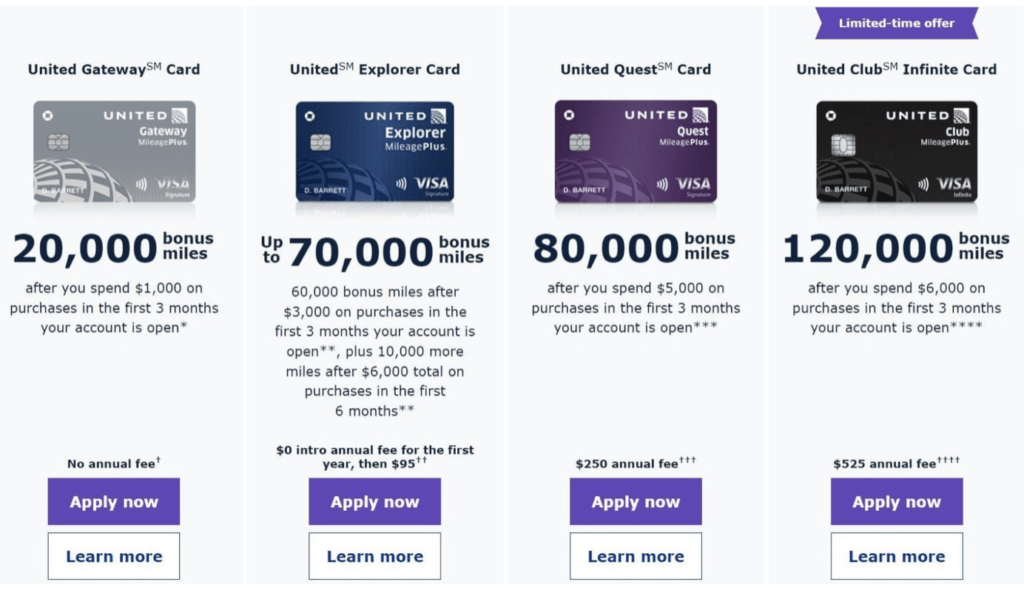

Chase and United Airlines have increased the sign-up bonuses on three out of the four credit cards that are offered.

If you’re interested in accruing United miles for free flights, now might be the time to give a United card a look.

Remember, Chase not only has a 5/24 rule (if you’ve been approved for 5 or more credit cards from any bank in the previous 24 months you (likely) won’t be approved for any Chase credit card), but if you’ve held any of the United cards you must wait 24 months from receiving the sign-up bonus before applying for that same card.

You don’t want to apply if you won’t be eligible to receive the increased sign-up bonus!

Now on to the specific United cards and each one’s bonus.

United Credit Cards

Let’s get the United Gateway card out of the way first.

United Gateway Card

The Gateway card is not offering an increased bonus, and, probably should be avoided if you truly value United MileagePlus miles as a 20,000-mile bonus isn’t so great.

Yes, it’s only a $1,000 spend in the first 3 months to get those 20,000 miles, but the card doesn’t offer any benefits aside from the 2x miles it earns on gas station, local transit, commuting and United purchases.

I’d try and stretch for the United Explorer if it’s at all possible for you.

United Explorer Card

Sign-Up Bonus

Earn 60,000 miles after spending $3,000 in the first 3 months from card approval and an additional 10,000 after spending $6,000 total in the first 6 months.

Annual Fee

$0 the first year, then $95 each year thereafter.

Ongoing Earning

- 2x miles per dollar spent on United purchases

- 2x miles per dollar spent on dining and hotel stays booked with the hotel

- 1x on all other purchases

The Explorer Card also provides:

- Free first standard checked bag for the cardholder and one traveling companion on the same reservation.

- 2 United Club one-time passes per year

- 25% back on United inflight purchases

- Up to $100 Global Entry or TSA PreCheck fee credit one time every four years

You can view more information on the Explorer Card, compare it to the other United cards and apply at the link below.

United Credit Card Information/Application Page

United Quest Card

Sign-Up Bonus

Earn 80,000 miles after spending $5,000 in the first 3 months from card approval.

Annual Fee

$250 (not waived the first year)

Ongoing Earning

- 3x miles per dollar spent on United purchases

- 2x miles per dollar spent on all other travel

- 2x miles per dollar spent on dining and streaming services

- 1x on all other purchases

The Quest Card also provides:

- Free first and second checked bags for cardholder and one traveling companion on the same reservation

- 25% back on United inflight purchases

- Up to $100 Global Entry or TSA PreCheck fee credit one time every four years

- Up to $125 annual United purchase credit

- Two 5,000-mile anniversary award flight credits (after first year anniversary)

You can view more information on the Quest Card, compare it to the other United cards and apply at the link below.

United Credit Card Information/Application Page

United Club Infinite Card

Sign-Up Bonus

Earn 120,000 miles after spending $6,000 in the first 3 months from card approval. This is the highest sign-up bonus for this card…and likely any United card, at least in my memory. But, this is a high annual fee card and likely not for those who don’t fly United fairly regularly.

Annual Fee

$525

Ongoing Earning

- 4x miles per dollar spent on United purchases

- 2x miles per dollar spent on all other travel

- 2x miles per dollar spent on dining

- 1x on all other purchases

The Club Infinite Card also provides:

- United Club membership (up to a $650 value each year)

- Free first and second checked bags for cardholder and one traveling companion on the same reservation

- 25% back on United inflight purchases

- Up to $100 Global Entry or TSA PreCheck fee credit one time every four years

- IHG Rewards Platinum Status

- $75 IHG statement credit for IHG Hotels and Resorts purchases in 2022

- $70 Discount on CLEAR annual membership

- 10% discount on United Economy Saver Awards

You can view more information on the Club Infinite Card, compare it to the other United cards and apply at the link below.

United Credit Card Information/Application Page

Wrap Up

Most of Chase’s United credit card line-up are offering increased sign-up bonuses right now.

There are no end dates listed for these increased bonus offers, so if interested you might want to apply sooner rather than later. We should see these offers available for at least the next few weeks, and possibly the next month or so.

Be sure to keep Chase’s 5/24 rule and 24 months since last receiving a specific card’s sign-up bonus rule in mind when applying.

I find United miles more valuable than American or Delta miles, so these increased sign-up bonuses always get my attention.

How about you?