The Federal Reserve Bank Has Started Raising Interest Rates and What That Means to You

The Federal Reserve Bank (Fed) today began its much-anticipated move toward normalizing U.S. interest rates.

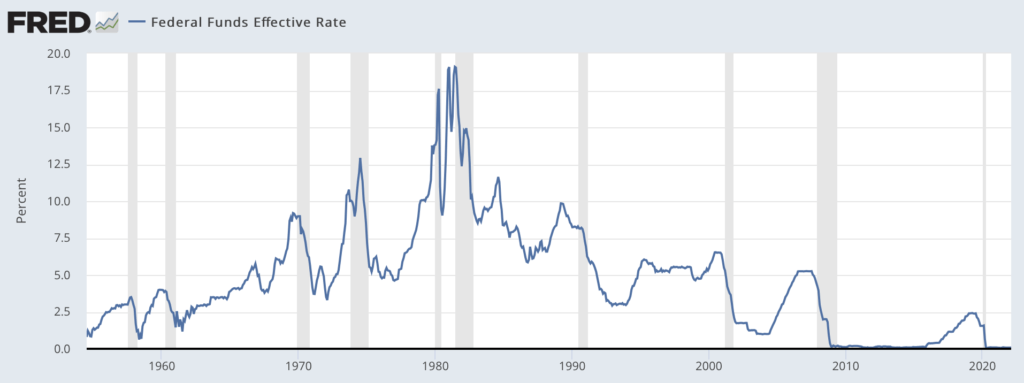

For over a decade now, the Fed has kept interest rates at artificially low levels. The results of this questionable policy have been a stock market that’s risen significantly, an economy that’s steadily grown – outside of Covid – and a U.S. debt level that is now over $30 trillion thanks to the ultra-low interest rates that have been paid on government debt.

While rising stock markets and a growing economy sound like positive points, and they are, the bigger point that they’re at least partially, if not largely, a result of manipulation can’t be ignored.

And while some in decision-making positions would love to have seen the Fed keep interest rates at near-zero levels for the sake of growth, that’s just not possible.

You see, the Fed is, primarily, tasked with maintaining stability in the labor market (keeping the U.S. employment rate at healthy/normal levels) and price stability (keeping the inflation rate at a manageable level). The way the Fed does that is through the raising or lowering of interest rates.

If you buy any products at all, you’re aware that the inflation rate in America is well above any level we’ve seen in recent history. The way the Fed can address the increased inflation rate is by raising interest rates to attempt to cool demand.

And thus, the Fed has started raising interest rates.

In fact, as part of the Fed’s announcement that it is raising interest rates by 0.25% today, it also communicated that it anticipates raising a total of 7-8 more times in 2022. Likely each increase will be an additional 0.25%, making the total interest rate increase at the end of 2022 2.0%.

I doubt we’ll see that.

No matter, what do these Fed interest rate increases mean for you and your money?

Fed Interest Rate Increases and Your Money

So, now that it’s clear the Fed is raising interest rates – for now – what does that mean for you and your money?

Well, let’s get the “good” news out of the way first.

If you have money sitting in a bank account or other savings vehicle that pays interest, you’ll likely see a small bump up in the amount paid. And by small, I mean really small. So don’t get overly excited.

Okay, with the good news out of the way, let’s look at the not-so-good news.

Interest rate hikes will increase the cost of:

- Credit card payments when you carry a balance

- Car loans and leases

- Mortgages

While the increases in each category may not be a 1:1 rate, expect the interest rates to go up.

Which means, if you’re planning on buying/leasing a new car in the coming months, your payment will be more than if you had done it yesterday.

And if this spring/summer was when you were going to buy a house, your mortgage payment will be more than if you had made the purchase earlier.

While the increased mortgage and car loan payments can be avoided by simply not buying, if you carry a balance on your credit card(s), you will see a higher payment in the coming months.

Plus, as with inflation, expect increased interest rates to filter through the economy into areas that you may not think are related, leading to even more cost increases.

So, one more hit to Americans’ already stretched budgets.

How Increased Interest Rates Might Help

The hope is that increased interest rates will cool the inflation currently running rampant in the U.S. economy by increasing costs and decreasing demand.

At least that’s the theory.

There’s one problem with the Fed raising interest rates now, though.

Or Not Help

Increasing interest rates into an overheated economy will dampen demand and potentially bring inflation to more normal rates. But there are more than a few signs that the U.S. economy is starting to slow, and increasing interest rates into a slowing economy can easily send it into recession.

Which is not what we want to see happen.

If the U.S.’s economy slows, especially to the point of recession, what can the Fed do to help the situation?

Lower interest rates to spur economic activity, of course.

Oh, but wait, the Fed has been effectively at 0% interest rates for years, and just now inching up to the quarter-percent rate. There’s not much room to lower rates to spur the economy.

So the Fed is hoping the economy stays strong enough to let interest rates hit a level so that lowering them again can offset the effects, somewhat, of a downturn should it come.

If you’re following, the bottom line is the Fed has held interest rates artificially low for way too long, and has now painted itself, and the U.S. economy, into a corner if everything doesn’t go exactly right.

And if you’ve been paying attention the past few years, you know things haven’t exactly been going right…the odds that things will go right for the Fed, and the economy, are a long shot to say the least.

And I won’t even get into what happens with America’s budget when interest rates increase payments on the U.S.’s sky-high debt.

But, here we are. The upcoming ride should be interesting. I really hope for every American’s sake that things go as planned with as little downside as possible.

The alternative is not what we need considering everything we’ve been subjected to the past few years.

What do you think? Are the interest rate increases going to affect your budget? And do you think the U.S. economy is strong enough to overcome all the hurdles being thrown at it?

:max_bytes(150000):strip_icc()/GettyImages-1500340373-9a9166e04b064f1d926066341a5e27f8.jpg?w=150&resize=150,150&ssl=1)