If You’re Not Fully Invested, You’re Missing Out

And the beat goes on for the U.S. stock market.

It’s almost like a broken record.

The markets continue their upward climb, with a drop here and there just to make it interesting before continuing to add to their gains.

Just last week – July 23, 2021, to be exact – The Dow Jones Industrial Average closed above 35,000 for the first time ever, marking its latest all-time high.

Both the S&P 500 and Nasdaq indices also hit all-time highs last week.

As I said, the broken record of markets moving up continues to play on.

And if your retirement/investment money isn’t fully in stocks, you’re missing out on some unprecedented gains.

Which is, and has been for quite a while, the problem.

I’ll touch on why that’s a problem in a bit. First let’s look at how the markets performed during the second quarter of 2021.

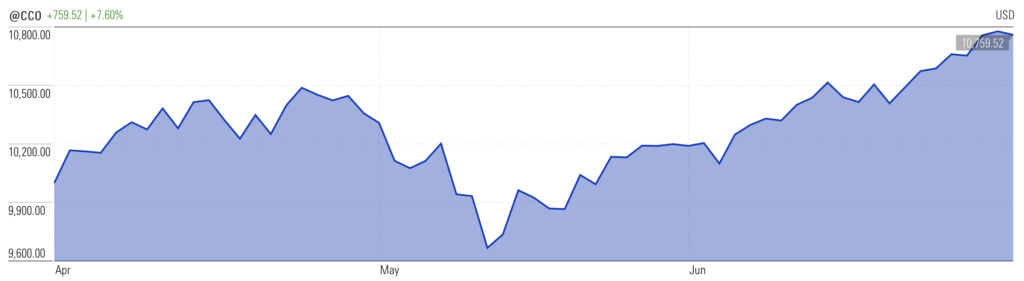

2021 Second Quarter Returns

The Dow Jones Industrial Average rose 406.99 points or 4.07%.

The S&P 500 increased 690.64 points for a 6.91% gain.

And the Nasdaq climbed 759.52 points for a positive percentage return of 7.60%.

The Return Machine

For the vast majority of Americans invested in the stock market, returns are the primary way they can ensure a comfortable retirement.

And the returns we’ve seen over the past years, have most assuredly juiced a large number of retirement accounts to help investors reach that goal.

The problem is, though, that this continued, high-return action of the markets is not normal.

When looked at over time and extrapolated to future market returns, a 6-6.5% average annual return is what should be expected.

The average annual return over the past ten years has been significantly higher than that.

The reasons for that are many, but at the risk of sounding like a broken record myself, the primary reason is the Federal Reserve Bank keeping interest rates unusually low for this extended period of time.

When bonds, which are considered a much safer investment vehicle, especially for those close to, and in, retirement, are providing little to no return on the funds invested, money is forced into stocks.

And that continued influx of cash contributes to the upward momentum of the markets.

Which is good, until there’s a problem.

Then all those retirees, pension funds, IRAs, 401(k)s, etc., that are not insulated from stock market drops through diversification that includes bond and other safer investments, pay a heavy price.

As long as the markets never have a significant correction, everything’s fine.

Reality

But, to think that is simply not being realistic.

And when the market manipulation can no longer be sustained there may be a significant financial toll to be paid.

I don’t continue to harp on the Federal Reserve being a reason for inflated markets to be negative about the stock market. Rather, it’s just to make everyone aware that the party probably won’t continue forever, and to have an exit plan already thought out should things turn ugly.

Not only do we in the U.S. have to worry about the stock market, but our federal government’s unchecked spending plays into the bigger financial picture, too.

And the huge debt levels we’ve accumulated, and continue to accumulate, very well could contribute to the economic problems that would negatively affect the markets.

It’s all intertwined, and there are far too many negatives currently at play to say everything is and will be fine.

So, just keep reality in mind when developing long-range financial goals that will build a sound financial future.

To do otherwise could end up being a very costly mistake.

:max_bytes(150000):strip_icc()/GettyImages-1271903572-0a9dd8753bca49e7bf2408ebbfd5ba52.jpg?w=150&resize=150,150&ssl=1)