How Badly Did the Coronavirus Impact the U.S. Stock Markets and Economy in the First Quarter?

It’s not a question of if, but, rather, how badly did the coronavirus impact the U.S. stock markets and economy in the first quarter of 2020?

Long-time readers of Savings Beagle are familiar with my quarterly updates, in which I look at how the markets performed during the previous quarter and what broader economic insights, if any, can be discerned.

Of course, anyone who follows the economy and stock markets, even from a cursory standpoint, has an idea of how things are, but sitting down and looking at the actual charts puts a finer point on the view, reinforcing, or at times contradicting, what is felt.

With the coronavirus smacking us all, firmly, across the face these past weeks, it’s hard to have a view that would be contrary to reality, but let’s let the charts speak for themselves.

2020 First Quarter Returns

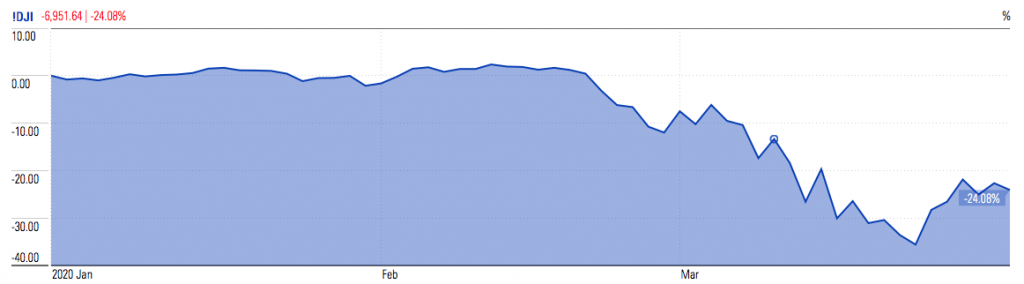

The Dow Jones Industrial Average plunged 6,951.64 points or 24.08%.

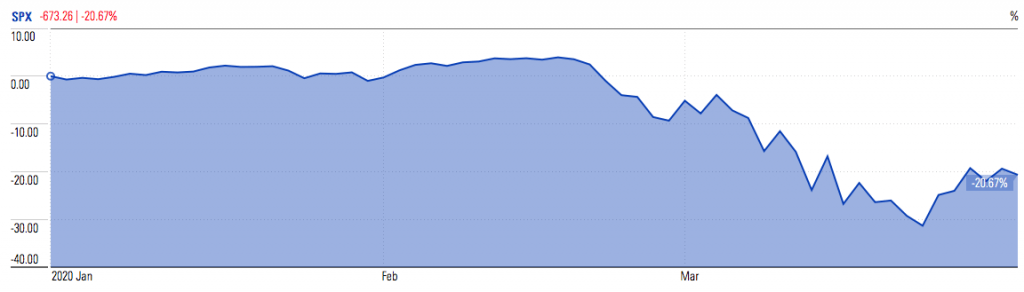

The S&P 500 dropped 673.26 points for a 20.67% loss.

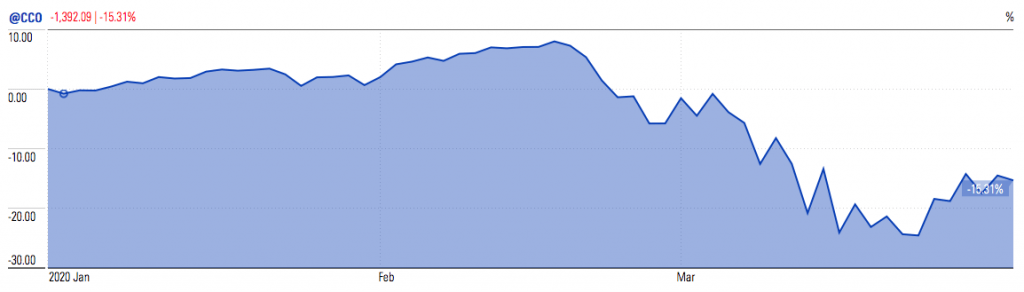

And the Nasdaq declined 1,392.09 points for a decrease of 15.31%.

And, it’s important to keep in mind, these ugly numbers include the slight upticks we saw as the quarter came to an end.

Without that rebound, the quarterly losses would have been much greater.

So, where we going from here?

2020 Going Forward

Unfortunately, the answer to where we’re going, both from a stock market perspective, and as it relates to the larger U.S. economy, is not an easy one determine.

Too many variables are at play right now, to make even an educated guess.

We, as a country, and a world, have never experienced anything like this during modern economic times.

The significant shut-down of large swaths of economic activity as a result of government-mandated efforts to mitigate the spread of Covid-19 are unparalelled.

How those economic stops will play out in the longer-term, simply aren’t known.

If we were to restart our economy, fully, tomorrow, the impact may be negligible.

However, with each week that passes in this “new normal” phase, more and more businesses will simply deem hanging on too difficult and will close operations for good. And with those closures go any associated jobs, be they 2, 20, 100 or more.

And, don’t forget, the associated tax revenue local, state and the federal governments received from those operating businesses and tax-paying jobs. All gone, during a time when governments are spending more and more toward unemployment benefits and other financial assistance programs that are vital during this time.

The losses, both from an economic and personal perspective, are hard to fathom.

And we haven’t even touched on the negative impacts a 25% – and possibly more – drop to the stock markets have.

Retirement accounts are down.

As to are the investments of many entities that are rarely considered when the movements of the stock markets are discussed.

Pension funds being one. I’ve touched on this often in past quarterly updates – state and local government pension funds, as well as the few remaining corporate pension funds, rely on stock market growth to be able to pay pensioners their promised benefits. Far too many pension funds across American are underfunded as it is, declines in stock market returns only make the problem worse. Will the promised benefits continue to be paid? Will taxpayers be tapped to offset the reduced pension funds at the expense of their pocketbooks?

See how the number of fallen dominoes grows as a result of a prolonged stay-at-home order?

That’s most definitely not to say we shouldn’t be steering clear of others to slow the coronavirus spread.

It’s just looking at the situation from a rational perspective.

And how the economic impact can snowball as a result of our efforts.

True, the federal government is stepping up to help many individuals and businesses through its various pieces of relief legislation passed in the last few weeks.

Trillions of dollars will be funneled to you and the small to medium-sized businesses that may employ you or someone you know, to help keep the economy somewhat stable during the next few months.

Likely even more money will be needed to help everyone affected by this coronavirus pandemic.

And while right now is not the time to discuss it, all those trillions of dollars of relief money come attached with their own significant downside.

I’ll be publishing a piece soon that will cover that topic.

Hopefully, the federal funding will smooth the transition from crisis to normalcy.

We will see.

All that is to say, though, there are way too many unknowns right now to say with any certainty what the 2020 landscape will look like over the remaining eight months.

All we can do is hope for the best at this point.

Stay well, everyone.