Have You Checked Your 401(k) Lately?

If you’ve logged in to check your 401(k) account over the past week, you’ve likely seen the results of the stock market’s ugly start to 2016.

If you’ve logged in to check your 401(k) account over the past week, you’ve likely seen the results of the stock market’s ugly start to 2016.

Happy New Year!

While this past week has been a downer for many invested in the stock market, my next point’s not going to do much to brighten that dreary mood.

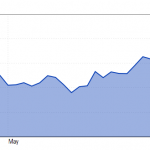

Take a quick look at the stock returns for all of last year. You can likely do that with your own investment account, or look at the charts below.

The Dow Jones Industrial Average, an index that measures how 30 large publicly owned U.S. companies have traded during a specific period of time, was down 2.23% when looking at its returns for all of 2015.

The Nasdaq Composite, an index that measures over 3,000 securities from both domestic and foreign companies, heavily laden with tech stocks, was up 5.73% for 2015.

And the S&P 500, a measure of 500 large companies having common stock listed on the NYSE or NASDAQ (and a somewhat better measure of the U.S. economy) was down fractionally, 0.73%, for 2015.

So what do these numbers tell us? Well, unsurprisingly, that most of the stock market had a middling year as far as returns go, and unless you had a stellar investment advisor, your 401(k), or whatever investment vehicle you have, likely performed in a similar manner.

While largely flat returns are better than significantly negative returns, they do pose some problems.

When you input numbers into those handy dandy retirement calculators, or your investment advisor does, most of those calculations rely on a typical 7 to 8 percent annual gain to achieve the results they provide.

Which means when the markets don’t reach those levels of returns, the retirement predictions you were counting on take a hit.

And if you’re part of a private (very rare these days) or public sector pension, where you are guaranteed a retirement benefit after a certain number of years, and you think you’re free and clear of all this stock market nonsense, think again.

Pensions are only able to provide the “guaranteed” benefits as a result of the returns that are earned from investments, most of which are in the very stock markets listed above. And, the “guaranteed” benefits these pensions tout are also based on an annual return in the 7 to 8 percent range of the investments the pension’s investment advisors make.

While down years won’t directly impact a pensioners final benefit payment, too many low-performance periods, coupled with other factors, will require adjustments to the benefits the pensions provide.

So, taking a quick look back to 2015 average returns, neither the retirement calculators, nor the pensions, hit the returns needed to remain on course.

And if you listen to the chatter of many in the economic/investment world, 2016 might not be too different.

We at Savings Beagle are not investment advisors. Our goal is not to guide your investment decisions or sell you investment products.

Rather, this article is presented to get you thinking about your long-term financial situation. And to illustrate that a lackluster stock market can have implications on your future, whether you’re directly invested in the market or are simply relying on a pension for those golden years.

A sound financial lifestyle is an important component to ensuring long-term fiscal stability. And saving money, wherever you can, plays a large part.

Which is where Savings Beagle comes in. We’re here to find the deals and pass along those tips that’ll save you money, and help keep you on a sound financial course.

So be sure to bookmark our site, follow us on Facebook, join us on Twitter or subscribe to our posts to ensure you receive every savings opportunity we’re able to pass along.

Together we’ll brighten that financial future and have some fun in the process.

female image courtesy of stockimages at freedigitalphotos.net

stock market images courtesy of morningstar.com