Experian to Allow Consumers with No Credit Report to Create One with Its New “Go” Program

If you’ve read any of our introductory personal finance posts, you know we view credit scores, better known as FICO scores, as the lifeblood of any individual’s personal finance plan.

Without a decent credit score, being able to obtain reasonably priced financing – or any financing for that matter – lower-cost insurance, or even a job, can be extremely difficult.

Whether it’s right or not, a wide variety of businesses use the FICO score to determine whether someone is an acceptable risk.

So, unless an individual has held a credit card for a period of time and/or paid regularly and on time for another type of consumer loan, a credit report/FICO score will be thin to non-existent. A definite detriment to those trying to obtain a mortgage, get a car loan, etc.

Which is why non-traditional ways of showing creditworthiness have become more mainstream.

Alternative FICO Score Building Opportunities

In 2018, the UltraFICO score was introduced which allows individuals to use bank account activity to show sound financial behavior.

And, in 2019, Experian launched Experian Boost, an option for consumers to add utility and cell phone bill payments to Experian credit reports, providing one more way to illustrate responsible financial conduct.

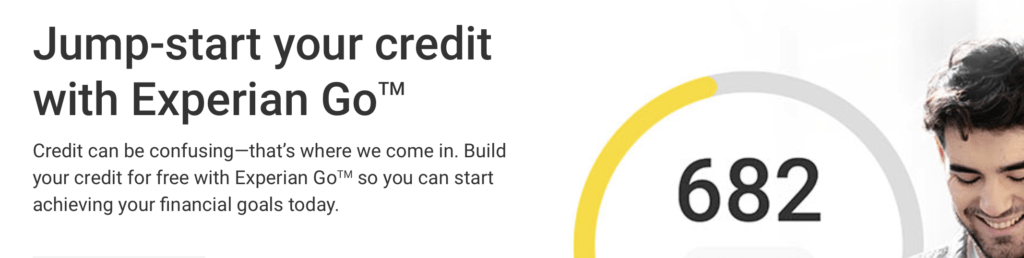

Now Experian is launching Go, an option for consumers with no credit history or reports to begin the FICO score building process.

Experian Go

According to a recent Wall Street Journal article by AnnaMaria Andriotis, Go “will involve consumers linking recurring nondebt bills to their newly created credit reports. The process is aimed at converting consumers from being invisible to banks to having a credit record and an increased chance of loan approval.”

Interestingly, according to Go’s pilot program, just by creating a credit report and linking nondebt accounts, an individual who had no FICO score prior would see a score of 665 after going through the process.

A score of 665 is in the middle range of the FICO score spectrum, definitely opening the opportunity to obtain financing. And while a score at that level would not provide the best interest rate, it’s a way to get into the system and build a more solid financial foundation from which to grow.

A positive not only for the individual but for the larger economy as well, since it will open the door to increased economic activity associated with homeownership, upwardly mobile employment opportunities and more.

If you’re in the beginning stages of building your credit profile, and are interested in the Experian Go program, you can get more information at the link below.

Experian Go Program Link

Anything that helps financially responsible individuals participate more fully in all aspects of our economic system is a good thing.

For some, this new program from Experian just might be the leg up that’s needed.

Know someone who might benefit from this information? Please pass this post along.